Recession may be over, at least for now, but the same cannot be said about U.S. unemployment market. The jobless rate surprisingly surpassed analysts’ estimate (of 9.9%) to a staggering 10.2% in Oct, higher than Sep’s 9.8% jobless rate. Strangely enough the stock markets, both Dow Jones and Nasdaq, didn’t take much cue from the double-digit jobless rate which is the highest since early 1983. United States recorded jobless rate of 10.8% during the period of September 1982 to July 1983 while during World War II the country experienced 11% of unemployment. The latest data may send U.S. economists at MFR Inc. back to the drawing board since their prediction of hitting jobless rate of 11% by mid-2010 may come sooner than expected.

So what does this means? It only means that while we may not have the opportunity to witness yet again another 1929 depression, the recovery is definitely moving at a snail pace. Make no mistake about it – the U.S. economy didn’t dive to the like of 1929 Depression because of government’s stimulus package and it appears that Obama’s administration may has no other option but to get ready it’s second stimulus bill, in case of more surprises such as credit card burst. But there’s something more worrying about the economy model that is sending many economists cracking their heads.

The global recession sparked by U.S. subprime mortgages problem may be the turning point that will shape a new way of how business cycle operates. We may not be able to claim back the jobs destroyed during the recession because if the latest jobless rate is anything to go by – jobs will not necessary be replenished after the recession dust is over. Recession which ended in 1991 took a year before re-hiring resumed and the recession ended 2001 took two years before the jobless could find their job. So if we’re lucky the current jobless rate may take at least three years to recover, provided the old way of business cycle is still intact.

However we’re no longer living in the age of manufacturing, at least not United States, a country which inherited such business model when one-third of their workforce were in the manufacturing. Of course the new manufacturing hub now is China but in the meantime what shall the U.S. men and women who lost their jobs do? With automation, technology and the shift in the services sector as the new way of doing business, employers may just have found the excuses of not hiring as many as they did before the recession. Hence it’s interesting to watch the next month’s jobless rate data.

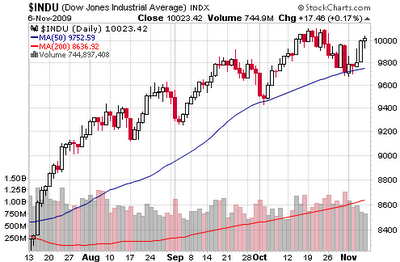

Back to the stocks, one of the reasons why the market didn’t tumble after the jobless rate data was release could be due to the bet that Federal Reserve has no reason to hike the banking lending rate so the record low rate or zero to 0.25% may stay for some time. Lower interest rate makes dollar unattractive and this would pump more liquidity into the stock market. So where will be new interests? Definitely you can short the dollar in currency trading; gold is still skyrocketing as if there’s no tomorrow and the Hurricane Ida may just create enough havoc in the Gulf Coast to push up oil prices.

Another reason why the stocks are still relatively bullish is due to the fact that holiday season is around the corner. Analysts are still waiting for the retailers’ earnings reports for clues if the consumers are willing to spend. Christmas may be used as an excuse to spend but otherwise the Dow Jones may drop to below 10,000 once the retailers’ earnings reports are not favorable.

Other Articles That May Interest You …

- Earnings Season send Bull Charging, Next Target – 10,000

- New Bull Run – Already Started or Another 10-Years?

- Get the Facts Right and You’ll Know What to Do Next

- Thank Goodness the Jobs Report was Great – What Now?

|

|

November 9th, 2009 by financetwitter

|

|

|

|

|

|

|

During 1929 Depression era, US debts is manageable but currently wonder how would US solve it ballooning debts of trillion dollars with more stimulus & keeping interest rate at 0% forever? Japan is still keeping her interest rate nearly at 0% until now with no sight of ever economic recovery !