The global rout was triggered by the biggest sell-off in the Chinese stock market for 10 years. The main Shanghai exchange fell 8.8pc, its worst fall since the death of premier Deng Xiaoping in 1997. The trouble began Tuesday – just one day after Chinese stocks hit a record – as investors unloaded shares to lock in profits amid speculation about a fresh round of austerity measures from Beijing to slow the nation’s sizzling economy.

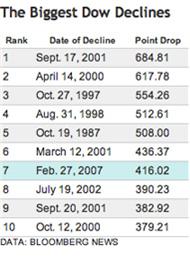

This followed by Wall Street when the Dow fell 546.20, or 4.3 percent, to 12,086.06 before recovering some ground in the last hour of trading to close down  416.02, or 3.29 percent, at 12,216.24. It was the Dow’s worst point decline since Sept. 17, 2001, the first trading day after the terror attacks, when the blue chips fell 684.81, or 7.13 percent. The drop hit every sector across the market, and a total of $632 billion was lost in total in U.S. stocks on Tuesday.

416.02, or 3.29 percent, at 12,216.24. It was the Dow’s worst point decline since Sept. 17, 2001, the first trading day after the terror attacks, when the blue chips fell 684.81, or 7.13 percent. The drop hit every sector across the market, and a total of $632 billion was lost in total in U.S. stocks on Tuesday.

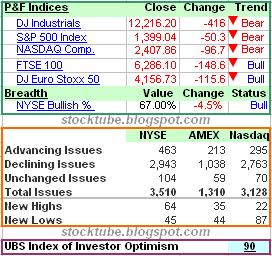

Investor optimism took a tumble in February falling back to  the level it reached in December 2006. The Index dropped 13 points to 90 (refer to chart), erasing all of its gains from January and bringing it back below 100, where it has generally been since December 2000. The Index is conducted monthly and had a baseline score of 124 when it was established in October 1996.

the level it reached in December 2006. The Index dropped 13 points to 90 (refer to chart), erasing all of its gains from January and bringing it back below 100, where it has generally been since December 2000. The Index is conducted monthly and had a baseline score of 124 when it was established in October 1996.

So I guess it’s true that China is the emerging new economic power of the world. Previously when U.S. sneezes, the rest of the world catches the cold. Now it’s time the China sneezes and you can see the effect. But China factor is only part of the reason. The global stocks/equity markets have been on uptrend and this China stocks’ plunge was taken as an excuse for investors to take profit and run for shelter. How long will the bear play with the stock market is everyone’s guess. It could be days or weeks before the sky is clear for investors to decide the next direction.

# TIP: For those with lion-heart, a panic-selling day is an opportunity to scalp the stock for a minor but fast profit. Panic sellers will dump at any price because the FEAR rules the day.Other Articles That May Interest You …

|

|

February 28th, 2007 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply