How long can the current rally last? That is a multi-billion-dollars question everyone would like to know. Boy! It’s not easy being either a bull or a bear. Damn the bull when the market tumbles and damn the bear when the market skyrockets. Many fundamentalists claimed they are not affected or rather they don’t care because they are long-term investors and equate themselves to Warren Buffett. The truth is you can really count with your fingers if these people are really who they claimed to be – cloning the investing strategy of the Oracle of Omaha. But these same people do not have what Buffett has and that is billions of free dollars waiting to buy into the right stocks at the right time.

They have forgotten they do not have deep pocket such as Warren Buffett yet they fantasize themselves as the great investor. Warren can make mistake, losses billions of dollars in investment and yet shareholders will still call Warren the greatest investor of all time. He can negotiate to buy ailing companies with great discount and still get very attractive dividend coupons. Most importantly he can hold for 10-year, 20-year or even forever in the name of long-term investment and nobody dares to say he would bankrupt the shareholders’ fund. But can the Warren Buffett wannabes do that?

So the next time you heard your friends or analysts talk about investing the exact same way as Warren Buffett, it’s alright to laugh at them. You can laugh even louder if they’re talking about adopting the same Buffettology in the local stock market. Why? Just go and compare the Dow Jones or S&P500 historical chart with local chart KLCI. Sure, there’re some cool local companies that are giving great annual returns without fail since 1970s which fit Warren’s profile but whether these stocks can continue to give the same returns in the next 30-years especially when the founders are long gone is the biggest question-mark, not to mention these stocks are already fully valued at the current price (and economic situation).

But the American’s economic crisis is over. The worst is over and many economists had said so. The Japan and Germany are out of the woods and Federal Reserves’ Ben Bernanke was praised for the job well done. The only problem is the, well, hundreds of thousands of jobless Yankees but given time they’ll be out of their misery soon. Have we forgotten that we’re seeing the sunshine because all these governments gave the boost of “stimulus packages” hence it’s not a genuine recovery. Hey, you shouldn’t argue on this (stimulus package) because if all the economic superpowers were doing it then it should be the right thing to do. Let’s not complicate the matter and be happy about it and heck, if need arises, there will be second, third, fourth and more stimulus packages to be introduced if this stubborn recession won’t go away.

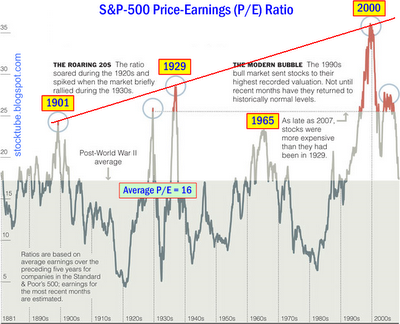

Such is the current situation now. The fact is most of us believed we’re on a “V-shape” if not a “U-shape” recovery. What if we’re going to experience a “W-shape” recovery instead? And to make multiple-orgasms, there may be multiple “W-shape” recoveries? Wow! That would be fantastic and I bet you’ve not experience multiple-orgasms for many months, if you’ve ever tried that before in the first place *grin*. Fundamentalists do not like to see technical charts but frankly a chart could tell us many things that may happen. Just like fortune-telling we’ll only believe what we like to hear but curse the fortune-teller till kingdom come if the reverse is true. However looking at the S&P-500 P/E ratio since the last three major bull markets (1900s, 1920s and 1960s), the stock market went through a mind-boggling 20-year (2-decades) of consolidation before a great bull market began again.

Now, assuming that we’re already into the tenth year of consolidation since the bull market in 2000, we still have another ten more years before the next super bull-run. But can we actually use the chart to predict safely the prophecy of 20-year consolidation cycle on current modern days – the internet whereby you can literally buy and sell stocks at the comfort at your home and in the process create volatility? Maybe we’ve actually entered a shorter consolidation period of say, 10-year, before the next climax come. And if that’s true then we’ve actually entering the next Super Bull Market. But do you dare to bet your fortune on it? On the other hand if you’re Buffett wannabe you can place your bet now and wait for another 10, 20 or 30 years to claim the trophy *grin*.

Other Articles That May Interest You …

- Get the Facts Right and You’ll Know What to Do Next

- Thank Goodness the Jobs Report was Great – What Now?

- Are you convinced the Bull was a suckers Rally?

- Even if the Worst is Over, So What?

- Stress Test a Hoax? Another Wave of Banking Tsunami?

- Beats Earnings – Blinded by Excessive Low Expectation

|

|

August 23rd, 2009 by financetwitter

|

|

|

|

|

|

|

[…] New Bull Run – Already Started or Another 10-Years? […]