Muslim countries, especially those that subscribe to Saudi Arabia’s Wahhabism, broadcasted and printed a piece of great news over the weekend. King Salman issued a royal decree restoring “all allowances, financial benefits, and bonuses” for civil servants and military personnel on Saturday. Saudi claimed it was due to a recovery in oil prices and internal changes.

Last September, in what appeared to be the energy-rich Saudi’s most drastic move to save money, ministers’ salaries were cut by 20% and perks for public sector employees were scaled back. It was indeed a desperate measure after the kingdom hiked petrol prices by more than 50%, not to mention price increases for electricity, water, sewage, diesel and kerosene.

When Saudi announced the cuts on September 28, the crude oil had already recovered from its low of US$28 a barrel in January 2016 – to around US$45 a barrel. When King Salman announced the cancellation of the salaries and perks cut over the weekend, the commodity price was at US$50 a barrel. Does it make sense for the country to make a U-turn after just a 5 bucks recovery?

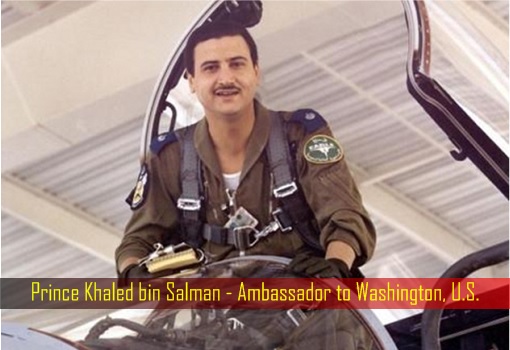

King Salman took the opportunity to also install two of his sons to key posts. Prince Khaled bin Salman, an F-15 pilot who has trained in the United States, was made ambassador to Washington. Another son and long-time oil policy official, Prince Abdulaziz bin Salman, was appointed state minister for energy affairs.

What the mainstream media from Sunni Islam nations refused to tell you was the “April 21 movement” which hit the Twitter hashtag. The cuts, which affected about two-thirds of working Saudis, were so unpopular that the Saudis demanded for the reinstatement of their financial benefits since it took into effect in October last year.

The calls for protests in at least four Saudi cities have spooked the Al Saud monarchy of Saudi Arabia. Regime forces were reportedly lined the streets of central Riyadh over the weekend in anticipation of a demonstration by unhappy citizens. Saudis were upset that while the monarchy continues with its lavish public spending, the normal citizens were victimized.

Although Saudi Minister of state Mohammed Alsheikh said it was Deputy Crown Prince Mohammed bin Salman who recommended the change (cancellation of cuts in benefits and perks) after alleged better-than-expected budget figures in the first quarter of 2017, clearly the monarchy dared not take the risk and therefore caved in to the peoples’ demand.

The bonus cuts had caused widespread grumbling in Saudi Arabia. For two-thirds of employed citizens, the bonuses had accounted for a substantial amount of their total take-home pay. The public discontent could trigger a similar “Arab Spring” as the protestors were also calling for an end to Saudi’s absolute monarchy (disguised as constitutional monarchy) in the “April 21 movement”.

Simon Henderson, Baker fellow at The Washington Institute and director of the Institute’s Gulf and Energy Policy Program said – “They adjusted things; they claim they are adjusting things because the economy is in a better position, but that’s nonsense. It sounds as though they felt it politically necessary to do something, which is economically risky.”

The unpopular cuts did not only affect the civil servants but also the military personnel. To pacify the powerful military forces, the monarch also ordered an additional two-month salary bonus for regime forces involved in a brutal and inhuman aggression against neighbouring Yemen. Salaries and allowances accounted for 45% (or US$128 billion) of government spending in 2015.

The panicked King Salman also made another U-turn when he told the kingdom’s central bank to instruct banks to maintain the current favourable terms of consumer and property loans to low-income Saudis, after having ordered their rescheduling in autumn to aid Saudis affected by the cuts. Another demand was for a halt to the sale of shares of state oil giant Aramco.

Saudi Arabia is in a mess, despite the slight recovery in oil prices. Although Deputy Crown Prince Mohammed bin Salman tries to play down the problems, the kingdom is facing its worst economy growth since the world recession in 2008-09. New construction projects are scarce, and payments to builders got held up last year. Nowadays, even Saudi banks aren’t attractive to buyers.

Royal Bank of Scotland Group Plc has reportedly been seeking for years to sell its 40% stake in Alawwal Bank (formerly known as Saudi Hollandi), while Credit Agricole SA is considering a sale of its 31% stake in Banque Saudi Fransi. Alawwal Bank reported a 50% plunge in net income while Banque Saudi Fransi saw its profit down 13%.

Other Articles That May Interest You …

- Sponsor & Supplier – Majority Of ISIS Militants Are Citizens Of Saudi

- Oil Going $42 – Speculators Give Up, Saudi Doesn’t Know What To Do

- A Month Of Asia Tour – King Salman’s Mission & The Real Reason He’s Here

- Congress Rejects Obama’s Veto – Now “Terrorist Sponsor” Saudi’s Assets Can Be Seized

- Exposing 9/11 Secrets – How Saudi Terrorism Began In 1979’s “The Siege Of Mecca”

- The Glory Days Are Over – OPEC Warlord Saudi Has Started Borrowing

- Saudi’s Past Arrogance & Terrorists Funding – Is This Karma?

- The Answer To ISIS Invasion Threat – The Great Wall Of Saudi

|

|

April 25th, 2017 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply