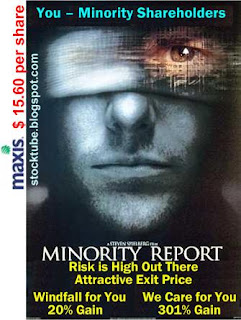

I believe most of the blogs, websites and business news are flooded with the latest happening in Malaysia corporate and potentially the biggest buzz of the year 2007 – MAXIS Privatization. The anxiety over the stock price of Maxis Communications Berhad (KLSE: MAXIS, stock-code 5051) when it opened today has somewhat taken a back seat as most of us know it’s going to jump above RM 15.00 per share at the opening-bell since the “generous offer” from Ananda Krishnan is $ 15.60.

I’m a little surprise that it was traded at $ 15.20 throughout most of the morning session although the highest stock price registered was $ 15.40  (constitute less than 4% of the volume traded). Do I smell something fishy that some invincible hands are pulling the strings to ensure the stock price is trading below $ 15.60 VGO (Voluntary General Offer) price so that the minority reluctantly but quietly (as if these poor investors have any other choice) agreed to sell to Ananda. The tycoon already has 46% in his pocket, how difficult it is to control the stock price? It could be that Ananda’s affiliate is buying the stock on open market in case the minority shareholders reject the offer.

(constitute less than 4% of the volume traded). Do I smell something fishy that some invincible hands are pulling the strings to ensure the stock price is trading below $ 15.60 VGO (Voluntary General Offer) price so that the minority reluctantly but quietly (as if these poor investors have any other choice) agreed to sell to Ananda. The tycoon already has 46% in his pocket, how difficult it is to control the stock price? It could be that Ananda’s affiliate is buying the stock on open market in case the minority shareholders reject the offer.

CIMB already said Binariang had obtained “irrevocable undertakings” from 15 firms who own a total 59.53 percent of Maxis to accept the offer. So it’s almost a green-light for the privatization plan to go ahead. As minority shareholders, you can’t do much, can you?

In the land where minorities are always taken for granted and treated as suckers, one should not be surprise to read all the praises and phrases which indirectly give the advance approval for such mega plan.

-

They Said – Windfall for Maxis shareholders (the Star newspaper). An investor who had bought 1,000 Maxis shares at RM13 each just before trading was suspended on Monday will make RM2,600, or a 20% gain on his investment.

-

You Should Say – Are you kidding me? Did Ananda or the newspaper tell us that Maxis will be taken private and we should buy on Friday in anticipation of the RM 2,600 generous bonus from the tycoon? I wouldn’t complaint much if only they let me know in advance (they actually can send me email – it’s published on this blog), would you? If this is the type of propaganda to get the minority investors to accept the VGO, they have to do better than this.

-

They Said – If a shareholder had bought, successfully get the Maxis shares at IPO price of RM 4.36 through the balloting process and kept his shares from that time, his gain would be 301%, including dividend payments.

-

You Should Say – At RM 4.36 per share, the IPO price was rather expensive back then and if you still can remember, the over-subscription rate was rather low – meaning not many people trust it can give a higher return. But the minority investors who willingly gave their money and souls believing Maxis has a good potential should not be neglected now that Ananda has grows his fortune leveraging on our own money in the first place. I say for the sake of our loyalty, Maxis should compensate additional RM 2.00 per share for each year of our holding to the stock in our portfolio. What say you?

-

They Said – VGO allows shareholders to exit at attractive price.

-

You Should Say – Are you insulting my intelligence again? RM 15.60 is attractive to Ananda and his affiliates but not minority investors. Based on the projected earning of 38 times commanded by Bharti Airtel’s (BOM: 532454), should Maxis listed in India, the same $ 13.00 per Maxis share currently trading at 16 times would translate to roughly RM 30.00 per share. So my demand for RM 22.00 per share is actually “very attractive” to Ananda.

-

They Said – The expansion to India and Indonesia will require huge amounts of new capital that could strain cashflow and dividend payments. These new challenges may not fit the risk appetite of existing minority shareholders and the voluntary general (VGO) offer allows them to exit at an attractive price.

-

You Should Say – Enough of your lame excuses and cheap justification. Since when did minority investors not aware of the risk associate with the oversea expansion? Else all the board of directors would have been booted out during AGM (Annual General Meeting). In fact, minority investors agreed that the only way to continue grows Maxis is to expand globally in the name of globalization.

-

They Said – The privatization gives Ananda greater flexibility to chart the forward direction for Maxis and re-enter Bursa when it has “stable earnings” again.

-

You Should Say – Are you playing the propaganda card again trying to give the public some sweets showing how Ananda “cares” the minority shareholders? To me, just give me RM 22.00 per share and don’t ever comes back to Bursa again because chances are I would have already allocated my funds to other telcos mainly on DIGI.com Berhad (DIGI: stock-code 6947) by then – provided the existing DIGI’s management still around.

The offer documents will be despatched to shareholders by May 24 with the closing date targeted at June 14. However I think the acceptance by minority shareholders would be very low even though it only constitute to a very negligible portion of the whole pie. Let’s wait for the day when it announce the acceptance level.

Other Articles That May Interest You …

May 4th, 2007 by financetwitter

If you enjoyed this post, what shall you do next? Consider:

The Media is on AK’s side, he’s got a lot of friends in high places to get write ups that favour him . 🙂