OPEC reported on Monday that Saudi Arabia cut its oil production in July, a surprise move after Riyadh had pledged to ramp up output following the June meeting in Vienna. Additionally, President Donald Trump has been threatening all and sundry to stop buying Iranian oil, as part of U.S. sanctions against the country. Theoretically, the oil prices should skyrocket.

In fact, some ultra-bullish hedge funds think that the U.S. sanctions will remove much more than 1 million bpd (barrel per day) of Iranian oil from the market. Hence, they are extremely excited and expect oil prices to jump to as high as US$150 a barrel in 18 to 24 months. That is more than double of current price. That would be excellent news to oil producer nations.

Jean-Louis Le Mee, CEO at London-based Westbeck hedge fund told Reuters – “Our view is that by November 4, we will have lost between 1.3 and 1.4 million barrels [of output] a day. It is a very big number. That’s based on the view that the U.S. will allow a few temporary exception waivers. Ultimately, we could see losses from Iran exceed 2 million barrels a day.”

As Trump administration looks to have Iran’s current customers reduce Iranian oil imports to “zero”, analysts expect the crude oil prices to go North. According to Bank of America Merrill Lynch, total cut-off of Iranian exports would lead to a price spike to above US$120 a barrel. For every 1 million barrels per day imbalance, the Bank of America sees a price impact on Brent of around US$17.

So, why has the oil prices sunk to its 8-week low instead? The American West Texas Intermediate crude is currently trading at US$65 a barrel, challenging the low of mid-June. The U.S. crude oil plunged on Wednesday, hitting an eight-week low after data showed that U.S. oil stockpiles rose unexpectedly last week.

The U.S. Energy Information Administration said in its weekly report that crude oil inventories rose by 6.8 million barrels in the week ended August 10. Analysts’ expectations were for a decline of 2.4 million barrels. The report also showed that gasoline inventories decreased by 740,000 barrels, compared to expectations for a drop of 583,000 barrels.

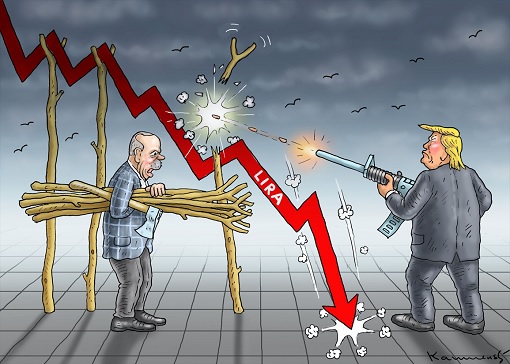

Besides the surprising rise in crude oil inventories, the other reason why the black gold defies the logic of Saudi oil production cut and Iranian sanctions can perhaps be found in President Trump’s tweet. The U.S. president decision of doubling of metals tariffs on Turkey – a whopping 20% on aluminium and 50% on steel – has spooked the global markets.

However, it isn’t the sudden Turkish Lira currency crisis that the market is concerned about, but rather the potential for economic and financial contagion stemming from the crisis. On its own, the crisis is a “home-grown” problem which should not be a threat to other countries. Turkish President Recep Tayyip Erdogan has so far retaliated with tariffs on U.S. imports.

Erdogan’s decree, raising tariffs on cars to 120%, on alcoholic drinks to 140% and on leaf tobacco to 60% will have limited impact on the United States. The Turkish Lira has rebounded, for now. But that’s because the country’s banking regulator has curbed investors’ ability to buy and short the national currency. Clearly, quick political fixes isn’t the answer to a long-term solution.

With the U.S. and China engaging in trade war, there’s little chance that the Chinese will take orders from the Americans in punishing the Iranians. Beijing has repeatedly asserted it will continue buying Iranian crude. Last month, Iran admitted – “If China … buys Iran’s oil, we can resist the U.S. … China is the only country which can tell the U.S. off.”

On its part, Iran reportedly has a tactic to save its market share – offering discounts – of its crude oil for Asian clients, arguably its biggest buyers. Reuters’ source confirms that the National Iranian Oil Company had reduced oil prices for Asian clients by between US$0.75 and US$0.90 a barrel, with prices for Western clients down by US$0.50 a barrel.

The latest conflict between Trump and Erdogan also means Turkey is more determined to keep buying Iranian oil, breathing another new line of life to Iran. Even before the mini war between the U.S. and Turkey, Erdogan has vowed not to obey Trump’s order to boycott Iran. The U.S. was also not impressed with Turkey’s decision to purchase Russian S-400 anti-aircraft defence system.

An ongoing trade dispute between the United States and China also continues to feed concerns that global economic growth will slow and ultimately shrink demand for oil. Chinese oil importers now appear to be shying away from buying U.S. crude oil as they fear Beijing may decide to add the commodity to its tariff list. This adds pressure to U.S. crude oil WTI as well.

Not a single tanker has loaded crude oil from the United States bound for China since the start of August – according to Thomson Reuters Eikon ship tracking data. In comparison, about 300,000 barrels per day (bpd) in June and July were recorded. Why should China buy from the U.S. when they can buy cheaply from Iran, even if there isn’t any trade war between both nations?

Other Articles That May Interest You …

- Turkey Financial Meltdown Looks Like The 1997 Asian Crisis – Erdogan May Look At Malaysia For Solution

- Dollar vs God – Lira Crashes 16% After Trump Doubled Tariffs To Teach Erdogan A Lesson

- China’s Latest Strategy Against Trump’s Trade War May Be Based On Sun Tzu’s Art Of War – Stays Quiet!!

- Iran Threatens To Close Strait Of Hormuz – Oil Price Could Spike And A Mini-War Might Happen

- BOOM!! – Crude Oil Prices Drop Spectacularly From Its $80 High, And Here’s Why It Will Continue To Fall

- Obedience!! Saudi-Led OPEC Ministers Agree To Raise Oil Production – Because Trump Orders Them To

- Saudi’s Dream For $100 Oil In Jeopardy As Trump Warns OPEC About Fake High Price

|

|

August 16th, 2018 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply