You can see the same similar statements shouted by former Malaysian Prime Minister Mahathir, Thailand prime minister, South Korea, Indonesia and so on during the  1997 Asia Economic Crisis. When the sentiment or the perception of majority investors are bearish the “fear” emotion rules and that’s when a falling-knife is about to happen. And no one wants to catch a falling-knife, do you?

1997 Asia Economic Crisis. When the sentiment or the perception of majority investors are bearish the “fear” emotion rules and that’s when a falling-knife is about to happen. And no one wants to catch a falling-knife, do you?

These investors are deaf or do not care about your fundamental data no matter how loud you echo it. In fact the fund managers and analysts were the one who sell first thing when things do not goes as expected. They’ll follow instruction to cut-loss, while retail investors are still standing still “hoping” for miracle to turn the table around – which most of the time will never happen.

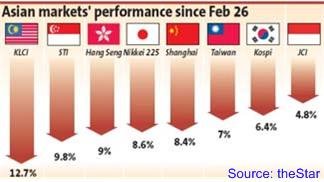

Today’s rebound can be categorized as “short-term technical rebound” after two weeks of bleeding (remember what goes up must comes down and vice versa?). Dozens will take the opportunity to tell you that the worst is over and you should start flocking back to the stock market. But should you? I’m not a risk-taker and I prefer to ride with the wave, so I’ll wait and see (you can curse if you wish to).

Now, let’s goes back to the period when the Malaysia Prime Minister announced confidently said that Malaysia stock market will rally to 1,350 points – matching the 1993 Super Bull-Run. At that day, do you know that there’s a huge group of people who queues up signing up new stock-trading accounts? This group of people is the youngster, the teenagers who have no experience whatsoever in the world of stock-market.

Now, let’s goes back to the period when the Malaysia Prime Minister announced confidently said that Malaysia stock market will rally to 1,350 points – matching the 1993 Super Bull-Run. At that day, do you know that there’s a huge group of people who queues up signing up new stock-trading accounts? This group of people is the youngster, the teenagers who have no experience whatsoever in the world of stock-market.

These young-chaps do not know what’s T+3 or the meaning of fundamental or technical analysis. And the rest is history. These beginners are the first and largest batch of investors who fall prey to the cruelty of the stock market right after they entered into the fantasy world. And they didn’t know what hit them – they’ll still figuring out what happen to the huge losses and the reason they’re in the pool of blood, till now.

Back in 1993 Malaysia Super Bull-Run, the indicators or hints were when ordinary folks – the chicken sellers and vegetables resellers in bazaar were busy talking to their brokers via the brick-size cell-phone. This time it’s the youngsters. Will these people learn their lessons? Are you one of them? Share your comments or thoughts here.

# TIP: Remember when others are fear, you should be greed and while the crowds are greedy you should be very fearful.

|

|

March 6th, 2007 by financetwitter

|

|

|

|

|

|

|

I also want to open CDS acc next week. I spent almost 2 month to study about a market before enter it. Now im so lucky becoz not enter it early.