Tim Cook has been jetting around the globe ever since the mighty Apple revealed its sales has finally stopped growing – for the first time in 13 years and after 51 consecutive quarters of doing so. He had just visited Beijing on Monday, talking to government officials about company matters as the company struggles to revive sluggish iPhone sales.

In China, one cannot help but notice the increasing tensions between the country and Apple, following trademark disputes and the ban on iTunes Movies and iBooks content. By hook or by crook, Tim Cook needs to boost sales in China, its second largest market after the United States. Apple needs China more than China needs iPhone.

Apple’s US$1 billion investment in taxi company Didi Chuxing, the Chinese version of Uber, could easily be misunderstood as sucking up to China. The burning of US$1 billion was quickly justified with an IPO of Didi in the U.S. in 2018, the year where Apple would reap its financial rewards. However, Didi, valued at roughly US$26 billion, has denied plans to IPO anytime soon.

After China’s visit, Tim Cook will fly to India to meet Prime Minister Narendra Modi. Mr. Tim is expected to persuade Modi to allow refurbished iPhone to be sold in India, in exchange for Apple production facilities to be set up so that Modi can tell all and sundry that he has made possible the “Made in India” manufacturing.

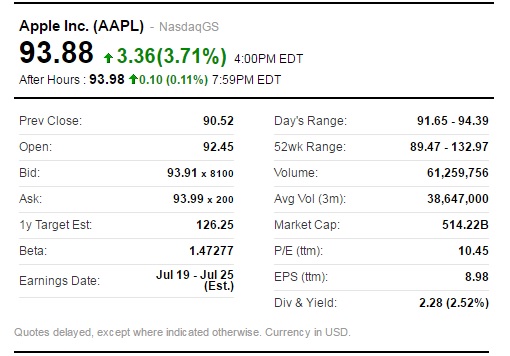

But if Apple is so problematic, why did the stock suddenly jumped 3.71% on Monday? The short and long answer – Berkshire Hathaway has paid over US$1 billion to buy 9.8-million shares of Apple. And that’s a big deal because with the exception of IBM, the Oracle of Omaha would stay away from technology stocks with a ten-foot pole.

Therefore, when Berkshire disclosed that it owned 9,811,747 shares of the iPhone maker in a latest regulatory filing, all hell breaks loose and everyone scrambles to buy Apple’s shares, pushing the stock up by US$3.36 a share. Purchased for a total US$1,069,382,000, that would translate Apple shares bought by Berkshire at US$108.99 a share.

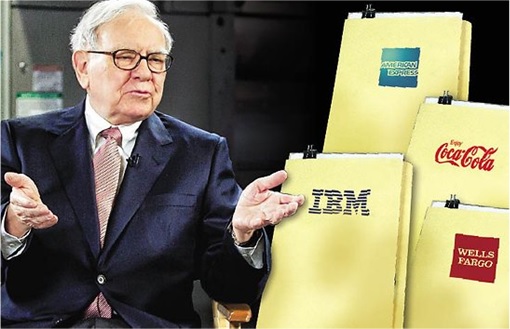

In the same filing, Berkshire also reveals the company has boosted its shares of IBM by 198,853 to 81.2 million shares. When Buffett disclosed his new adventure of investing IBM back in 2011, it raised eyebrows. However, the stock has since fallen by 20%. Warren acknowledges that he isn’t perfect.

So, why on earth did Warren Buffett touch technology stock again, after getting burnt by IBM? Last month, billionaire-activist-investor Carl Icahn said he sold his entire Apple stake, on concern that China could make it harder for the company to do business there. In fact, almost all investors and analysts have either sold or slashed their stake in Apple.

One may quick to conclude that this is part of Warren Buffett’s contrarian strategy – the best time to invest in a stock is when short-sightedness of the market has beaten down the price. Even though Buffett invests based on fundamental and not technical analysis, surely he knows that Apple isn’t done with the beating and is heading to US$80 a share.

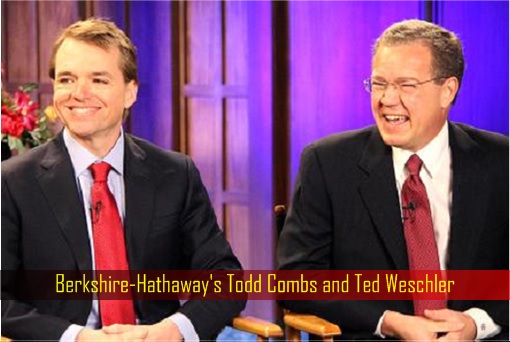

Before you jump on the bandwagon, just because Berkshire Hathaway had done so, you should realize that not all investment decisions were made by Warren Buffett himself. If you care to read Berkshire shareholder letter dated 2015, you should know that the company has two investment managers who are handling US$9 billion – each – in investments.

The two Berkshire portfolio managers – Todd Combs and Ted Weschler – were the actual guys who dumped US$1,069,382,000 for 9,811,747 shares of Apple at an average price of US$108.99 a share. Mr. Todd and Ted were recruited in 2010 and 2011 respectively by Warren Buffett.

Hence, if your plan was to follow Warren Buffett’s investment portfolio, don’t bother. Buffett didn’t buy Apple stock. Todd Combs bought Apple stock. Ted Weschler invested Apple shares. And billionaire Buffett wouldn’t care or question the wisdom of his top lieutenants as part of the transition process in Berkshire Hathaway.

Here’s another reason why you shouldn’t follow the Berkshire portfolio managers. The Form 13F-HR quarterly report was for the period ended 31 March 2016 although the filing date was on 16 May 2016. Therefore, Todd Combs and Ted Weschler bought the shares “before” the disastrous Apple earnings report in April which saw the collapse of its sales growth.

Sure, Warren Buffet trusts both Todd Combs and Ted Weschler but that doesn’t mean their calls to throw US$1 billion on Apple stock is a wise one. But hey, even if Apple is another IBM where the stock price is about to lose 20% in 5-year, these gentlemen would not beat their heads against the wall over US$200 million losses.

Monday’s jump was primarily because all the financial headlines scream – “Warren Buffett Bought Apple”. The stock would have had behaved differently, for obvious reason, if the headlines read – “Todd Combs and Ted Weschler Bought Apple” instead. The Buffett brand can really sell.

Other Articles That May Interest You …

- Saturation – Game Over As Apple Sales Plunged After 13-Year Of Sexy Growth

- FBI Finally Cracked iPhone, But Did Apple Help Them – “Secretly”?

- Berkshire Annual Letter – Billionaire Buffett Reveals 7 Important Messages

- Apple iOS-Liked Technology Coming To Your Car’s Windshield?

- Revealed!! – Billionaire Warren Buffett’s Youthful Secret

- Admission!! – Apple CEO Tim Cook Is Proud To Be iGay

- One More (Secret) Thing … Apple iOS 8 Allows Wireless Charging Using MicroWave

- Apple Pay, iPhone 6 & Watch – Welcome To The Party, But You’re Late

- Here’s Proof That Apple Deliberately Slow Down Its Old Models, Before A New Release

- Apple Has More Cash Than Malaysia, France & Dozens Other Countries

- Warren Buffett’s 2013 Top-10 Stocks

- Here’s How To Tell If You’re A Samsung or Apple Fan

|

|

May 17th, 2016 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply