Warren Buffett, the CEO and largest shareholder of Berkshire Hathaway (NYSE: BRK.A, stock) is one of the wealthiest men on planet Earth. Every now and then, he would trim his holdings while add other stocks into his portfolio. In June 2013 alone, he added stocks like General Motors, Wells Fargo, VeriSign, National Oilwell Verco and Bank of New York Mellon. He also reduced his holdings such as Moody’s Corp, Kraft Foods and Mondelez International in the same month. Due to the fact that Warren is a long-term investor, many investors follow his investment portfolio for obvious reason.

Fortunately, United States makes it a mandatory requirement for any fund managers who oversee more than US$100 million in assets to declare their equity holdings in a quarterly report – Securities and Exchange Commission’s 13-F report. This must be filled within 45 days of the end of each quarter. Hence, this quarterly report provides an opportunity for Warren Buffett wannabe investors to have a glance on what the Oracle of Omaha had bought in the previous quarter. For example Warren Buffett had added new stocks to his portfolio in June 2013 – Suncor Energy and DISH Network to the tune of 0.59% (17,769,457 shares) and 0.03% (547,312) stakes respectively.

Here’re Warren Buffet Top-10 stocks, via his Berkshire investment arm, which could make you some money as at the end of June 2013:

[ 10 ] Moody’s Corporation (MCO) — Year-To-Date: 28.3%

Berkshire reduced its shares in the ratings agency during the second quarter, but still held 24.9 million shares, worth US$1.52 billion at the end of June 2013.

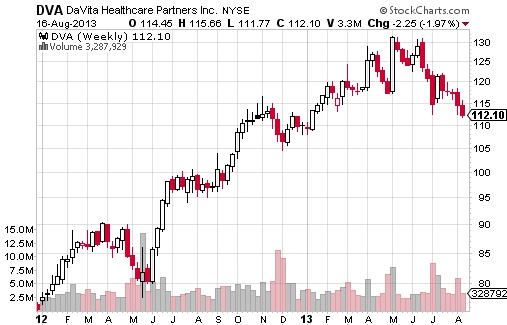

[ 9 ] DaVita HealthCare Partners (DVA) — Year-To-Date: 1.5%

The stake in the healthcare company is most likely the work of Buffett’s managers, Ted Weschler and Todd Comb, but Berkshire held nearly 15 million shares, worth US$1.81 billion at the end of June.

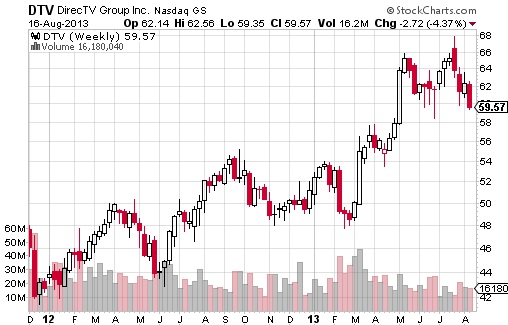

[ 8 ] DIRECTV (DTV) — Year-To-Date: 18.9%

Berkshire held 37.3 million shares of the satellite provider at the end of the second quarter, worth $2.3 billion. In comparison, Berkshire’s new position in DISH Network was valued at US$524 million.

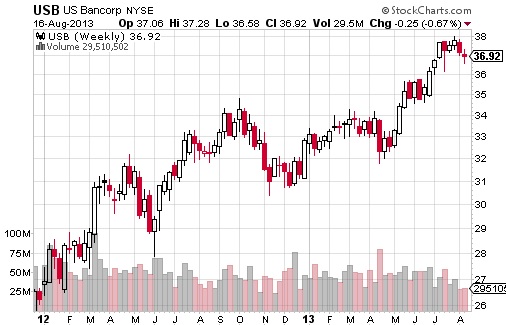

[ 7 ] U.S. Bancorp (USB) — Year-To-Date: 15.7%

The Minnesota-based bank was in high demand at Berkshire as the firm increased its stake by almost 17 million shares to 78.3 million shares during the second quarter, worth US$2.83 billion.

[ 6 ] Wal-Mart (WMT) — Year-To-Date: 8.6%

Berkshire held 49.2 million shares of the world’s largest retailer at the end of the second quarter, worth US$3.67 billion.

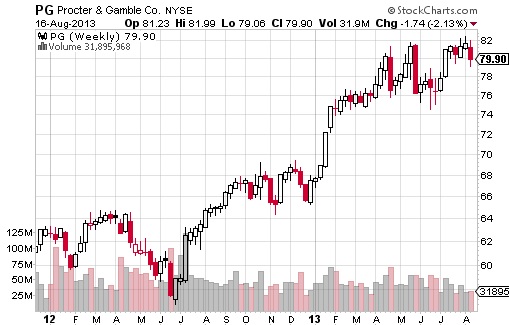

[ 5 ] Procter & Gamble (PG) — Year-To-Date: 17.7%

During the second quarter, Berkshire kept its stake in the Ohio-based company at 52.8 million shares, worth US$4.06 billion.

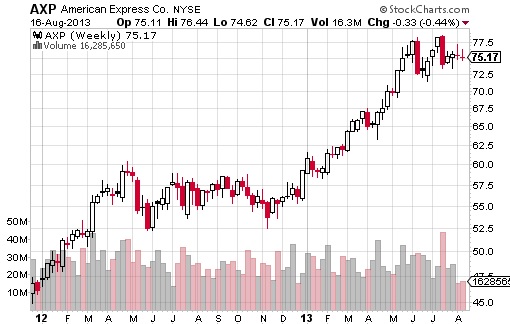

[ 4 ] American Express (AXP) — Year-To-Date: 30.9%

Berkshire held 151.6 million shares of the credit card giant at the end of the second quarter, worth US$11.33 billion.

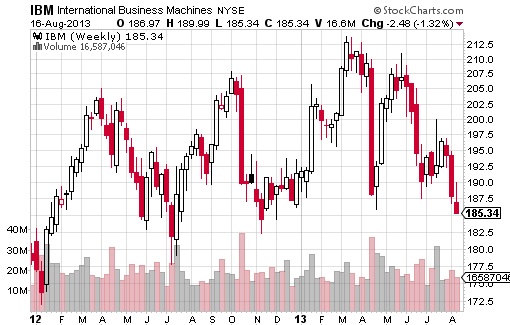

[ 3 ] International Business Machines (IBM) — Year-To-Date: -3.1%

The information technology is the most influential blue chip in the Dow Jones Industrial Average, and one of Buffett’s biggest holdings. Berkshire held 68.1 million shares of IBM at the end of the second quarter, worth US$13.02 billion.

[ 2 ] The Coca-Cola Company (KO) — Year-To-Date: 7.6%

Berkshire held 400 million shares of the world-known beverage company at the end of the second quarter, worth US$16.04 billion.

[ 1 ] Wells Fargo (WFC) — Year-To-Date: 25.2%

The nation’s largest bank by market capitalization is also Buffett’s top holding. Berkshire held 463.1 million shares of Wells Fargo at the end of the second quarter, worth US$19.1 billion.

Other Articles That May Interest You …

- The Biggest & Luxurious Private Jet – $500 Million Airbus

- How to Get Back Your Genneva Gold and Money – 10 Things To Do

- Top 20 Countries With Highest Proportion of Millionaires

- Richest Man on Earth – Financial or Political Genius?

|

|

August 19th, 2013 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply