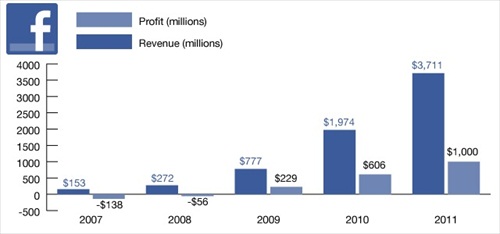

Facebook, in one of the world’s most widely anticipated IPOs (initial public offerings) of stock, filed papers to raise at least $5 billion, which is expected to value the whole company at $75 billion to $100 billion, and is set to begin trading on stock exchange by May (under the symbol “FB”). The filing revealed that in 2011 it had profits of $1 billion on sales of $3.7 billion. Morgan Stanley is leading the role as underwritter with other investment banks involvement such as Goldman Sachs, Bank of America, Merrill Lynch, Barclays Capital and JP Morgan.

Judging by the IPOs paper, Facebook generated only $4.39 per registered user, a huge challenge to the social network company as compared to Google’s $30 per user. Even struggling Yahoo and AOL make $7 and $10, respectively. That means Facebook certainly have to attract a lot more users or be more aggressive with its advertising, without driving its users base away. However Wedbush Securities analyst Michael Pachter claimed Facebook should easily be able to increase revenue per user to $10 to $12 annually.

In actual fact, Facebook doesn’t need to be listed in the stock exchange to raise money as it has already made a great deal of money as a private company. However since Facebook already has more than 500 investors, it is required to make certain financial information public anyway under SEC regulations, not to mention its investors would like to recoup their investments in the company.

Nevertheless by going public, Facebook will have access to new pool of cash and can use the value of its stock to do anything including to acquire other companies and to reward its employees. Of course, the flip side would be the needs to declare its profits and losses and answer to shareholders every quarter thus losing its inner mystery. On the bright side, many of Facebook’s 3,000 employees could now become Silicon Valley millionaires. Zuckerberg, himself, is already said to be the world’s youngest billionaire.

There’re also surprises, in case you didn’t already know, about the inner secrets of Facebook with the IPOs filing paper:

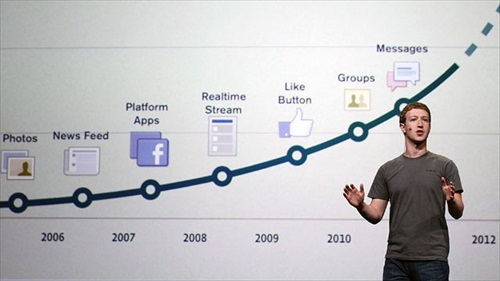

[ 1 ] How many Facebook users?

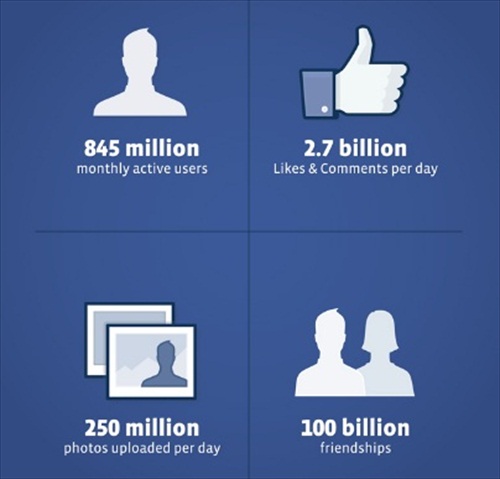

- Facebook now has 845 million users – 45 million more than the company reported in September 2011 – and 483 million daily active users. Those users generate $2.7 billion daily likes and comments.

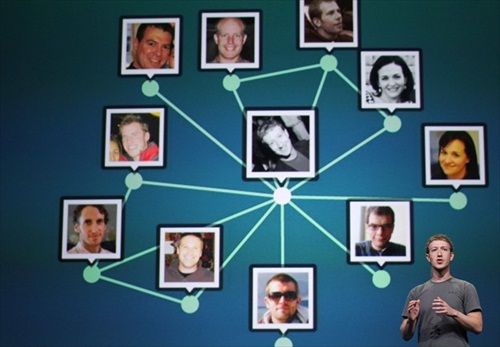

[ 2 ] How many Facebook relationships are there?

- Facebook has a mind blowing 100 billion relationships on its site – that’s one for every dollar of the highest estimate of its valuation.

[ 3 ] How profitable is Facebook?

- Facebook’s revenue and profit in 2011 are $3.7 billion and $1 billion respectively.

[ 4 ] What is Facebook’s future growth?

- Facebook’s growth now depends on the rest of the world particularly Brazil, India and China although stiff competition comes from Russia and Japan. Its growth in United States is almost at a standstill.

[ 5 ] What is Facebook’s biggest problem in its growth story?

- Facebook’s filing reveals mobile as its problem which could hurt its bottom line going forward. As of now, it doesn’t have display ads on its mobile products and since it doesn’t make its own phone, ads control is a huge problem hence finding a non-intrusive way for mobile marketing is almost equivalent to Holy Grail.

[ 6 ] What is Facebook risk factor?

- Surprisingly losing its COO (chief operating officer) Sheryl Sandberg was listed as one the the risk factors. The former Google executive is rumored to be leaving Facebook (after the IPO?) and venture into politics. Sheryl is the highest-paid employee – earning a cool $30.87 million in salary and stock in 2011. She is in charge of everything except the product – which is Zuckerberg’s baby.

[ 7 ] Who is the most important business partner?

- In its S-1 filing, it was revealed that Zynga contributed a whopping 12% of its total revenue – thats about $445 million of Facebook’s 2011 revenue, a great amount of money that Facebook receives through Zynga’s online game purchases and advertising.

[ 8 ] Who are Facebook’s shareholders?

- Chief Executive Mark Zuckerberg

- biggest shareholder with 56.9% of the voting shares, thanks to proxy arrangements

- stake of 28.4% or 533.8 million shares – worth $28.4 billion (based on valuation of $100 billion, or $53 a share) making him the fourth richest person in America.

- he made a salary of $483,333 in 2011, in addition to a $220,500 bonus for the first half of 2011.

- James Breyer, principal partner of Accel Partners

- invested in Facebook 7 years ago

- has a stake of 11.4% or 201.4 million shares – worth about $10 billion

- co-founder Dustin Moskovitz

- stake of 7.6% or 133.7 million shares – worth about $6.6 billion

- DST Global (Digital Sky Technologies)

- stake of 5.5% or 94.5 million shares – worth about $4.7 billion

- Sean Parker

- The Napster co-founder who helped Facebook wrangle early investors has 4% stake worth about $4 billion.

- Peter Thiel

- the billionaire contrarian who is Facebook’s first outside investor has a stake of 2.4% or 44.7 million shares – worth about $2.2 billlion.

- Peter invested $500,000 in Facebook in late 2004

- COO Sheryl Sandberg

- She holds 1.9 million shares or about 0.1% of Facebook

- However, she may ultimately collect 38.1 million additional shares, pushing her into the billionaires club, provided she doesn’t get fired.

- Facebook CFO David Ebersman

- has a stake of 0.11% or 2.17 million shares – worth about $101 million

- Facebook VP of engineering Mike Schroepfer

- has a stake of 0.11% or 2.1 million shares – worth about $98 million

- Mark Zuckerberg’s father

- Edward Zuckerberg, a New York dentist, provided the company with “initial working capital” in 2004 and 2005.

- In return Facebook issued Mark’s father an option to buy 2 million shares, which went unused.

- In December 2009, the Facebook board “issued an aggregate of 2,000,000 shares of our Class B common stock to Glate LLC, an entity owned by Mr. Zuckerberg’s father.” – now worth about $100 million

The question remains if Facebook, the social network that changed “friend” from a noun to a verb, together with its “Cocky” Zuckerberg boss, would do as well as Google, if not better. Also with the euro zone crisis and the ballooning US debt on the horizon, now could be a bad timing for Facebook’s floatation, if the listing of Zynga and Groupon is any indicator to goes by.

Other Articles That May Interest You …

- Here’s What Happen On Internet Every 60(Sixty) Seconds

- How Did Some Great Companies Get Their Cool Names?

- Tattoo Of 152 Facebook Friends, A Cool Marketing Stunt

- LinkedIn IPO At Crazy Price, IPO Scramble To Follow

- Hello, My Daughter’s Name is “Like”

- Facebook’s New Campus In Menlo Park (Photos)

- Obama Dinner – Steve Jobs, Mark Zuckerberg are VVIP

- Facebook IPO, from $50 Billion to $124 Billion Valuation

|

|

February 4th, 2012 by financetwitter

|

|

|

|

|

|

|

I simply couldn’t leave your site prior to suggesting that I really enjoyed the usual info a person provide in your visitors? Is gonna be again continuously to inspect new posts