PTPTN – National Higher Education Fund Corporation – is supposed to be a noble plan to extend loans to help students pursuing tertiary education in Malaysia. It was formed in 1997 during the Mahathir 1.0 era. Now that Mahathir 2.0 has returned as the prime minister for the second time, the PTPTN has become a national crisis due to mountains of debt accumulated.

The PTPTN is a rolling fund. You can even imagine it as an MLM or Pyramid Scheme – just to make it more dramatic (*grin*). If nobody pays back, then there will not be any cash to pass on to the next batch of students wanting to study in tertiary institutions. So far, the total outstanding debt is around RM39 billion – that’s about RM2 billion of debt being accumulated every year since 1997.

Over the years, more and more students who had taken the student loans decide not to pay for various reasons. Had the relevant authorities been tough on defaulters – those who can pay but refused to pay, won’t pay or didn’t care to pay – from the beginning, it would not have had blown to a huge crisis. It didn’t help that 1 out of 5 remain unemployed from more than 250,000 graduates produced every year.

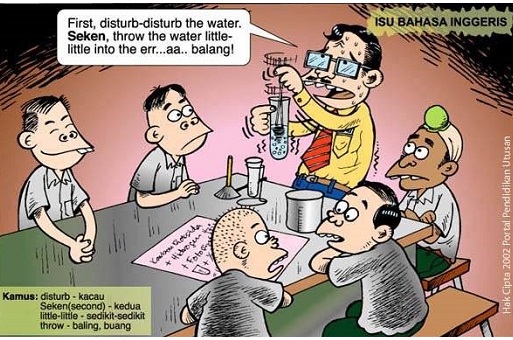

It’s not hard to understand why they were unemployable. About 52% of the graduates took the easy way out – studying in arts and social science. And 66% of the unemployable graduates have the cheek to ask for unrealistic salary and benefits. A whopping 58% possessed poor character or attitude while 52% have poor command of English.

Adding salt to the injury, the PTPTN fund keeps shrinking because we have more students studying compared with the year before. Imagine what will become of a bank if people started refusing to service their car loans. The bank will definitely go belly up. But can you blame the loaners if the bank announced that all loans would be written off if they were to win the “Best Bank of the Year” award?

Pakatan Harapan in its 2018 election manifesto pledged to postpone the student loan repayment for those earning below RM4,000 a month, as well as not blacklisting defaulters. But if you think that was bad and insane and nothing but a silly political gimmick, you should go back 6 years earlier just before the 2013 general election. It was astonishing!

Then, the de-facto opposition leader Anwar Ibrahim (now premier-in-waiting) had proposed to abolish PTPTN study loans and provide free higher education. He proposed to use Petronas funds to write off the RM43 billion in PTPTN loans taken since 1999 and provide free higher education for subsequent generations of students. It was clearly a sexy plan and had won the opposition tons of votes.

Fortunately for Mr. Anwar, he isn’t the prime minister today else he would be on the frying pans. The previous government had dug up a “debt hole” so huge that the country’s financial status is close to bankruptcy. Forget the 2018 election manifesto pledging to postpone the student loan repayment for those earning below RM4,000 a month, let alone writing off them altogether.

But to blame Najib regime and curse the son of Razak until the kingdom comes will not fix the problems. The latest plan to take repayments directly from borrowers’ salaries has angered many students. On Wednesday (Dec 5), PTPTN chairman Wan Saiful Wan Jan announced the new scheme of monthly deductions for borrowers with salaries of RM2,000 and above starting Jan 1, 2019.

Apparently, the deductions will range from 2% to 15% of the borrower’s salary. A borrower whose monthly salary is RM2,000 will have to pay RM40 per month while those earning RM8,000 will need to fork out RM1,200. But that would also mean borrowers who have been consistent in payments according to their agreements are to be unfairly punished.

Like it or not, the new government screwed up when they decided to remove the blacklisting of stubborn defaulters who do not pay their PTPTN loans at all. And now they decide to punish responsible borrowers who pay consistently by nullifying their contract and making them pay more with the new plan. The shift from RM4,000 to RM2,000 has already undermined the new government credibility.

In September, Mahathir criticised the PTPTN borrowers who refuse to repay their loans. He said it only cost RM100 a month to repay the loan which wasn’t much for someone earning a RM2,000 salary. The old man said – “I’m ashamed, but they are not. They are earning an income which can allow them to pay very well, they just don’t feel like paying.”

During the launch of the unlimited travel pass MY100 and MY50 early this month, PM Mahathir bitched again – the government cannot provide everything for free in efforts to reduce the high cost of living faced by the people. But is the 93-year-old man totally blameless that certain people deliberately refuse to pay under the pretext of the high cost of living?

Mahathir should realise that it was during his era that a certain group of people were brainwashed into thinking they were special and enjoy privileges not accorded to other ethnicity. Such mentality contributes one way or another to the ballooning of the PTPTN debt, which burst today. Ex-PM Najib made it worse – giving special discounts and exemptions – to some graduates.

What does PTPTN have to do with racial composition? In November 2013, Education Minister Muhyiddin Yassin revealed that from a total of 412,245 borrowers who did not service their PTPTN loans, Malays formed the largest number of defaulters at 328,550 (79.7%), followed by the Chinese (55,445 defaulters or 13.4%) and Indians (28,250 defaulters or 6.9%).

Now we know why PM Mahathir has been whining and crying about Malay being lazy and untrustworthy. We also know pretty much who he was referring to when he said he was ashamed of PTPTN borrowers who refused to pay back their student loan. It certainly didn’t help that 90% of the personal income tax which the government collects are paid by the ethnic Chinese, as admitted by Mahathir himself.

With the PTPTN fund depleting every day, fresh funds are needed. But even the 90% of income tax paid by the minority Chinese aren’t enough to supplement the deficit. It would be a different story, if those defaulters can add value to the system, either as entrepreneurs or innovators providing employment or inventing world-class products to help boost the country’s economy.

Instead, the defaulters are more often than not proud employees of the already bloated civil service. That’s why Mahathir complained about the excessive government servants a week ago (Dec 1), blaming former prime ministers Abdullah Badawi and Najib Razak. When he resigned in 2003, public servants were 1-million. It has since ballooned to 1.6 million – a 60% increase.

And when Mahathir stepped down, the government spent RM22 billion on salaries for civil servants. By 2016, the expenditure had more than doubled to RM74 billion. Still, the fact remains that Mahathir was instrumental in shaping the mindset of the majority, if not all, Malays today. He actually inherits the fruits of his very successful game of 3R (religion, racial and royalty) after playing it for 22 years (1981-2003).

Let’s call a spade a spade. The PTPTN student loan repayment issue didn’t pop-up out of nowhere. Mahathir harvests what he sowed. Had he sowed good seeds and genuinely produced good quality graduates, regardless of race and religion, he will harvest good crops. But since he had sowed bad seeds for 22 good old years, most of his crops have turned wither.

Sure, the cost of living has gone up. A condominium which cost RM140,000 in 1997 can only be purchased for RM500,000 today – if you’re lucky. However, at the same time, it’s totally unacceptable that a graduate earning RM2,000 cannot afford to pay RM40 a month. Amusingly, some of these graduates can afford a nice car and a fancy iPhone, not to mention meals at exotic restaurants.

Currently, only around 55% of PTPTN borrowers are repaying. This means close to half of PTPTN money loaned to students have become bad debt – evaporates into thin air. The government is already injecting fresh fund of around RM2 billion every year to plug the repayment gap. The government is at the mercy of the graduates because of their votes. This student loan model doesn’t work.

Regardless of the reasons or excuses, one must pay what has been borrowed. Sadly, such simple moral value is missing from the vocubulary of 45% of PTPTN students-turned-defaulters. This makes them untrustworthy persons. Perhaps this explains why PM Mahathir bitched again yesterday – that corruption has become part of Malay culture, and those who are corrupted do not care for the future of the country.

Taking a portion from their EPF to pay for the student loans could be a temporary solution to the PTPTN problems. At the same time, the government must ensure access to affordable housing, transportation and food. More importantly, the education system must be overhauled to provide not only a quality education but also responsible and trustworthy graduates.

Other Articles That May Interest You …

- Mahathir Has Spoken (Again) – Malays Are Lazy & Untrustworthy, Banks No Longer Trust Them

- Learn From China – Mahathir Has To Dismantle Discrimination & Racist Economic Policy First

- Only Extremist & Racist Would Feel Inferior And Lack Of Confidence Over UEC Recognition

- Mahathir Should Leverage His Popularity To Promote Meritocracy – NOT Racism – For The Sake Of The Malays

- China Geely Introduces Meritocracy – But Handicapped Proton “Bumiputeras” Aren’t Happy

- Robert Kuok – How Chinese Become Amazing Economic Ants Despite Poverty & Discrimination

- China Invasion – Top 10 American Iconic Brands Now Owned By Chinese

- Bandar Malaysia Has Become “Bandar China” – The U.S. & Malays Conned By Najib

|

|

December 7th, 2018 by financetwitter

|

|

|

|

|

|

|

The PTPTN itself and the govt should be blamed for their lack of creativity and intelligence in recouping the bad debts. They (PTPTN) sorely lack the initiatives in harnessing the database of its own loan defaulters by having their office staff sitting on their own fat arses in the office instead of moving down to the fields like the salespeople with targets to achieve.

So my suggestion to PTPTN and govt:

1) Stop whining in the public again and again. Don’t expect miracle from mere complaints. The last thing we want to hear is doing the same thing repeatedly and expecting different results. That’s madness.

2) Fully utilise what technology has bestowed on us – use all data available through big data technologies and data science algorithms to predict and track the loan prospects and defaulters. Who is likely to default? Where are the locations with the highest loan defaulters? Can we source more data of the current loan defaulters through synchronised information system for EPF/banks/CCRIS/CTOS/employers? All these information are vital to track the current status of the hardcore defaulters. And not to forget to write-off the deceased outstanding loans as a caring govt.

3) Penalise on individual manner – don’t put up policies that can jeopardise current repayments. With all the defaulters database available, PTPTN can easily inidividualise each payment/penalisation plan like the typical financial institutions. One simple example is by adding these info into CCRIS/CTOS or employment check as soon as the graduates started applying for credit facilities.

4) Stop lending with PTPTN. Yes.That’s the most viable way to handle the issue, by stopping the bleeding. PTPTN should be restructured to handle only current repayments and defaulters. The new lending applications can be managed by setting up a new loan agency with different name (SPPN for example – Skim Pinjaman Pendidikan Nasional) with MORE stringent checks on the students’ background and the institutions’ courses itself in order to stem the students from dropping out or failure of institutions to maintain their qualities. The institutions with high drop-out cases or bad reputation should be blacklisted from the loans.

I believe that with the above measures, the defaulters will then think twice about NOT paying PTPTN loans. Do what the banks have done all these years, and you shall reap the responsible and trustworthy fruits.