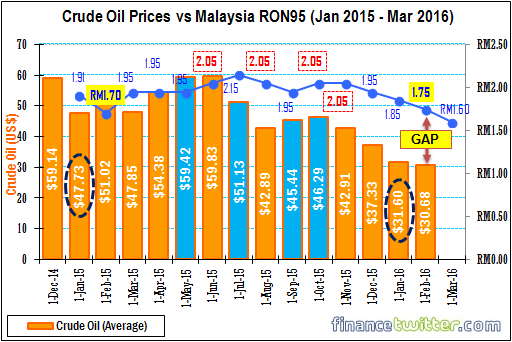

Effective Dec 2014, Malaysia scrapped decades-old fuel subsidy and the prices of RON-95, RON-97 petrol and diesel have been based on a “managed float system”. It’s been 15 months now since the implementation and so far so good. Malaysians can proudly say they can survive without subsidy, even though the (subsidy) money came from taxpayers in the first place.

However, Najib administration hasn’t been able to explain the formula or mechanism used in determining the petrol prices. What the public knows is the new prices depend on the performance of global oil prices from the previous month. Perhaps the government thought the formula was too complex and sophisticated for the average people to understand.

That’s fine because Malaysians always trust their government since the Independence. After all, how could the son of Abdul Razak, the second and supposedly most noble Prime Minister of Malaysia, cheat and scam his own people, right? PM Najib had returned 90% of US$681 million donated by Saudi royal family so he must be the only honest man on planet Earth (*grin*).

Effective March 1 (this month), the price of RON-95 has been set to RM1.60 a litre, the lowest since the so-called managed float system kicks in. But hardly anyone celebrates. Understandably, prices of produce, goods, electricity and whatnot remain unchanged. Producers, suppliers, distributors, transporters and even the government play dumb as if nothing has happened.

However, if one cares to look at the chart plotting the relationship between average crude oil prices and RON-95 prices since the system’s deployment, there’s one disturbing issue. It seems the government has been tweaking and adjusting their formula since July 2015. That’s when the crude oil price starts “not to correlate” with RON-95 petrol price at pump stations.

Unless the government or specialists could explain any new variables being added since July 2015, the layman view is that a “gap” linking crude oil and petrol prices “exploded”. What this means is the public might have been forced to pay more than the actual price, and in the process subsidizing the government instead. In short, the government has been secretly making money.

The average prices of crude oil in May and June 2015 were negligible – roughly US$0.40 per barrel in difference – but RON-95 was raised by RM0.10 in July. When the average crude oil for July tumbled by US$8.70 (US$59.83 – US$51.13), the price of petrol was adjusted down – also by RM0.10 (Aug). Still confuse? Let’s look at another angle.

Let’s take the point of RM2.05 / litre; which occurred in June, August, October and November 2015. This price was derived because of what had happened to crude oil the previous month. Turns out, the prices were US$59.42, US$51.13, US$45.44 and US$46.29. Does it make sense that RON-95 was selling at the same price of RM2.05 / litre regardless whether the crude oil was at US$59 or US$45?

The government should explain as to why they were able to sell RON-95 at RM2.05 / litre under fluctuation of US$14 / barrel (US$59 – US$45). At best, they were so caring that they actually subsidized it. At worst, they were ripping off peoples’ hard-earned money. Considering how much Najib Razak has borrowed, it’s hard to bet people were secretly enjoying subsidy.

Now, take a look at the pump price for Feb 2015 and Feb 2016. Consumers were paying roughly the same price – RM1.70 and RM1.75 – on both months. But the month before that saw crude oil prices at US$47.73 (Jan 2015) and US$31.60 (Jan 2016). The difference in crude oil prices for both months was US$16.13. Yet the pump price was only 5-sen apart.

Clearly, Najib administration has been milking truckloads of cash from the public. That means Malaysians have been overpaying for every litre of RON-95 pumped into their tanks. The biggest question is this – where have all the extra monies, easily run into hundreds of millions of ringgit, gone to? Otherwise, how do you explain the discrepancy?

Other Articles That May Interest You …

- FB Angry Emoji – CY Leung Gets 170K, Najib Razak Most Hated In ASEAN

- Worst Is Over On Oil? Not So Fast – Here’s Why

- Budget 2016 Revision – What Najib Razak Doesn’t Want You To Know

- Forget $1 Gasoline, It’s Happening — 46-Cents A Gallon In Michigan

- Cheaper Than Water – This British Bank Thinks Oil Would Go To $10 / Barrel

- Meet United States – The World’s Latest Oil Exporter – After 40 Years

- Here’s Why Oil Above $100 Will Never Happen Again, Ever, Forever!!

- Malaysians Refused To Give Way To VIP – A Sign Of People’s Uprising?

|

|

March 2nd, 2016 by financetwitter

|

|

|

|

|

|

|

Your argument is only valid if MYR is pegged to USD. Refer to the USDMYR graph in the past 1 year.