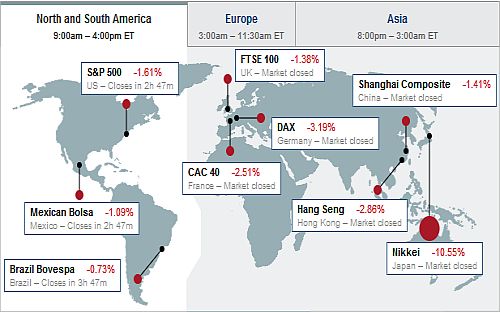

The Dow Jones Industrial Average lost nearly 300 points before regaining ground. Japan’s main index, the Nikkei 225, has dropped a shocking 16% in two trading days since the earthquake – the largest two-day drop since the 1987 crash. Japan government was so worry about the panic sell-off that the Bank of Japan injected a whopping total of 20 trillion yen ($245 billion) into the market today in a bid to provide liquidity support.

Now, is this nuclear Armageddon thingy for real? Prime Minister Naoto Kan himself warned that radiation that had leaked earlier had already spread from the crippled reactors and that there was “a very high risk” of further leakage. In the latest incident, Tokyo Electric Power Company (TEPCO) announced that it was unable to pump water into No. 4 reactor’s storage pool for spent uranium fuel after the spent fuel rods were exposed to the air. TEPCO then announced they would be using helicopter to dump cold water from above, a desperate measure if you were to ask me.

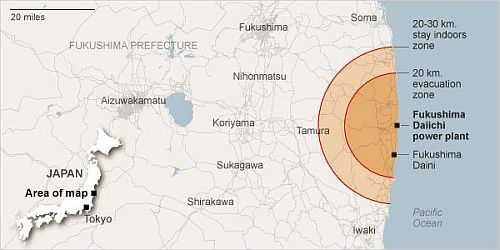

The explosion at the plant’s No. 2 reactor and a fire at the No. 4 reactor briefly pushed radiation levels at the plant to about 167 times the average annual dose of radiation. Earlier Tuesday the Japanese government told people living within about 20 miles of the Daiichi plant to stay indoors, keep their windows closed and stop using air conditioning. About 200,000 people living within a 12.4-mile (20 kilometer) radius of the plant already had been evacuated. And 170 miles south of the plant, the metropolitan government of Tokyo said it had detected radiation levels 20 times above normal over the city.

Chief Cabinet Secretary Yukio Edano said he could not rule out the possibility of a meltdown at the troubled reactors. In the worst-case scenario of a meltdown, the nuclear fuel rods will melt the steel and concrete structure containing them and then spill and spread toxic radioactivity through the air and water. To make matter worse, all eyes are now on reactors No. 5 and 6 at the plant where the cooling systems weren’t functioning well. Heck, U.S. navy is even moving three incoming ships to a new location because of “radiological and navigation hazards” at their intended destination on the eastern coast of Honshu.

Economists at BlackRock said that the disaster might cause the Japanese economy to contract in the second quarter while analysts at Credit Suisse and Barclays Capital have estimated the damage in Japan at up to 15 trillion yen, or $183.5 billion. But the multi-billion question is have we seen the worst or the bottom in the stock markets triggered by this earthquake? Analysts would believe so and the panic selling is over but it really depends on the development at the nuclear reactors. And it will take days or perhaps weeks before a full-scale of the damage could be assessed, if it’s certain there won’t be any meltdown.

Other Articles That May Interest You …

- Photo Galleries: The Day After Japan’s Tsunami

- Japan Tsunami’s Greatest Problem – Nuclear Meltdown

- Gaddafi Moved Personal US$4.8 Billion To London

- Mad Dog Gaddafi to Spook Oil Prices Up North

- Nuclear Plant – Tenaga’s new Toy worth RM10 billion?

|

|

March 16th, 2011 by financetwitter

|

|

|

|

|

|

|

[…] Nuclear Fears Rips Global Stocks, Ain’t Over Yet […]