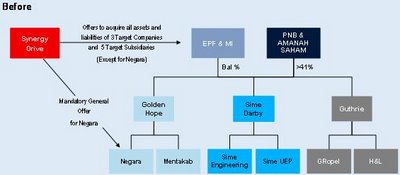

CIMB Investment Bank Berhad (CIMB) officially announced a proposal for the merger of Sime Darby Berhad, Golden Hope Plantations Berhad and Kumpulan Guthrie Berhad to create the world’s largest listed oil palm plantation player valued at RM 31 billion.

CIMB Investment Bank Berhad (CIMB) officially announced a proposal for the merger of Sime Darby Berhad, Golden Hope Plantations Berhad and Kumpulan Guthrie Berhad to create the world’s largest listed oil palm plantation player valued at RM 31 billion.

directors are Tan Sri Dato’ Md Nor Yusof (Chairman), Dato’ Zainal Abidin Putih and Wan Razly Abdullah. CIMB will provide initial financing for Synergy Drive.

directors are Tan Sri Dato’ Md Nor Yusof (Chairman), Dato’ Zainal Abidin Putih and Wan Razly Abdullah. CIMB will provide initial financing for Synergy Drive. -

Mentakab Rubber Company (Malaya) Berhad (MTAKAB : stock-code 2518)

-

Highlands & Lowlands Berhad (H&L : stock-code 2402)

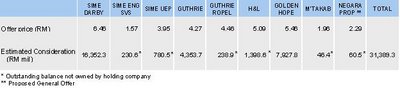

Synergy Drive’s proposed offer price for the nine companies is about five percent premium to the closing price of the last trading day prior to suspension of each counter.

The purchase consideration will be settled by the issue of Redeemable Convertible Preference Shares (RCPS) which shareholders can immediately convert to Synergy Drive’s shares valued at RM5.25 per share or redeem for cash. Upon completion of the merger, Synergy Drive would seek a listing on the Main Board of Bursa Securities whilst all the companies which businesses have been acquired would be de-listed.

On the assumption that all shareholders accept shares, Synergy Drive’s share capital would be approximately 6 billion ordinary shares of 50 cents each. Based on merger exchange price of RM5.25 per share in market capitalization would be RM31.4 billion making it among Malaysia’s top five listed companies, after Tenaga Nasional (TENAGA : stock-code 5347) currently at RM46.1 billion, Maybank (MAYBANK : stock-code 1155) at RM44.0 billion, MISC (MISC : stock-code 3816) at RM33.9 billion and Telekom Malaysia (TM : stock-code 4863) at RM32.1 billion.

Other Articles That May Interest You …

Other Articles That May Interest You …

|

|

December 3rd, 2006 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply