For the first time since 1970 – almost 50 years – the United States can loudly tell Saudi Arabia that Americans will never be taken hostage by the Arabs – again. In November 2017, the U.S. oil production rose to 10.038 million barrels a day, 4% more than the previous month. That milestone is slightly less than 10.044 million barrels a day, the monthly record in November of 1970.

On October 1973, OPEC kingpin Saudi Arabia decided to teach the Yankees a lesson for its military support for Israel in a 1973 war with Egypt and Syria. As the U.S.’ thirst for oil skyrocketed in the 1970s, Saudi conspired with other Arab nations and slapped America with an oil embargo, triggering the infamous 1973 Oil Crisis.

The Arab Oil Embargo of 1973-74 caused long gas station lines, soaring fuel prices and rationing for American drivers. By the end of the embargo in March 1974, the price of oil had risen from US$3 per barrel to nearly #US12 globally. But the shale revolution would transform America into an energy powerhouse – 40 years later in 2016.

America, having learnt a bitter lesson from the Arab oil embargo, was determined not to be humiliated and threatened again. Starting January 2016, the U.S. becomes the world’s latest oil exporter. Saudi woke up to find that the Yankees, after 40 years under the thumbs of the notorious OPEC oil cartel, weren’t under its magic spell anymore.

Initially, Saudi Arabia pumped relentlessly in order to squeeze out higher cost American shale producers as the panicked kingdom tried to maintain its market share, and at the same time kill off its competitors, during the oil crash in 2014. That tactic had pushed prices well below US$30 per barrel and forced many U.S. producers to scale back in 2015 and 2016.

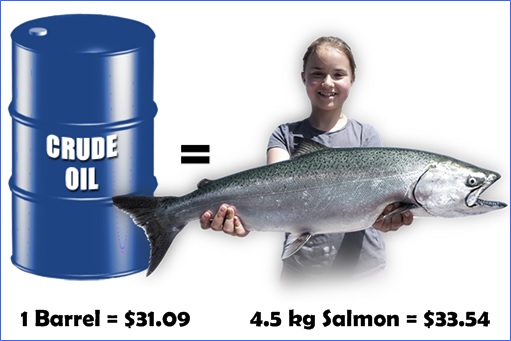

The oil had gotten so cheap that you could literally trade one 4.5-kg salmon fish, 5 pieces of cauliflower or even the “barrel” itself – for a barrel of crude oil. However, the American shale producers didn’t die and with the infrastructure in place, they took a rest instead. As Saudi burns its foreign reserves to the ground, without serious damage to the U.S. shale industry, they changed strategy.

Working hand in glove with non-OPEC member such as Russia, the Saudi then led the increasingly powerless OPEC (Organization of Petroleum Exporting Countries) to curb output in response to a global supply glut fed in part by shale. After an initial success, they agreed to extend the curbing of production – cut 1.8 million barrels a day – throughout 2018.

Even though Russia’s Economy Minister Maxim Oreshkin admitted that the deal with OPEC to curb oil productions were hurting Russia’s economic growth, the strategy works wonderfully. The Brent crude oil price has breached the US$70 psychological level but has since retreated slightly – the highest level since 2014.

OPEC nations realize that lower production would excite oil prices and this is perhaps the only solution for them. Fighting against the U.S. shale producers is futile. Now, the alliance of OPEC and non-OPEC is at the crossroads. Should they increase their production in a significant way to prevent the U.S. from eating the market share without a fight?

At US$70 a barrel, the resurgence of the U.S. shale industry is the latest turn in the tug of war between shale producers and the OPEC. As U.S. producers pump more, oil imports from foreign countries are shrinking to new lows and American crude exports are rising. In fact, the U.S. could even dethrone both Saudi Arabia and Russia as the planet’s leading oil producer.

The U.S. hasn’t been the global leader, nor ahead of both Russia and Saudi Arabia, since 1975. But that’s about to change. Based on research firm Rystad Energy, the United States is able to ramp up production by 10% in 2018 to about 11 million barrels per day. The Norwegian firm sees U.S. crude output hitting the 11 million figures by December, surpassing global leader Russia and OPEC kingpin Saudi Arabia.

Interestingly, even after the news that the U.S. has topped 10 million barrels a day, it couldn’t crash the oil prices. It was offset by OPEC’s strong compliance of oil supply cut. However, compliance can only do so much to push up prices. What will happen when the U.S. eventually adds another million barrels of crude oil a day?

A Reuters poll showed that oil prices are unlikely to advance much above US$70 a barrel in 2018, since the market is caught between the opposing forces of OPEC-led production cuts and surging U.S. output. Already, the U.S. oil inventories rose 6.8 million barrels in the week to January 26, after 10 straight weeks of declines.

Even if the U.S. couldn’t unseat Saudi or Russia this year, they could always try it next year. The Permian Basin of Texas and New Mexico – the engine room for shale production since the oil-price crash – is expected to comprise almost 30% of output this year. ExxonMobil Corp. is spending billions to triple output by 2025 from the Permian, where its costs are as low as US$15 a barrel.

Other Articles That May Interest You …

- Everyone Knows Oil Supply Will Be Up In 2018, But Nobody Knows By How Much

- If Oil Goes Above $70, The Complacent & Lazy Saudi Might Not Reform At All

- U.S. Oil Producers Eating Up Asian Market, And There’s Nothing OPEC Can Do

- Here’s How Oil Could Crash To $10 – In 6 To 8 Years

- Challenging The US Dollar – Soon, China Will Buy Saudi’s Oil Only In Yuan

- Karma Is A Bitch! – Desperate Saudi Whines & Begs U.S. Not To Pump So Much Oil

- Meet United States – The World’s Latest Oil Exporter – After 40 Years

- Here’s Why Oil Above $100 Will Never Happen Again, Ever, Forever!!

|

|

February 1st, 2018 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply