You don’t want to pick up a fight with Donald Trump if you’re not 100% sure what you’re getting into. In a little more than a year as POTUS, this president has made more enemies than any president in the history of U.S. presidency. On the international stage, he picked up fights with EU, NATO, UN, Mexico, Canada, South Korea, North Korea, Japan, China, Muslims and whatnot.

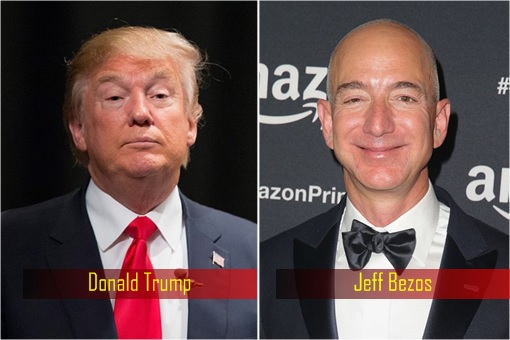

Domestically, not only both Democrats and Republicans were targeted, Trump also fought the Hollywood, FBI, Intelligence Community, Attorney General, mainstream news media and even White House top guns hired by himself. And now he’s going after fellow American and world’s richest man – Jeff Bezos. And things could get really ugly before the Chinese could even pull its trigger.

The war between Donald Trump and the Amazon’s big boss isn’t new. It’s a public knowledge that both Trump and Bezos don’t see eye to eye. Jeff Bezos initially bought the Washington Post in 2013 for US$250 million as a tool to persuade Washington politicians to keep Amazon’s taxes low and help the company avoid antitrust scrutiny. All hell breaks loose when Trump runs for president.

In case you didn’t know, Donald Trump is a vengeful person. And he’s now looking for blood for what Bezos had done to him during the United States Presidential Election of 2016. When Trump electrified his supporters with a pledge to be tough on Amazon, Mr. Bezos used his media to write nasty – even fake articles – about Trump to stop him from reaching the White House.

Bezos is a globalist and a liberal while Trump is a nationalist and a conservative. That pretty much sums up the lack of love between both billionaires. But even after Trump stunningly won the presidency, the Washington Post hadn’t stopped its attacks on President Trump. On the contrary, Bezos’ media has instead intensified its blitzkrieg on Trump administration.

You don’t need a rocket scientist to calculate the level of anger inside Trump when Bezos skyrocketed to become the world’s richest man, unseating Microsoft Bill Gates, whom has been the richest person in the world for 18 of the past 24 years. The ultimate war started on Saturday when Trump unleashed his bazooka, aiming at Bezos’ crown jewel – the Amazon.com.

Freedom of the press in the United States is protected by the First Amendment to the United States Constitution. Therefore, there’s only so much damage President Trump can do to Jeff Bezos’ media. But against Amazon, it’s an entirely different animal. The POTUS is going after the e-commerce giant, calling it a “scam” that’s bleeding the U.S. Post Office “billions of dollars.”

His Saturday’s tweet basically says that the company founded by Bezos pays “little or no taxes to state and local governments.” This wasn’t the first time Trump has gone after Amazon though. On August 16, 2017, Trump tweeted – “Amazon is doing great damage to tax paying retailers. Towns, cities, and states throughout the U.S. are being hurt – many jobs being lost!”

But Trump’s tweet on Saturday is seen as what many believe to be a real declaration of war against Amazon. And judging by the reaction of stock markets, Trump’s punch has caused more than a bloody nose to billionaire Bezos. On Monday alone, Trump’s attack on Amazon resulted in a sell-off, erasing 75 bucks off the stock and wiping nearly US$45 billion from its market value.

More importantly, the open war between Trump and Bezos drags the entire technology sector. The NASDAQ lost 2.74% or 193.33 points while the Dow Jones Industrial Average plunged 458.92 points or 1.90%. Add in the risk of trade war between the U.S. and China, and throw in the Facebook scandal, and you’re looking at the recipe of disaster.

Claiming that Amazon has been taking advantage of the U.S. Postal Service and not paying enough tax, Trump tweeted – “Only fools, or worse, are saying that our money losing Post Office makes money with Amazon. THEY LOSE A FORTUNE and this will be changed. Also, our fully tax paying retailers are closing stores all over the country…not a level playing field!”

It is understood that Amazon pays the U.S. postal service roughly half what it would to United Parcel Service Inc or FedEx Corp to deliver a package. Trump claims that the U.S. Postal Service is losing US$1.50 on average for each package it delivers on bahalf of Amazon. That losses were based on a Citi Research analysis in April 2017.

Trump wants the U.S. Postal Service, which reported a loss of US$2.7 billion in 2017, to charge more. Obviously, higher postal rates could cut into Amazon’s profits in online sales, which depend heavily on the Post Office for delivery. A source reportedly said the POTUS is obsessed with finding a way to go after Amazon with antitrust or competition law.

As Amazon prospers, the company has created tons of business enemies along the way. And they are complaining to Trump that Amazon is killing shopping malls and brick-and-mortar retailers. The U.S. president has been telling all and sundry that Amazon has gotten a free ride from taxpayers and cushy treatment from the U.S. Postal Service.

Amazon registered a mind-boggling US$177.9 billion in revenue last year and employed more than half a million employees. The company purchased Whole Foods Market for US$13.7 billion last year, in a deal approved by the Federal Trade Commission. It’s growth and diversification could be used by Trump to slap Amazon with antitrust law – ultimately breaking up the company.

I have stated my concerns with Amazon long before the Election. Unlike others, they pay little or no taxes to state & local governments, use our Postal System as their Delivery Boy (causing tremendous loss to the U.S.), and are putting many thousands of retailers out of business!

— Donald J. Trump (@realDonaldTrump) 29 March 2018

While we are on the subject, it is reported that the U.S. Post Office will lose $1.50 on average for each package it delivers for Amazon. That amounts to Billions of Dollars. The Failing N.Y. Times reports that “the size of the company’s lobbying staff has ballooned,” and that…

— Donald J. Trump (@realDonaldTrump) 31 March 2018

…does not include the Fake Washington Post, which is used as a “lobbyist” and should so REGISTER. If the P.O. “increased its parcel rates, Amazon’s shipping costs would rise by $2.6 Billion.” This Post Office scam must stop. Amazon must pay real costs (and taxes) now!

— Donald J. Trump (@realDonaldTrump) 31 March 2018

Only fools, or worse, are saying that our money losing Post Office makes money with Amazon. THEY LOSE A FORTUNE, and this will be changed. Also, our fully tax paying retailers are closing stores all over the country…not a level playing field!

— Donald J. Trump (@realDonaldTrump) 2 April 2018

Bezos, whose net worth stood at nearly US$130 billion on Monday (March 26), has seen his fortune down to US$114 billion a week later today – thanks to 4 tweets from Donald Trump. The U.S. president has just burnt US$16 billion away from him, more than what Amazon earned – US$789 million – as a result of Trump’s cut in the corporate tax which benefited the company.

Other Articles That May Interest You …

- You Want Trade War, Here’s The War!! – China Strikes Back, And It’s Just The Appetizer

- Record 2,208 Billionaires – So Rich They Complained About Having So Much Money

- Something Is Very Wrong!! – World’s Richest 1% Grab 82% Of Global’s Wealth

- Trump’s Worst Enemies Aren’t Russia Or China – It’s Within America

- These 8 Men Are As Rich As 3.6-Billion People, Or Half The World

- Globalism & Capitalism Not Working – 0.7% Rich Population Control US$116.6 Trillion

- A Powerful & Vengeful President Trump – ISIS & Radical Muslims Are In Grave Trouble

- Here’s What $100 Is Actually Worth In Each State Of America

|

|

April 3rd, 2018 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply