Subprime lenders provide mortgages to people with poor credit. Though they are a relatively small part of the U.S. economy, their difficulties raise larger concerns about the housing market. The Commerce Department said sales at U.S. retailers rose 0.1 percent in February as wintry weather in much of the country kept shoppers away from stores. Investors had expected an increase of 0.3 percent from January – spooking investors if Americans’ buying power will withstand an economic slowdown.

Subprime lenders provide mortgages to people with poor credit. Though they are a relatively small part of the U.S. economy, their difficulties raise larger concerns about the housing market. The Commerce Department said sales at U.S. retailers rose 0.1 percent in February as wintry weather in much of the country kept shoppers away from stores. Investors had expected an increase of 0.3 percent from January – spooking investors if Americans’ buying power will withstand an economic slowdown.

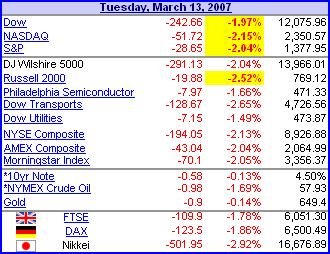

Options expiration on this Friday and the high IV (Implied Volatility) registered since the market’s big plunge on Feb. 27 only worsens the situation. The blue chip index is now down about 710 points, more than 5 percent, from its record close reached Feb. 20. Many market watchers suspect that the market’s correction is not over.

The subprime worries have been mounting for weeks now, but came to a head when the New York Stock Exchange took steps to de-list shares of New Century, which said Tuesday that the Securities and Exchange Commission would be probing accounting errors that inflated its loan portfolio.

Late in the session, General Motors Acceptance Corp. – General Motors Corporation’s (NYSE : GM, stock) part-owned financing arm — reported that its fourth-quarter profit rose, but struggles in its Residential Capital LLC unit were eating into earnings. That news gave investors extra motivation to sell.

Traders now await the producer and consumer price indexes, scheduled to be release Thursday and Friday, respectively. The two inflation gauges should give investors a better idea of whether costs are escalating too fast, and if the Federal Reserve might give consumers some relief by lowering interest rates later in the year.

Traders now await the producer and consumer price indexes, scheduled to be release Thursday and Friday, respectively. The two inflation gauges should give investors a better idea of whether costs are escalating too fast, and if the Federal Reserve might give consumers some relief by lowering interest rates later in the year.

As a result, stocks in Japan, Hong Kong and Australia all fell more than 2 percent, while shares in Singapore, India, Malaysia and the Philippines tumbled at least 3 percent. The Shanghai Composite index was down 1.28 percent while in India, Bombay Stock Exchange, down by 397 points, or 3 percent, to 12,585.70 points in midday trading.

It is obvious the bear still rules the street. Any slight negative data or news will send a wave of sellers into the queue unloading stocks to limit their losses. No one can guarantee that the one-day drop will not continue for the next subsequent days ahead. Prior to China becoming the new economic giant, everyone looks at how U.S. stock market performs. But know the whole world depends on both China and U.S. Either one sneezes, you’ll catch the cold.

So what should you do with such situation? It depends, really. If you’re trading option or investing stocks in U.S. stock market, then you’re pampered with choices. With bearish sentiment – you can sell-short, buy “Put”, activate your “Bear Call” Spread strategy and so on. But if you’re residing in Malaysia or Singapore where you can only profit from stock in one direction, you have no other choice but to wait, pray and hope (if you’re already in the market and making losses) or you can take the risk of entering now (with high percentage of getting slaughtered).

Other Articles That May Interest You …

|

|

March 14th, 2007 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply