China is not out of the wood yet although President Trump’s order to impose a 25% tariff on steel imports could hardly hurt the Chinese. Under pressure (including that of Gary Cohn’s resignation) that his tariffs would hurt American friends more than its enemies, the U.S. president made some changes and exempted Canada and Mexico by virtue of both nations being NAFTA partners.

For the rest of the world affected by the tariffs, they are welcomed to make appointments and negotiate with Trump for exemptions. That’s the game plan of “The Apprentice” celebrity. He likes to see contestants fighting and badmouthing with each other. He also likes chairing a meeting in the boardroom to get the best deal, hence his book “The Art of the Deal.”

But the steel and aluminium tariffs were the last thing that concerns China. After all, they would only suffer US$689 million in trade losses. Besides unfair trade practices leading to the massive U.S. trade deficit with China, the United States have a truckload of ammunitions to punish the Chinese. And it appears Trump is about to unleash his next round of tariffs.

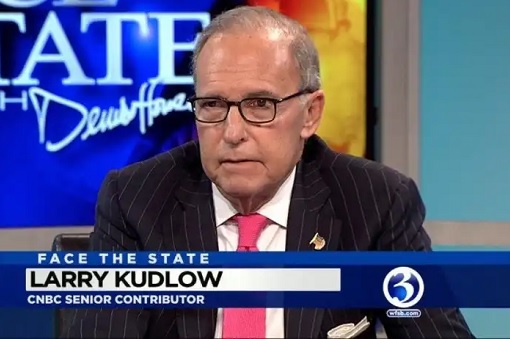

The appointment of Larry Kudlow to succeed Gary Cohn as the new director of the National Economic Council could only mean one thing – China will be forced to retaliate, even though the Chinese had said they don’t want a trade war. In his first public interview since the president offered him the job, Mr. Kudlow had harsh rhetoric for China.

Kudlow said – “The United States could lead a coalition of large trading partners and allies against China, or to let China know that they’re breaking the rules left and right. That’s the way I’d like to see. You call it a sort of a trade coalition of the willing.” That “coalition of the willing” was previously used by former President George W. Bush in the war against Iraq.

The new chief of National Economic Council also said – “I don’t like blanket tariffs and I don’t think you should punish your friends to try and punish your enemies in international affairs.” Essentially, Trump’s economic adviser has indirectly declared “Trade War” with China, and it could mean US$60 billion worth of Chinese goods could be slapped with a new round of tariffs.

As far as Trump is concerned, he can’t ignore the elephant in the room, even if he wants to – China’s US$375 billion trade surplus with the U.S. He could be plucking a figure from the sky but Trump wanted to reduce that deficit by US$100 billion. He can’t punish China using the steel tariffs because the Chinese was at 11th position in terms of steel exports to the U.S.

Therefore, Trump’s going to hit Beijing with indefinite tariffs, investment restrictions and possible visa restrictions on Chinese travellers. Last week, U.S. Trade Representative Robert Lighthizer presented Trump with a proposal which would target Chinese goods to the tune of US$30 billion a year, involving more than 100 products ranging from electronics to furniture and toys.

Trump reportedly wasn’t impressed with the figure and wants steeper duties on China, preferably at least US$60 billion, according to Reuters. Of course, Trump wrongly sent a tweet that his administration wanted China to reduce its trade surplus with the U.S. by US$1 billion, when he actually meant to say US$100 billion.

While losing US$60 billion out of US$375 billion in trade surplus seems like something which China can live with, it’s hard to see how Beijing could sit on its hands and does nothing. Beijing has repeatedly said – “If the United States takes actions that harm China’s interests, China will have to take measures to firmly protect our legitimate rights.”

China doesn’t seem to have any good options or justifications not to retaliate. If they keep quiet, Trump would interpret that as weakness and would probably go to the next rounds of new tariffs on other Chinese goods. Thus, China will be forced to retaliate, even if they don’t like to. The key question is whether the U.S. will retaliate against that retaliation.

Trump administration is betting that they would win the trade war with China because it’s the Chinese who are enjoying the trade surplus, not America. If the trade war gets ugly, they believe China would surrender to protect whatever is left of their trade surplus with the U.S. However, the Chinese think they could strategically hurt Trump where it hurts the most.

If yesterday’s stunning loss in Pennsylvania’s 18th Congressional District special election is an indicator, China’s immediate counter-tariffs will be targeting American farmers. If the Pennsylvania steelworkers couldn’t bother about Trump’s steel tariff, imagine the backlash when the Chinese imposes their own tariffs on U.S. soybean, corn and sorghum (a cereal grain used to feed livestock).

More than half of U.S. soybeans exports (worth US$14 billion in 2016) go to China. Similarly, more than 90% of sorghum arrivals in China come from the U.S. – worth US$1 billion last year. Clearly, if the Chinese hits back, American farmers who supported Trump would suffer terribly. China has a long history of tit-for-tat retaliation when it comes to trade war.

The fragile U.S. farm economy cannot afford a trade war with China. Since 2006, U.S. farmers have grown more than three-fold – from less than 29 million metric tons to an expected 97 million metric tons this year – specifically because of soybean export to China. The Chinese could easily switch to Brazil, which produces superior quality soybean.

As part of a tit-for-tat trade war with the U.S., China can also decide to reduce its purchase of U.S. Treasurys. Of course, when push comes to shove, the Chinese could sell the U.S. debt papers, creating havocs in the bonds and stocks markets. They could divert their money thereafter to buying European bonds, for example.

Boeing, which was awarded a US$38 billion orders, will be replaced by Airbus while Apple iPhone sales – worth US$44.7 billion (2017) – could be affected. General Motors, the biggest foreign car brand in China, sold a record 4 million units in the country last year. The U.S.-made automaker could suffer in the crossfire.

China could change its stance on North Korea by simply re-opening free trades with the hermit kingdom, allowing free flows of business transactions and crucial commodities such as crude oil under the pretext of humanitarian. Trump and his allies should not underestimate the effect of Chinese retaliation. The question is – how would China like the end results to look like?

Other Articles That May Interest You …

- Stunning Loss! – Pennsylvania Shows Flashing Trump Card Won’t Work All The Time

- Gary Cohn Resigns – He And Trump Were Never Compatible From The Beginning

- U.S. Latest Steel & Aluminium Tariffs Show Trump Isn’t Actually Targeting China

- Tariffs On Solar & Washing Machines – Why Trump’s Trade War Is Smart & Dumb

- China Reveals Strategy To Fight U.S. Trade War – Stop Buying American Debt

- U.S. Household Debt Hits Record $12.84 Trillion – China Top Owner Of I.O.U. Papers

- A US-China Trade War About To Happen – Here’s Why The Yankees Can’t Win

- U.S. Debt – How Much Does Each American Owe?

|

|

March 15th, 2018 by financetwitter

|

|

|

|

|

|

|

CHINA CANNOT SELL THE USA DEBT PAPERS IF THE USA DOES NOT BUY THEM. IT COULD TRASH THEM BUT THAT WOULD HURT CHINA MORE BY strengthening its currency. The U.S. dollar would do the opposite and weaken… this would create a situation where all the jobs would to the U.S. This is why consumer based economies have more leverages in deals… the only way to hurt them is it hurt yourself more.