Enjoy the party while it lasts, as the saying goes. In the case of about 32 million Malaysians, they still have another 3 weeks to enjoy low petrol or fuel price. After 9th May, depending on the global crude oil prices, the whole country could be in a shock as price at stations would show a mind-boggling increase.

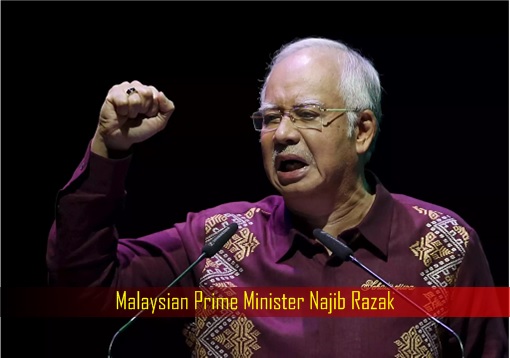

For the 5 consecutive weeks, the caretaker government of Najib Razak has fixed the fuel prices to RM2.20 for RON95 and RM2.47 for RON97 while diesel remains at RM2.18 per litre. This is despite the global crude oil hitting the 3-year high. The Brent crude oil trades at US$73.93 a barrel while the WTI crude oil hits US$68.85 a barrel.

Since 30th March, 2017, Malaysians pay for their fuel based on weekly system, which is calculated based largely on the benchmark prices determined by Mean of Platts Singapore (MOPS). But MOPS benchmark is just one of many factors determining the final fuel price at stations. The exchange rate of local currency ringgit against US dollar is the next biggest factor.

Of course, there are refineries sale prices, operating expenses, profit margin for oil companies and dealers to be considered too. However, the Najib government has not been transparent about the calculations about the so-called “Automatic Pricing Mechanism”. Obviously, the caretaker government is subsidizing the fuel price out of fear of losing the general election.

The Malaysian Parliament was dissolved effective Saturday, 7th April 2018, while the Polling Day is on 9th May. When the RON95, RON97 and diesel prices were first fixed at RM2.20, RM2.45 and RM2.18 per litre respectively on 22th March, Mr. Najib artificially set them lower than expected, knowing he was going to call for the dissolution of the Parliament 2 weeks later.

As the fuel prices change on weekly basis, stations’ price on 22th March was based on previous week’s historical prices. And on the week leading to 22th March, the crude oil jumped from about US$64 to nearly US$70 a barrel – an increase of 6 US dollars. The global oil price then retreated to US$67 before skyrockets to US$73.70 a barrel today.

In short, the crude oil has shot from US$64 to US$73.93 a barrel – close to 10 bucks – and the fuel prices at stations remain unchanged for the same period of time. It’s worth to note that the currency exchange rate of ringgit against US dollar has been negligible during the same period – strengthening from RM3.91 to RM3.86 before weakening to RM3.89.

So, does it make sense that despite currency appreciation of RM0.05 (five sen) but crude oil appreciation of US$10 a barrel, the prices at the fuel pumps can “remain unchanged” for the last 5 weeks? You don’t need a rocket scientist to conclude that the stagnant fuel prices ahead of the 14th General Election have been manipulated.

The higher the crude oil goes, the more painful it would be for the 32 million Malaysians once the election is over and Najib emerges victory. That’s because the bubble will be so huge that it will burst with a big bang. It would be payback after 9th May when Najib Razak rushes to form his government for the next 5 years.

But how much could be the jump at fuel stations after the polling on 9th May? Considering that the highest fuel prices for RON95 and RON97 were RM2.31 and RM2.58 a litre respectively on 31st January, 2018 (crude at US$68 a barrel and exchange rate of RM3.90), the difference of then RM2.31 and current RM2.20 (for RON95) means an imminent hike of RM0.11 a litre.

However, the crude oil is now close to 6 US dollars higher (while maintaining roughly the same currency exchange rate) since then. Therefore, it’s estimated the fuel prices for RON95 and RON97 could easily jump by RM0.20 a litre – conservatively – after the election. Even if the ringgit appreciates, Najib is expected to recoup the losses (subsidy) incurred during his present attempt not to anger the people.

Of course, between now and 9th May – that’s 3 weeks away – a lot of things could happen. The crisis in Syria after the missile strike by the alliance of US-UK-France will not go away overnight. And the tension over Iran nuclear agreement can only get worse with national security adviser John Bolton and soon-to-be Secretary of State Mike Pompeo cheering Trump for war.

U.S. crude oil stockpiles continue to drop as the Saudi Arabia reportedly targeting US$80 per barrel oil – or even US$100. Production in Venezuela continues to decline as the economic crisis paralysed the nation. Even a sudden movement of Russian military assets into Syria could easily spook the global crude oil to trade higher.

Other Articles That May Interest You …

- Thanks To Trump, Oil May Spike To $100 – That’s Precisely What Putin Wants

- 70% Success Rate – Syrian Intercepted 71 Out Of 103 Missiles Using Obsolete Russian Defence System

- Najib’s Final Gamble – His Cheating, Bullying & Suppression May Backfire Spectacularly

- Oil Crashes!!! U.S. Produces So Much Oil That They Even Sell To The Arabs

- U.S. Oil On Its Way To Beat Saudi & Russia – Tops 10 Million Barrels / Day Since 1970

- Everyone Knows Oil Supply Will Be Up In 2018, But Nobody Knows By How Much

- If Oil Goes Above $70, The Complacent & Lazy Saudi Might Not Reform At All

- Here’s How Oil Could Crash To $10 – In 6 To 8 Years

- Meet United States – The World’s Latest Oil Exporter – After 40 Years

|

|

April 19th, 2018 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply