The Dow Jones posted its ninth consecutive week of advances, its longest weekly winning streak in nearly 24 years. This was the first time the DJIA (Dow Jones Industrial Average) index crossed 26,000 points since November 9, and the nine straight week gains marked the longest streak since a 10-week run between March and May 1995.

The primary reason why the bull charges so ferociously has been the positive progress toward a U.S.-China trade deal. President Trump had a shock of his life when the stock market plunged. On Christmas, he slammed Federal Reserve over raising interest rates “too fast” – even had considered the option of firing Chairman Jerome Powell.

With negotiation between the world’s two biggest economies – United States and China – in full swing, economists and analysts are expecting good news of an end to the trade war between both nations. Talks have been under way for more than a month between delegations from the two sides. Vice-Premier Liu He is leading China’s latest trade negotiations in Washington.

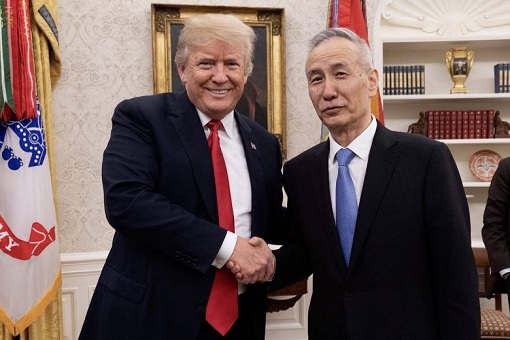

Appointed as the special envoy to Chinese President Xi Jinping, Mr. Liu is given the authority to negotiate directly on trade matters with the U.S. He is scheduled to meet President Trump on Friday. The important meeting between Liu and Trump aims to strike a trade deal before March 2, failing which additional U.S. tariffs on Chinese goods could come into effect.

The fact that the negotiations have been extended for another 2 days (supposedly ends on Friday) suggest that the trade war between both countries could come to its end soon. Also, Trump said earlier this week that the deadline (March 2) was not a “magical date,” and has hinted it could be moved – suggesting that the U.S. president is ready to grab a deal in order to prevent the stock market from plunging again.

The Chinese Vice-Premier said the two teams had made “positive progress” over the past two days in areas including the trade imbalance, agriculture, forced technology transfers, intellectual property protection and financial services, and that a deal was “very likely”. President Xi has also delivered an optimistic message to President Trump.

Mary Ryan, senior equity options strategist at E-Trade Financial, said – “Trade is the likely catalyst to tip the scales in either direction, and there are three scenarios: If negotiations crumble, we could get a pullback, if they strike a deal we could see a breakout, and anything in between could be a jolt in either direction,”

If the negotiations break down and no deal is made by March 1, the rate of tariffs on US$200 billion Chinese-made goods are set to increase to 25% from 10%. China will then expect to retaliate with its own tit-for-tat punishment on American products, services and even corporations. But there’s another sign to be optimistic that Trump prefers a deal than continues the existing trade war.

Trump apparently confirmed a report that he is planning a meeting with Xi late March. If that materialise, the summit would be at Trump’s Mar-a-Lago golf club in Palm Beach, Florida. The last time both leaders met was at the dinner table in Buenos Aires, Argentina, where they agreed to a 90-day trade truce Argentina. It was also the same night Huawei CFO was arrested by Canada at the request of the U.S.

Interestingly, Trump has hinted that he might drop the charges against Huawei Technologies Co. Ltd. as part of a trade deal with China, as the negotiations appear to be reaching a deal. At an Oval Office trade meeting with Chinese Vice-Premier Liu He, Mr. Trump told reporters that he “may or may not include” a resolution to the Huawei situation in the deal.

China reportedly has reportedly committed to buying up to US$1.2 trillion in U.S. goods, especially agricultural products – including an additional 10 million metric tonnes of soybeans. Beijing has also reportedly agreed to open its electronic payment market to Visa and MasterCard. Trump could definitely brag about these achievements to his supporters.

Despite Mr. Trump’s optimism, however, China does not appear to offer the commitments that would ensure the actual economic transformation sought by the Trump administration in the first place. Significant gaps remain between the United States and China on structural issues, such as forced technology transfer, digital trade and data flows.

Amusingly, in a meeting with the Chinese delegation and reporters at the White House, Trump and U.S. Trade Representative Robert Lighthizer clashed over the use of MOUs – an embarrassing moment – after the U.S. president said he did not like the term “memorandum of understanding” as it is not a real final contract. The disagreement has prompted a laugh from Vice-Premier Liu He.

Other Articles That May Interest You …

- “You Cannot Crush Us” – Huawei Founder Warned About Shifting Investment From The U.S. To U.K.

- What Trade War? US Trade Deficit With China Hits Record High $323.32 Billion Last Year

- Chicken Out? – Canada Ambassador Offers Tips On How Huawei Sabrina Could Avoid Extradition To America

- The U.S. To Officially Request Sabrina’s Extradition – But Canada Isn’t Happy Their Citizens Are Being Punished

- From Trade War To Political Kidnapping – Two Canadians Held “Hostage” As China Retaliates

- China Furious!! – CFO & Daughter Of Huawei Founder Arrested In Canada On Behalf Of The U.S.

- US-DOJ Investigates Huawei For Violating Iran Sanctions – It’s All About Business, Stupid!!

- China Invasion – Top 10 American Iconic Brands Now Owned By Chinese

|

|

February 23rd, 2019 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply