At a time when 33% Americans say they would have trouble coming up with an emergency US$2,000, any sign of economy trouble is devastating. For the first time since the U.S. 2016 Presidential Election, markets have slammed the brake for an emergency stop when the Dow Jones dropped 237.85 points, or 1.14%, drop.

The sudden crash, hopefully a temporary one, also saw Standard & Poor’s 500 stock index suffered its worst day of the year Tuesday. It closed down 1.24% or 29.45 points for the first time since Oct. 11, 2016. That’s a brutal plunge of more than 1% after 110 trading sessions. This also means the stock market has ended its longest streak of calm since 1995.

Wall Street experts say the market, which has enjoyed a virtually uninterrupted rise and a nearly 10% gain since President Trump’s election win in November, was dragged down by politics. This time, don’t blame the sore loser Democrats who have been blaming, protesting and bitching about Trump administration since the humiliating loss of Hillary Clinton.

It’s isn’t President Trump’s fault either. Instead, the president’s economic agenda is being bogged down by Republicans. U.S. stocks had enjoyed an uptrend in the wake of President Donald Trump’s election victory on Nov. 8, on the back of hope for a roll out of a raft of pro-business policies, including tax cuts, deregulation and a boost in infrastructure spending.

Controlling the presidency, the Senate and the House since then has made some Republican politicians big-headed. They’re now fighting against their own president. The repeal of Obamacare appears to have hit some snags, so much so that Trump was brought in earlier Tuesday to warn House Republicans of political consequences.

If those Republican politicians can’t fix the Obamacare problem despite controlling both houses, traders worry the same suckers would put more road-blocks to Trump’s other plans. President Trump was so sicked and tired of his arrogant comrades he warned those seeking re-election that their jobs were on the line in next year’s mid-term elections.

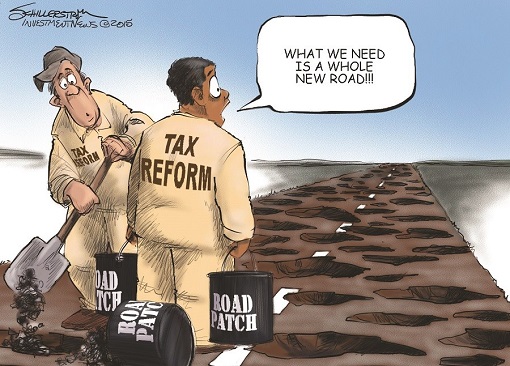

The stock plunge is the clearest signal that financial market is losing hope after expectations for tax reform, deregulation and more government spending increased dramatically. True, a failure in repealing and replacing the Affordable Care Acton doesn’t mean the Americans won’t get tax reform. But Trump administration has promised that after the health-care act, tax reform would be up next on the agenda.

The Republicans proposes a 20% tax on all imports coming into the U.S., a plan that would generate US$1 trillion in revenue over 10 years. This new income would be able to offset a drop in corporate tax rate to 20%. Still, the sexy plan is clouded with disagreement. The markets are simply exhausted and frustrated of excessive politicking within House Republicans.

In fact, infighting among Republicans is so pathetic that a monthly fund managers’ survey done by Bank of America Merrill Lynch shows only 10% expects to see U.S. tax reform passed by Congress before its August recess. They also believed that the stock market was extremely overvalued; therefore, the markets would find any excuse to sell in a strong wave.

That would explain why the banking sector, led by Goldman Sachs, J.P. Morgan Chase & Co and Wells Fargo suffered the sharpest retreat. The market selloff was overdue. As emotion kicks in, the fear overwhelmed the greed. Investors, realizing that Trump won’t be able to get everything he wants done as fast as he’d like, decided to sell everything they got.

Still, the selloff could be just a healthy pullback after a strong run for the market. For now, the good news is only a few experts are predicting a correction – which is a 10% pullback from a market high. There’s almost none who sees an emerging bear market, which could spark a 20% drop or more. But everything depends on President Trump and the stubborn Congress.

Other Articles That May Interest You …

- Trump The Powerful – G20 Finance Chiefs Chickened Out Of “Free Trade”

- Trump The Invincible – Dow Hits 20,000 As Stock Market Gains US$2 Trillion Wealth

- China Is Terrified – Trump Has The Power & Ability To Screw Its Economy

- These 8 Men Are As Rich As 3.6-Billion People, Or Half The World

- Globalism & Capitalism Not Working – 0.7% Rich Population Control US$116.6 Trillion

- BREXIT 2.0!! – Here’re 12 Major Reasons Trump Wins Presidency, Against All Odds

- 10 Business Philosophy Billionaire Trump Disagreed With Billionaire Buffett

- 50 Cool Signatures Of World’s Rich & Famous People

|

|

March 22nd, 2017 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply