NutriSystem Inc. (NASDAQ: NTRI) : will announce it’s earning tuesday, 24-oct-2006 amc …

NutriSystem Inc. (NASDAQ: NTRI) : will announce it’s earning tuesday, 24-oct-2006 amc …

NTRI is a provider of weight management system based on a portion-controlled, prepared-meal program … the company’s customers purchase monthly food packages containing a 28-day supply of breakfasts, lunches, dinners and desserts, which they supplement with milk, fruit and vegetables …

latest financial news from Briefing indicates Kaufman Bros reiterates “Buy” raises target from $85 to $100 … NTRI is within the list of top performing Zacks #1 Rank (Strong Buy) stocks … ranked first on Forbes’ list of 200 best small companies …

latest financial news from Briefing indicates Kaufman Bros reiterates “Buy” raises target from $85 to $100 … NTRI is within the list of top performing Zacks #1 Rank (Strong Buy) stocks … ranked first on Forbes’ list of 200 best small companies …

NTRI has a rating of 5 out of 10 :

-

wall street consensus : 0.52

-

whisper number : 0.53

-

smart-estimate : 0.53

-

schaeffer rating : 7/10

-

power rating : 5

-

insider trading (last 52 weeks) : ($95.65M)

stocktube research believes this is one of the stocks worth investing which can make money …

-

Mar 2007 65 Call options

-

IV for Nov 2006 $65 Strike : 81.39 %

let’s play this stock (with over 140 days as insurance in case of trend-reversal) and let the game begins … cautious that the volatility is very high … a high-risk game though …

let’s play this stock (with over 140 days as insurance in case of trend-reversal) and let the game begins … cautious that the volatility is very high … a high-risk game though …

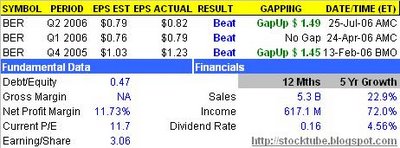

W. R. Berkley Corporation (NYSE: BER) : will announce it’s earning wednesday, 25-oct-2006 bmo …

W. R. Berkley Corporation (NYSE: BER) : will announce it’s earning wednesday, 25-oct-2006 bmo …

BER is an insurance holding company that operates in five business segments of the property casualty insurance business: specialty, regional, alternative markets, reinsurance and international …

latest financial news indicate A.M. Best has affirmed the FSRs of A (Excellent) and the ICRs of “A” of Berkley Insurance Group …

BER has a rating of 8 out of 10 :

-

wall street consensus : 0.83

-

whisper number : NA

-

smart-estimate : 0.85

-

schaeffer rating : 8/10

-

power rating : NA

-

insider trading (last 52 weeks) : ($591.06K)

stocktube research believes this is one of the stocks worth investing which can make money …

-

Apr 2007 35 Call options

-

IV for Nov 2006 $35 Strike : 28.02 %

let’s play this stock (with over 170 days as insurance in case of trend-reversal) and let the game begins …

let’s play this stock (with over 170 days as insurance in case of trend-reversal) and let the game begins …

|

|

October 24th, 2006 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply