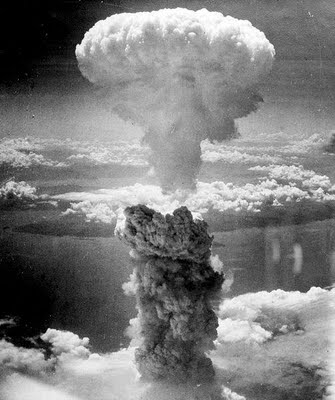

Besides studying the fundamental and technical analysis of stocks there’re many other things you need to be aware of. One of these is the history of the stock markets itself. Too bad if you hate history but I found history to be very interesting although I’ve to admit I scored my history papers by memorizing the facts. Yes, history is about facts although there’re many politicians who are trying to re-write the history even from primary schools’ text-books – to ensure their individual’s survival based on racial cards. We learn from history and because of history we may not see another world war (hopefully) again, at least we’ve the will to prevent it because the Hiroshima and Nagasaki’s destructions were enough to spook us.

The month of September started with a bang – Dow Jones and Nasdaq went down the drain plunging 185.68 and 40.17 points respectively or 2 percent each. In fact, since 1929’s Great Depression September has been the worst single month in the history of U.S. stocks. With September and October traditionally being two worst months of the year, you should find this as an excuse not to enter the stock markets. Who can forget the Sept 11th terrorist attacks that left many stock punters flabbergasted? On Sept 2007 we saw queues of panic customers withdrawing their monies from Northern Rock while Sept 2008 witnessed the collapse of Lehman Brothers and the rest is, well, history.

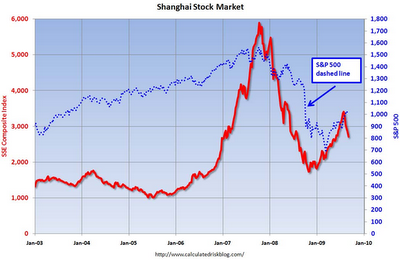

To the Chinese it’s the seventh month in the lunar calendar where all the souls from the “underworld” are coming to pay us visits *grin* – the Ghost Festival. And these ghosts do visit stock markets, mind you. So while you’re busy glueing yourself to the display board at the stock gallery, remember to leave some seats to these “brothers or sisters”, will ya? Heck, I was joking and you should not adopt investing by the calendar. Take it with a pinch of salt although it’s wise not to put all your monies on the table simply because investors are taking some of their monies off the table. This is natural after the recent rally from March to May although I think it won’t do any harm if you can spend some time monitoring the Shanghai Stock Exchange – hopefully S&P 500 is not following Shanghai’s pattern, if the Chinese stock market is indeed experiencing a huge correction.

But let’s not panic after the Dow’s overnight 25% plunge because the DJIA is still above 9,000-level. Maybe we can press the panic button only if it tumbles below this level. Furthermore recent investor sentiment survey showed 51.6% bulls, 19.8% bears and most importantly 28.6% actually expecting a correction after the recent rally. However I suppose in a market where the bull is taking its rest, rumors of more bank failures can easily send stocks players run helter-skelter. It seems investors have pulled a staggering $4.77 billion from two Cerberus hedge funds. That amounts to almost 20% of Cerberus’s total $24.3 billion in assets and although the managing director of Cerberus Capital Management LP has promptly denies the rumor that the fund has made huge losses on private equity investments in Chrysler and GMAC, the damage has been done.

Supposing the rumors were untrue and the stocks are set to rebound soon, do you dare to jump in? Where is that buy when everyone is selling and sell when everyone is buying motto of yours *grin*? Anyway watch out for the Friday’s employment report from the U.S. government – it could send another round of selling if the reading is not right.

Other Articles That May Interest You …

- New Bull Run – Already Started or Another 10-Years?

- Get the Facts Right and You’ll Know What to Do Next

- It Ain’t Over Yet – China and Unemployment are Next

- The New Great Depression is a Different Animal, Stupid

- The Mortgage’s plague spread into Britain from U.S.

- Investing Stocks, Option Trading – U.S. & China’s factor

|

|

September 2nd, 2009 by financetwitter

|

|

|

|

|

|

|

Comments

Great post! Very informative and helpful… I can see that you put a lot of hard work on your blog, I'm sure I'd visit here more often. Maybe, you want to come by my site too. It's mainly about Do it Yourself Credit Repair . I'm sure you'd find it useful. thanks!

nice inspiration for me friends, Im just a beginer. regards..Keep your post