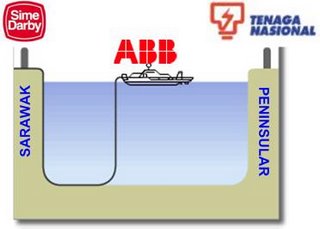

That’s the headline from Business Times today, when Sime Darby Bhd (KLSE: SIME, stock-code 4197) is said to have won the contract worth USD 4.3 billion to erect undersea submarine power cables linking Sarawak’s Bakun hydroelectric dam to Peninsular Malaysia. The cables would take power from the 2,400-megawatt Bakun hydroelectric dam, which is nearing completion in the Malaysian state of Sarawak on the island, and plug it into the power grid on the peninsula.

ABB), the world’s biggest maker of power transformers, to carry out the project. Besides listed in New York Stocks Exchange, ABB also listed in Zürich Stock Exchange (VTX: ABBN), Stockholm Stock Exchange and Bombay Stock Exchange (BOM: 500002). ABB Asea Brown Boveri, was the result of a merger between Asea AB of Sweden and BBC Brown Boveri Ltd. of Baden, Switzerland in 1988 and has presence in more than 140 countries with about 180,000 employees.

The daily quoted unnamed sources involved in the contract talks as saying: “A decision to award the contract was made very recently and that Sime will be informed officially soon.” Malaysia’s monopoly power distributor, state-controlled Tenaga Nasional Bhd (KLSE :

TENAGA, stock-code 5347), is likely to pay between 15 and 18 Malaysian cents per kilowatt hour for the Bakun power.Earlier, it was reported that Malaysian Resources Corp Bhd (KLSE : MRCB, stock-code 1651) and Eden Enterprises (M) Bhd (KLSE : EDEN) partnered with ABB for the bidding.

I doubt Peninsular Malaysia requires such a huge 2,400-megawatt (since existingly TENAGA has excess capacity of about 40%) but it’ll be interesting to see if the “volts” will go to wastage or re-channel to some other means of good use. If the Government does not have a proper plan, then the same process of TENAGA incurring losses again will happen, the same way it was forced to swallow all the megawatts generated by IPP (Independent Power Provider) such as Malakoff Berhad (KLSE: MALAKOF, stock-code 2496), YTL Power International Berhad (KLSE: YTLPOWR, stock-code 6742) and Ranhill Power Berhad (KLSE: RPOWER, stock-code 9067).

On the other hand, should there be demands for power-hungry industry such as the rumored aluminium smelter in Sarawak, then TENAGA will benefits from the pure-demand which should comes from the foreign companies such as Rio Tinto (NYSE : RTP, stock), Alcoa (NYSE : AA, stock), BHP Billiton (NYSE, ASX : BHP, stock) and Smelter Asia-China Aluminium International Engineering.

# TIP: As the commander of the world’s largest plantation Synergy Drive and now this multi-billion project, SIME is indeed moving into the direction in becoming one of the largest GLC (Government-Link-Companies) in Malaysia. I’m bullish on the stock in long-term.

Other Articles That May Interest You …

|

|

January 17th, 2007 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply