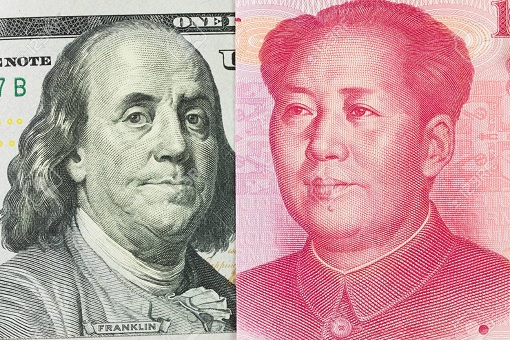

Every night at 9 p.m. ET, the People’s Bank of China (PBOC) fixes a level at which the Yuan (Renminbi) will trade against the U.S. dollar within China. On Wednesday, the central bank sets the Yuan midpoint at 6.9996 per dollar. But by Thursday, it crossed the red line and breached the 7 level – setting its currency at 7.0039 to a US dollar, the weakest since April 2008.

Since the 2008 Financial Crisis, whenever the spot rate approached 7, officials of the Chinese central bank were seen to take extreme steps to prevent further depreciation. Before Beijing weakens its currency further to 7 level on Thursday, JPMorgan Chase & Co. said the Yuan could sink to as low as 7.35 by year end. But it appears that day could come earlier.

As Beijing gets aggressive with its currency devaluation to help offset the revenue impact of tariffs imposed by Trump, the U.S. president will now be forced to raise the 10% tariff imposed on US$300 billion Chinese goods to 25%. China has gone ballistic and seems to be provoking the U.S. to take the next step immediately to make the trade war deadlier.

Investors can no longer hope that the fixing of the Chinese currency may not break the 7 in the future. It’s already a done deal. It was only 3 days ago when China retaliated on Monday with President Donald Trump’s announcement that the U.S. will add 10% tariff to US$300 billion worth of Chinese goods – by suspending purchases of U.S. agricultural imports and letting Yuan to fall.

In fact, according to hedge fund manager and Hayman Capital Management founder Kyle Bass, China’s currency would plunge 30% to 40% without Beijing’s support. It doesn’t matter whether Trump calls China a currency manipulator or not. The Chinese have expected worse than name calling when they decided to weaponise their currency to fight the U.S.

Now that China has crossed the red line, investors and analysts believe that the world’s second biggest economy is prepared to accept an economic slowdown to prevent President Trump from winning his 2020 re-election. The suspension of U.S. agricultural product purchases and devaluation of the Yuan are considered high-stakes measures, which could put Chinese businesses at risk.

It is now clear that China is playing the game of unleashing weapons designed to endanger Trump’s re-election, even at the risk of collateral damage to the global economy and financial markets, while waiting (or rather hoping) for a change of leadership in Washington. Of course, Beijing’s strategy could backfire if Trump gets re-elected anyway in 2020.

But by the time Trump gets re-elected, which is about a year away, the damage done to the economies of both China and the U.S., if it hadn’t plunged the world into a recession, may provide sufficient proof to leaders of both nations to stop the trade war. Besides, Trump might not have any incentive to continue the trade war once he gets re-elected.

However, if Trump loses his 2020 re-election and China emerge the winner, the subsequent American presidents will not dare to start any trade war again with the Chinese in the future. So, it’s a game of high risk, high gain. For now, the direction of the U.S. stock market, something which Trump cares very much, is being determined by China’s currency.

And that’s a big deal because Beijing can do what it likes – every day – by fixing the exchange rate of Yuan against the dollar. To make things worse for the U.S., the latest trade data released today shows China’s exports unexpectedly better than expected despite mounting economic pressure from U.S. tariffs. That shows the country’s economy continues to grow.

China’s exports in July rose 3.3% from a year ago, as compared to estimates by Reuters had expected the exports to fall by 2%. On the other hand, imports fell 5.6% during the same period, when the same poll had expected a decline by 8.3%. The July trade data show China registered yet another month of trade surplus of US$45.06 billion, compared to a US$50.98 billion surplus in June.

By influencing not only the U.S. stock market, but also the U.S. bond market with its daily adjustment to its currency, a falling Yuan as strategized by China would mean that the Chinese want the trade war to drag until next year. Perhaps they want to test what other types of weapons the U.S. has in its arsenal during those wild intraday swings.

Nevertheless, the fact that central banks in New Zealand, India and Thailand all making surprise interest-rate cuts on Wednesday goes to show that if things really go south, the global financial markets and economies would plunge into crisis. So far, China’s actions speak volumes that it is prepared for that doom and gloom day. Is Trump ready to join the party?

Other Articles That May Interest You …

- China Strikes Back!! – Trade War Becomes Currency War After Suspends U.S. Agricultural Goods & Devalues Currency

- How Wall Street Lost 590 Points After Trump Slapped China With 10% Tariff On $300 Billion Goods

- The Trump Effect! – Home Sales Plunge 36% As Chinese Buyers Flee, Continue Dumping US Treasury

- Economists Thought China’s Economy Depends On The World – But McKinsey Research Shows Otherwise

- What Trump Doesn’t Want His Supporters To Know – China Lowered Tariffs To Everyone Except The U.S.

- China’s New Message To The U.S. – “Negotiate – Sure!”, “Fight – Anytime!”, “Bully Us – Dream On!”

- Trump Is Bluffing – He Will Not Let The Stock Market Collapse, And He Lied About Forcing China To Pay $100 Billion

- China Reveals Strategy To Fight U.S. Trade War – Stop Buying American Debt

|

|

August 8th, 2019 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply