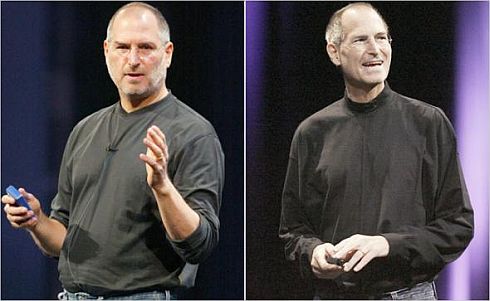

News that Apple CEO Steve Jobs is taking another medical leave of absence spooked investors so much so that many speculators predicted the stock price would tumble at least by 10% even before the opening bell on Tuesday. As expected, the stock price plunged but by a smaller 6 percentage points only. At the end of the trading day the stock closed down 2.3% to $340.65. Apple’s shares then rose $4.25 to $344.90 in extended trading after the release of its earnings result.

Steve Jobs had surgery in 2004 that he said cured him of a rare form of pancreatic cancer. In 2009, Jobs announced a half-year leave during which time he had a liver transplant but this time, Apple did not say whether Jobs is acutely ill again or when it expects him to return. But the news was sufficient to send crazy speculators into panic selling.

Steve Jobs is synonym with iPhone, iPad, iPod, Mac and whatnot so it’s understandable that investors couldn’t take the news that he plans to stay away on medical leave. But if the past of his medical leaves are any indication, it actually provides the best opportunity to buy during Apple’s stock pullback simply because the stock would recover eventually. Furthermore it was widely expected that the company would release another mind-blowing earnings.

So, the simple trick was to buy during the early trading session when people were selling. If you had bought when the stock plunged more than $13 bucks on Tuesday, you would have made handsome profits when the stock recovers at the end of the trading session. Not that I like Steve Jobs health to deteriorate further but the more trips he makes to the hospital the more chances it would provide me in making easy money.

Anyway, here’s the summary of Apple’s earnings result

1) Revenue up 70% to $26.74 billion from $15.68 billion a year ago. Analysts forecast – $24.5 billion.

2) Net income up 78% to a record $6 billion from $3.4 billion a year ago. Analysts forecast –

3) Earnings per share $6.43 a share from $3.67 a share a year ago. Analysts forecast – $5.38 a share.

4) iPhone sales up 86% to 16.24 million units from a year ago. Analysts forecast – 16 million units

5) iPad sales up 75% to 7.33 million units from a year ago. Analysts forecast – 6 million units.

6) iPod sales was slightly down (7% down) at 19.5 million units from a year ago. Analysts forecast – 18.7 million units

7) Mac computers sales were 4.13 million units. Analysts forecast – 4.2 million units

8) Apple’s cash holdings equal $59.7 billion from $51 billion.

9) Revenue from China, Hong Kong and Taiwan totalled $2.6 billion – about 10% of its total revenue

10) Upside guidance for next quarter – expects net income of $4.90 per share on revenue of $22 billion. Analysts’ expectation was net income of $4.48 per share on $20.9 billion in revenue.

Other Articles That May Interest You …

- Verizon iPhone Is Here And The Winner Is – Apple

- Apple Earnings – The Good, The Bad and The Ugly

- 6 Tips from Earnings to Help You Choose Stocks

- 5 Reasons Why Apple Stock Crash After Opening

- 10 Facts About APPLE’s Latest Earnings

- Apple Steve Jobs’s latest gadget – a Liver Transplant

|

|

January 19th, 2011 by financetwitter

|

|

|

|

|

|

|

[…] Apple’s Blowout Earnings & Steve Job’s Medical Leave […]