Starting today, anybody can buy China stocks at the debut of an exchange link that allows Hong Kong and Shanghai investors to trade shares on each others’ bourses. Called “Stock Connect”, mainland Chinese can now trade shares in Hong Kong for the first time, while foreign investors in Hong Kong are allowed to buy and sell stocks listed on the Shanghai stock exchange directly.

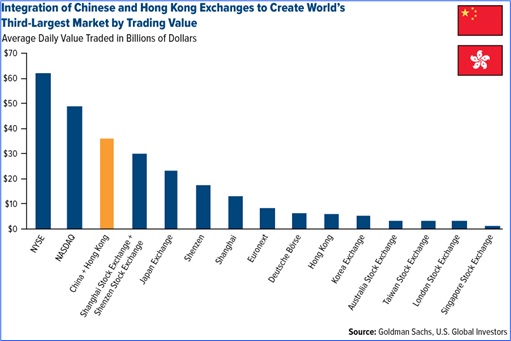

Considered as the single most important move by communist China to open its markets to the world in recent history, both Shanghai and Hong Kong stock exchanges opened about 1% higher but soon gave up the gains, the first trading day today. With a combined capital of a mind-boggling US$4.2 trillion, analysts were optimistic “Stock Connect” would eventually lead to the creation of the world’s third largest stock exchange.

By noon just now, foreign investors buying stocks in Shanghai had nearly reached the daily limit of 13 billion renminbi (US$2.1 billion; £1.3 billion; RM7 billion) in value and about 10 billion renminbi in transaction volumes. Prior to today’s liberalization, investors could trade only the stocks of certain companies listed in China through a limited program. Still, the fact that the limit was set at US$2.1 billion a day shows the China government is not ready to let go of its control on the stock market, at least not now.

Here’s how it works – institutions and individuals can trade Shanghai shares via Hong Kong. On the other hand, mainland institutions and individuals with at least 500,000 yuan (US$80,000; £51,999; RM270,000) in a trading account can buy or sell Hong Kong shares. Shanghai shares remain in Shanghai and are held in trust by a broker or custodian on behalf of the foreign investors, and vice versa for Hong Kong shares.

For now, purchases of mainland stocks (“A” shares) are capped at 13 billion yuan a day and 300 billion yuan in total on a “first-come, first-served” basis. The Hong Kong stock limits are 10.5 billion yuan daily and 250 billion yuan overall. On average, Hong Kong’s daily turnover is about 30 billion yuan, while Shanghai’s about 71 billion yuan. This means, it could add 35% and 18% “volatility” into Hong Kong and Shanghai stock exchange respectively.

Over the longer term, French bank BNP Paribas estimates the stock connect could boost the average daily value of stock trading in Hong Kong by about 38% by 2015. Prior to this, Beijing has established offshore yuan centers from Sydney to London, signed swap lines with countries in the Middle East and has allowed foreign companies in China to move renminbi across borders with greater freedom than ever before.

However, there were teething problems with the implementation of stock connect, particularly about taxes. In order to push for the programme into reality, China’s Finance Ministry announced it would temporarily exempt taxes on profits made from the “Stock Connect” scheme. Of course, Hong Kong CEO C.Y. Leung took the opportunity to blame the delay on the launching, supposedly on October 27, squarely on pro-democracy protest.

Interestingly, it was an eleventh hour decision from Beijing to exempt international investors from a capital gain tax, as well as giving mainland investors a 3-year grace period from paying capital gains tax. Mainland individuals buying Hong Kong shares will be liable for tax on dividends though. Investors on both sides will be liable for stamp duties, and Hong Kong investors will be taxed 10% on dividends earned from mainland investments.

Nevertheless, it raises speculations why was President Xi Jinping rushing the stock connect programme. But with Japan’s latest update that the country had slipped into recession (for real), the needs for the stock connect has become more vital in order to pump more hot money into China. Needless to say, investors are still nervous about the whole tax exemption thing because they can never know when Beijing will revoke it – suddenly.

Although the stock connect is only a pilot program, Beijing could enhance the liberalization if it sees foreign money could help its sagging stock markets. But most importantly, the Chinese government hopes the inflow of foreign investment money could offset the local speculation money, and in the process stabilise the world’s 6ht largest stock market by market capitalization – the Shanghai Stock Exchange.

Other Articles That May Interest You …

- Foreign Exchange Scandal – 5 Big Banks Fined A Paltry US$3.3 billion

- After China Steel Cheaper Than Cabbage, Now U.S. Gasoline Cheaper Than Milk

- Dollar Bull Run Could Wreck Havoc In Asia, Particularly Malaysia

- The Luxury Diaper Goldmine – Here’s How Mainland Chinese Make Money

- There’s A New Bank On The Block, And The U.S. Isn’t Happy About It

- Here’re 5 Spectacular Signs Global Economy May Get Ebola

- China – Ain’t Sick Man Of Asia, Too Wealthy For Anyone To Lecture Them

|

|

November 17th, 2014 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply