Wall Street pulled back by more than 100 points as a result of poor earnings from AT&T Inc., DuPont and McDonald’s Corp. Analysts said the latest earnings report somehow confirmed the economy status is having its’ toll on the companies. To add fuel to the fire the light, sweet crude for May delivery rose as high as $119.90 a barrel before settle at $119.37. No wonder most of the stocks are in red, with the exception of Google Inc., of course.

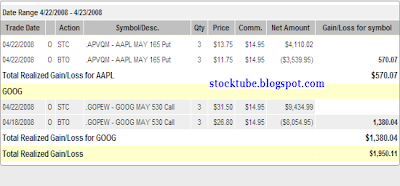

Thanks to American Technology Research analyst, Shaw Wu, I managed to squeeze some pocket money out of Apple Inc. (Nasdaq: AAPL, stock). Shaw cut his rating on the stock from “Buy” to “Neutral”, justifying that expectations for Apple’s fiscal second quarter are too high and the likelihood of stress on its product supply in the June quarter due to the timing of new product releases. Hey, he was right about the “expectation” thingy and he shared his concern about investors being forgiving with conservative guidance, something that is synonym with Apple Inc.

On the other hand I hope investors could continue to bash the stock on Wednesday before the earnings announcement so that the high expectation could be reduced. I’m still bullish though and there’s nothing wrong to buy “some” Put Options which are way out-of-money as a method to hedge. If the stock was to be punished rest assure that it would drop like a rock, the same way Google rockets to the moon.

On the other hand I hope investors could continue to bash the stock on Wednesday before the earnings announcement so that the high expectation could be reduced. I’m still bullish though and there’s nothing wrong to buy “some” Put Options which are way out-of-money as a method to hedge. If the stock was to be punished rest assure that it would drop like a rock, the same way Google rockets to the moon.

Other Articles That May Interest You …

- AAPL’s earning – the key is on the International Revenue

- Stocks do not go linear – Scalp your way to make money

|

|

April 23rd, 2008 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply