Billionaire Elon Musk, who became the first person on the planet to achieve a net worth of more than US$500 billion last month (October 2025), has continued to hold the top position since May 2024, and chances are he could become the world’s first trillionaire soon. According to Forbes’ billionaires index, Oracle founder Larry Ellison is the world’s second-richest person, with a fortune of about US$350.7 billion.

Well ahead of rivals in the global tech sector, Musk’s fortune does not depend on one basket, but spread across Tesla, artificial intelligence start-up xAI and rocket company SpaceX. His huge wealth is closely tied to his 13% stake in Tesla, which has seen its shares rise sharply this year. But his journey to trillionaire has just begun. Tesla shareholders have approved a record-setting pay package for the CEO.

A plan designed to motivate the world’s richest man with a jaw-dropping US$1 trillion in additional stock, the proposal was approved with over 75% support. Flanked by dancing humanoid robots on a stage bathed in pink and blue light at the electric vehicle maker’s Austin, Texas, headquarters, Musk thanked the crowd. Shareholders also voted in favour of Tesla investing in Musk’s AI startup, xAI.

“What we’re about to embark upon is not merely a new chapter of the future of Tesla but a whole new book. I guess what I’m saying is hang onto your Tesla stock,” – Musk said. But even before the shareholders’ approval, Musk revealed last month that he had bought about US$1 billion worth of Tesla shares – indicating not only his vote of confidence in the company, but also his confidence that the shareholders would approve his pay package.

Prior to the voting, Elon Musk, who also owns the X social media platform, had made a string of promises – from, in April, beginning production of the Cybercab, its 2-seater steering-less robotaxi, to unveiling its next-generation Roadster electric sports car. He also said Tesla would need “a gigantic chip fab” to make AI chips and should consider working with Intel.

Musk, who is also CEO of SpaceX and xAI, had threatened on social media to leave Tesla if the proposal had been rejected. He is already Tesla’s biggest shareholder, with a roughly 15% stake. But he said he wanted a big enough ownership stake in Tesla to be comfortable that the“robot army” he was developing didn’t fall into the wrong hands, but not so large that he couldn’t be fired if he went “crazy.”

Crucially, the voting was largely seen as a referendum on the company’s longtime captain and his vision to shift Tesla’s focus to humanoid robots and artificial intelligence. The vote also allays investor concern that Musk’s focus would turn to running his other companies, including rocket maker SpaceX and xAI. Musk had publicly hinted of spending more time to catch up in the AI (artificial intelligence) race.

While the board warned Musk could leave if he didn’t get the pay package, they also argued that the record-setting pay package benefits shareholders in the long run as Elon Musk must ensure Tesla achieves a series of milestones to get paid. “If completed, these tranches of awarded shares follow strong improvements in revenue growth for Tesla,” said Brian Mulberry, a senior client portfolio manager at Zacks Investment Management.

The new pay package, which includes 12 chunks of stock, could give Musk control over as much as 25% of Tesla if he hits a series of milestones and expands the company’s market capitalization to US$8.5 trillion over the next 10 years. Its market cap is now around US$1.5 trillion. Tesla’s board described the package as pay for performance, designed to motivate Musk to transform the company with new products such as autonomous vehicles, robotaxis and humanoid robots.

Divided into 12 tranches, Musk could reach the first tranche if Tesla’s market cap grows to US$2 trillion from around US$1.5 trillion today, and all the way to US$8.5 trillion. Other goals for Musk over the next decade include the company’s delivering 20 million vehicles, having 1 million robotaxis in operation, selling 1 million robots and earning as much as US$400 billion in core profit.

It’s not hard to see why selling one million robots and maintaining an adjusted EBITDA of US$400 billion are some of the most challenging milestones. Last year, Tesla only posted an adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) of US$16 billion. For each tranche he unlocks – an operational goal and a valuation milestone – Musk would receive 1% of stock.

Therefore, the plan could still reward Musk tens of billions of dollars even if he falls short of most of its ambitious targets. Once he earns a tranche, he could vote those shares but wouldn’t be able to sell them until they vest, in either 7.5 years or 10 years. If Musk, who has a track record of overpromising on products like his Optimus robots, hits all of them, he would be eligible for 12% in stock, adding more than 423 million shares to his holdings, or about US$1 trillion.

However, the net value of those shares would be US$878 billion, because the package is structured to exclude the value of the stock on the day the board passed the proposal in early September. Still, some major investors had opposed the plan, including Norway’s sovereign wealth fund, as did proxy firms Glass Lewis and Institutional Shareholder Services.

For a moment, Tesla struggled to keep Musk’s attention earlier this year as he spent time in Washington running the Department of Government Efficiency. Tesla’s vehicle sales fell more than 13% in the first half of the year. After Musk left Washington in May, he turned his focus to his start-up xAI and the development of its chatbot Grok.

Tesla has faced a number of challenges in recent years, including tough competition from rival electric car makers such as China’s BYD. Sales and profits plunged in the first half and Tesla faces potential billions in lost revenue due to reduced US government support for electric vehicles. Once a key member of President Donald Trump’s inner circle, Musk’s relationship with the president has deteriorated into a bitter public feud.

Elon Musk at present gets no salary and his entire compensation is in Tesla stock. So, even if the trillion-dollar payout doesn’t pan out, if he manages to drive the carmaker’s stock to US$8.5 trillion market cap, Musk could still become the world’s first-ever trillionaire. Getting all the shares under this package over the next 10 years would be the equivalent of earning US$275 million a day, dwarfing any other executive pay package in history.

But for Tesla to reach the US$8.5 trillion in market value needed, shares need to jump 466% from today’s stock price. That’s also about 70% higher than the world’s most valuable company, Nvidia, which hit a record US$5 trillion market cap last week. Tesla, however, is shifting focus from merely selling EVs to selling self-driving cars, including a fleet of “robotaxis,” as well as humanoid robots.

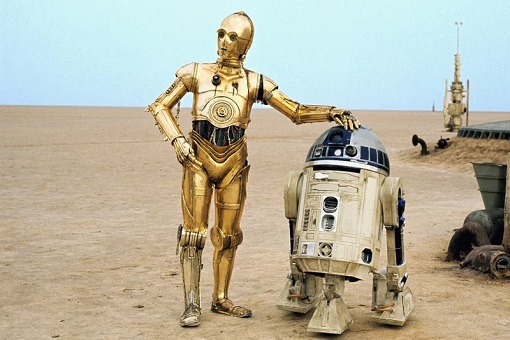

In his remarks to shareholders, Musk spoke more about robots, which have yet to go on sale, than he did about the company’s cars. He argued that the robots will be bigger than the company’s car business – or any other business, even. “I think it’s going to be the biggest product of all time by far. So like bigger than cell phones, bigger than anything. I guess a way to think about it is that every human on Earth is going to want to have their own personal R2D2 or C3PO,” – he said.

Heck, he even predicted Tesla’s robots could replace surgeons, leading to the end of global poverty and re-shape the global economic order. He claims they could be produced for US$20,000 each, allowing the company to sell them for about the price of a car. It was a sales pitch, selling a dream – even a fantasy – which Musk was quite good at.

Still, those products and concepts are still under development and haven’t gone on sale. That means even with the passage of the pay package, it’s not certain that Musk will ever see any of its potential hundreds of millions of shares. He will need to fix the company’s current problems and then deliver the big promises that he’s made for the future.

Musk has insisted he needs the additional shares to have more control over the company, not because he wants so much more wealth. “It’s not like I’m going to go spend the money,” Musk said on a call with investors last month. “There needs to be enough voting control to give (me) a strong influence – but not so much that I can’t be fired if I go insane.”

Other Articles That May Interest You …

- Chaos & Confusion As Trump Slaps $100,000 Fee On H-1B Visa

- Forget BYD’s 34% Discount – Here’s How “Zero-Mileage” Used Cars Spread Like Wildfire To Boost Sales

- Trump Has Already Lost His Trade War Against China – But He Can’t Find Ways To Climb Down And Save Face

- Beijing Raises Tariffs To 125% – American Goods No Longer Marketable In China

- Co-President Elon Musk Flexes Power – Europe In Chaos As Tesla Billionaire Having Fun Interfering In Politics

- ISIS-Inspired Terror Attack & Tesla CyberTruck Explosion – The Military Connection In The 2025 New Year Terrorism

- Tesla Disaster – Owners Stranded As “Dead Robots” Won’t Charge In Freezing Temperature, But China Has The Solution

- BYD Beats Tesla Again – How The U.S. Carmaker Lost Its Crown As World’s Top Electric Vehicles Manufacturer

- Malaysia Snatched Tesla From Indonesia – How PM Anwar Convinced Elon Musk To Set Up HQ In The Country

- Tesla & JPMorgan Won’t Quit China – Why U.S. Billionaires And Business Leaders Refuse To Decouple From China

|

|

November 7th, 2025 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply