Last year, for the first time in 7 years, Huawei successfully broke the Samsung-Apple’s domination, No. 1 and 2 respectively, in the smartphone market. Huawei shipments skyrocketed and overtook Apple to become the world’s second-largest smartphone maker. Apparently, the strategy of positioning Honor to capture mid-tier segment and premium P20 Pro appeared to be working.

On Tuesday, Apple unveiled earnings for its December quarter. The iPhone maker confirmed its earlier warning that holiday revenue declined. Although iPhone revenue came in just slightly below projections, the stock gained in extended trading. Below is the summary of the company’s earnings report:

- EPS:$4.18, vs. $4.17 forecast estimates

- Revenue:$84.3 billion, vs. $83.97 billion forecast estimates

- Q1 iPhone revenue:$51.98 billion, vs. $52.67 billion forecast estimates

- Q1 services revenue:$10.9 billion, vs. $10.87 billion forecast estimates

- Projected Q2 revenue:between $55 billion and $59 billion, vs. $58.83 billion forecast estimates

Apple saw a sharp decline in iPhone revenue during the quarter. The gross margin was 34.3%, lower than the 38% margin Apple reported for its overall business. CEO Tim Cook said on the company’s earnings call – “Our customers are holding on to their older iPhones a bit longer than in the past, resulting in iPhone revenue that was down 15% from last year.”

The earnings report reveals its fiscal first quarter under “a new structure” – showing gross margin figures for its services and product segments but withholding unit sales numbers for the iPhone. The new structure of reporting was designed to shift focus from the iPhone to other growth metrics, such as services which included Apple Pay, Apple Music and iCloud storage.

Overall, Apple’s services have grown from less than US$8 billion in 2010 to over US$41 billion in 2018. Unlike the services segment, Apple’s total sales of $84.3 billion represent a year-over-year decline of 5% – marking the first annual revenue decline during a holiday season quarter since 2001. More importantly, Apple saw almost US$5 billion less in revenue in China than a year ago.

To hide the shrinking smartphone sales, due to market saturation and probably pricier iPhone, Apple has stopped reporting the unit sales for the gadget or other major product lines. The company sold US$51.98 worth of iPhone, less than the US$52.67 billion estimated by analysts. Revenue for the iPad grew 17%, and revenue for the Mac grew 9%.

Even though Apple’s revenue in China came in at US$13.17 billion during the December quarter, a drop of nearly US$5 billion, most analysts were relieved that the earnings have been “better than feared”, hence the stock’s pop. However, some analysts were flabbergasted – is Apple a services company or still an IT hardware company?

Perhaps these analysts or fund managers deliberately try to push up the stock price before unloading – a typical trick in the Wall Street. Some even have declared the worst was over for Apple in China. But the fact remains that Apple is continuously losing market share in China, as Chinese brand especially Huawei moves further away north.

Huawei has been extremely aggressive in offering a better quality, sexier design, larger battery, and cheaper smartphone to rival Apple iPhone. As a result, Chinese consumers are more than willing to switch to the Android phone. Make no mistake. They still like the premium iPhone. But the premium iPhone comes with a premium price tag, a great burden in a time of slowing economy.

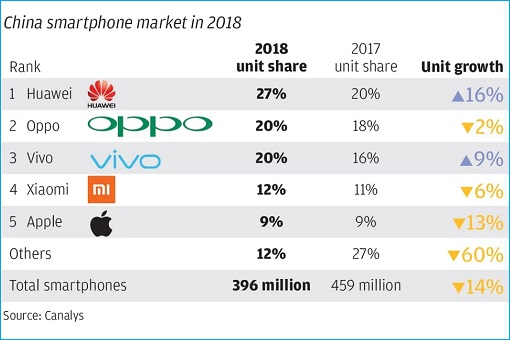

Competition is extraordinarily fierce in China. With the world’s biggest internet population and smartphone market, China had as many as 300 domestic mobile phone companies about three years ago. Thanks to competition, the number was reduced to 200 last year. Huawei is leading the Chinese smartphone market, capturing 27% last year, up from 20% a year ago.

“Oppo” was at second place together with Vivo, commanding 20% of the China market. Xiaomi has lost its shine, but still at a respectable fourth place with a 12% market share. Apple, on the other hand, is fast losing its market share at fifth place (9% share). To be fair, Apple got trashed primarily because it does not compete in low-end smartphone segment.

Even if Apple ventures into low-end products, the American brand can never beat Chinese lowly-priced brand like Xiaomi. As local brands improve on quality, performance, design and features, iPhone tried to become more premium – by hiking its price. The bullish Chinese brands could come to an abrupt stop though, if a prolonged US-China trade war leads to Washington restricting the export of American-made software.

Other Articles That May Interest You …

- The U.S. To Officially Request Sabrina’s Extradition – But Canada Isn’t Happy Their Citizens Are Being Punished

- What Trade War? US Trade Deficit With China Hits Record High $323.32 Billion Last Year

- Ouch!! Apple Has Lost $452 Billion – That’s 3 Times Size Of McDonald’s Or The Entire Facebook

- Mutual Assured Destruction – Tim Cook’s Latest Sales Warning Shows More Havoc Is Coming

- 2019 Recession May Have Started – December Stock Market Will Be The Worst Since 1931 Great Depression

- President Trump’s Trade War Strategy Against China Isn’t Working – It Gets Worse!!

- China’s Latest Strategy Against Trump’s Trade War May Be Based On Sun Tzu’s Art Of War – Stays Quiet!!

- 30 Investing Tips & Tricks You Won’t Learn At School

|

|

January 31st, 2019 by financetwitter

|

|

|

|

|

|

|

It’s my way or the HuaWei… 🙂