The Saudi government is aiming to confiscate cash and other assets worth as much as US$800 billion (£610 billion; RM3.38 trillion) in its massive crackdown on alleged corruption and money laundering among the kingdom’s elite – reported Wall Street Journal. Prince Alwaleed bin Talal, easily the richest among a busload of princes detained, worth close to US$16 billion (Forbes) alone.

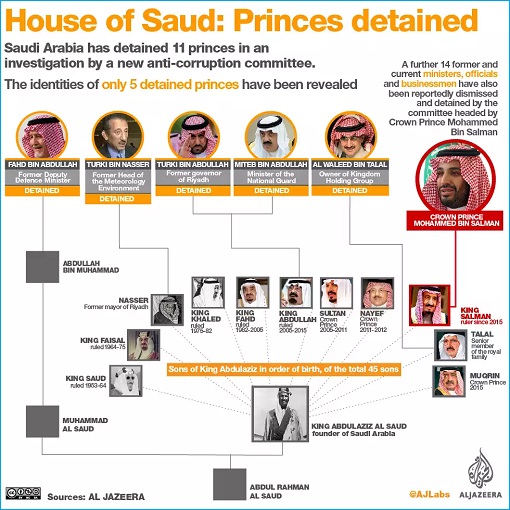

Former Crown Prince, Mohammed bin Nayef, was the latest Saudi royal targeted in the crackdown masterminded by Crown Prince Mohammed. Apparently, Saudi authorities have also frozen bank accounts of the former crown prince. The first phase of purging – involving 11 princes, 4 ministers and tens of former ministers – obviously was just the beginning.

By Wednesday, Saudi authorities have moved in and scooped more VVIPs. Sources said going by the rate fresh arrests are being carried out, the number of suspected individuals could easily climb into the hundreds eventually. From 1,200 on Tuesday, the number of domestic bank accounts frozen skyrocketed to 1,700 by Wednesday.

Even those who had died are not spared. Immediate family of the late Crown Prince and Defence Minister Prince Sultan bin Abdulaziz who died in 2011 were also reportedly being detained. Prince Sultan was the Crown Prince of Saudi Arabia from 2005 to 2011. So far, the crackdown has drawn no public opposition within the kingdom either on the street or social media.

But abroad, critics perceive the purge as further evidence of intolerance from a power-hungry Crown Prince Mohammed keen to stop influential opponents blocking his rise to become the Saudi King. Even the U.S. State Department said on Tuesday it had urged Saudi Arabia to carry out any prosecution of officials detained in a “fair and transparent” manner.

While it’s very obvious the purge exercise was done selectively aiming at Crown Prince Mohammed’s enemies within the royal house, there’s also another hidden reason why it was launched. Similar to the plan to isolate and invade Qatar, which was exposed and failed, the latest anti-corruption operation could bring as much as US$800 billion, or even more if it continues.

Lately, investors, analysts and speculators have been raising questions about Saudi Arabia’s Aramco IPO. The Kingdom of Saudi Arabia is still burning its reserves like crazy to stay alive. Their foreign exchange reserves fell to US$487 billion in July, a significant drop of 34.5% down from US$744 billion in September 2014.

In other words, Saudi has literally burnt a third of their reserves within 34 months since September 2014. That’s about US$7.5 billion of hard cold cash being burnt – every month. And according to the IMF (International Monetary Fund), in order to achieve zero deficits in 2017, Saudi’s breakeven oil price is US$73.10. In short, the country is still burning its reserves as we speak.

Hence, the corruption crackdown, which is partially genuine, was a brilliant plan to kill many birds with a stone. First, the purge would project a perception that Saudi, under Crown Prince Mohammed leadership, will be a corruption-free country which foreign investors could confidently inject their money into. That would attract foreign hot money into many mega projects mooted by the prince.

Second, the Saudi Aramco IPO could shed some doubts about the country’s lack of transparency. Confidence is a rare commodity which Aramco desperately needs to command premium on its share price. Third, a sudden royal crackdown would shake the financial, stock and commodity markets. The sudden surge in crude oil price is what the crown prince has been hoping for.

Fourth, of course, was the desire to crush the crown prince’s enemies from challenging for the throne, and what better ways than to drain their financial capability. Fifth, the anti-corruption purge is an essential tool to win the hearts of the young Saudis, creating an illusion that the young Crown Prince Mohammed is a clean leader whom they can rely on and trust upon.

But the most important factor which forced the future Saudi king to flex his muscles against the brothers of House of Saud is none other than to replenish the national coffers, which has been bleeding since September 2014. It’s indeed embarrassing that the once cash-rich Saudi is being reduced to borrowing from bond markets to make ends meet.

He knew the whole House of Saud is corrupted for decades. With more than 60 princes, officials and other big-name Saudis in custody, the kingdom is already looking at potentially US$800 billion worth of assets and cash that could be confiscated. That’s more than US$10 billion of “dirty money” from each of the detainees being imprisoned in the “5-star Ritz Carlton Hotel”.

While US$800 billion speaks volumes about the level of corruption, money laundering and misappropriation of public funds by the “untouchable” elite, it also provides a crucial source of money to the future King Mohammed to modernize the economy away from its dependency on oil. He reportedly needs “cash to fund the government’s investment plans”.

However, a great deal of assets held by the alleged corrupt officials, businessmen and royals is abroad. That’s why a no-fly list has been issued and that security forces in several Saudi airports were ordered to bar private jets owners from taking off without a permit. It was part of the plan to force the suspects to cooperate – give up most of the money in exchange for leniency.

If you think US$800 billion is insignificant to Saudi, think again. That amount is more than the foreign exchange reserves the Kingdom of Saudi Arabia has ever possessed – US$744 billion – during its peak in 2014. Even if half of the assets could be confiscated, it would be more than enough to offset the money lost from its foreign exchange reserves. It would be like the oil price crash had never happened.

Other Articles That May Interest You …

- Game Of Thrones – Crown Prince Crackdown On Princes, Alwaleed Arrested For Corruption

- If Oil Goes Above $70, The Complacent & Lazy Saudi Might Not Reform At All

- Saudi Prince Finally Admits Extremism, Promises A U-Turn Back To “Moderate” Islam

- Finally, Saudi Women Can Drive – Only Because They’re Needed To Boost Economy

- Arabs Played By America – How Trump Sucks Billions Of Dollars Selling Weapons

- Arab VS Arab – The Hidden Reasons Why Saudi & Its Gang “Unfriend” Qatar

- The Glory Days Are Over – OPEC Warlord Saudi Has Started Borrowing

|

|

November 9th, 2017 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply