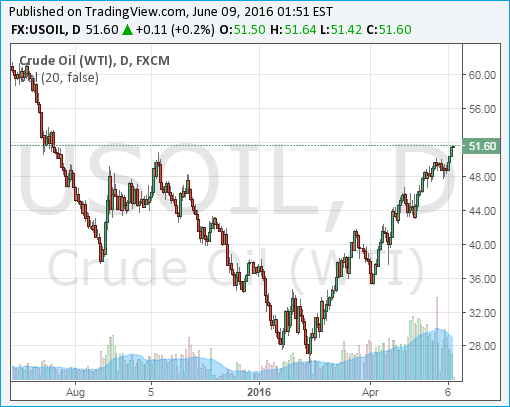

Crude oil prices – both WTI and Brent – have breached US$50 a barrel, and that is good news to oil producers. West Texas Intermediate (WTI) crude futures for July were trading above US$51 per barrel for the first time since July 2015. So, what’s the big deal? Because a technical analysis shows the bull is not over yet, even though fundamental analysis says otherwise.

Fundamentally, we know crude oil gets its boost after a series of production disruptions, ranging from Nigeria to Canada. Being the largest producer of crude oil in Africa, militant attacks in Nigeria have seen the country’s supply reduced by up to 500,000 barrels a day. Chevron, Exxon Mobil, Royal Dutch Shell have all been affected.

Unlike Nigerian constant militant attacks, Canada oil supply disruption is pretty straight forward. Wildfires in Canada have resulted in loss of around 1-million barrels per day of crude oil. But the wildfires problem is not something that happens frequently or periodically. Regardless, the crude oil prices should retreat if disruptions come to an end.

However, technical analysis shows an “inverse head and shoulders” pattern – and a straight line up to at least US$60 a barrel, which could happen either this month or the month of July. The chart is the only thing that has gotten oil producers and speculators bullish about crude oil. Of course, the reverse is true and if oil fails at its current level, it would form a double top – a very bearish formation.

While the technical chart tells you there’s roughly 10 bucks to be made by betting the crude oil would go higher, you should realize it can only drive the market temporarily, before the fundamentals kick in to push it lower. One has to remember that oversupply remains the biggest issue as Iran keeps pumping more oil while Saudi is left with no choice but to do the same to maintain market share.

Factor such as a possibility of an interest rate hike by the Federal Reserve which would strengthen the dollar will definitely hurt crude prices. But there’s a bigger problem to people who like to see a higher crude oil price. The drilling by the notorious U.S. share drillers, whom had stopped temporarily, is back – with vengeance.

The oil rig count jumped by nine last week to 325 active oil rigs, the sharpest increase since December 2015. According to the Wall Street Journal, there are a few spots where companies are stepping up drilling activity namely the Permian Basin in West Texas and the Stack play in Oklahoma.

Apparently, drillers in both areas can earn between 10% to 30% return with oil prices at US$45 per barrel. Continental Resources, an Oklahoma City-based shale driller, says that it can earn a 75% return from its best wells in the Stack play, even when oil prices are at just US$45. That’s possible because the needed pipeline infrastructure and processing facilities are ready nearby.

Pioneer Natural Resources said in April that it would add 5 to 10 rigs if oil prices returned to US$50 and stayed there. Its executive VP Joey Hall said the company is planning to allocate US$1.8 billion (90% of its total budget) to operations in the Permian. The company is now ready to ramp up its rig count in Spraberry and Wolfcamp – two of its Permian fields.

Another player, Occidental Petroleum, is also planning a production increase in the Permian. Armed with US$3 billion in capex, the company’s production could increase by 4-6%. Chevron has identified 4,000 wells that it believes can provide a 10% return in the Permian basin with oil at US$50 per barrel.

True, crude oil at US$50 a barrel may not be awesomely profitable to start drilling and pumping, but it surely is an encouragement to do so. But at US$60 a barrel, that would be a totally new incentive for oil drillers – to drill like crazy. Shale drilling stops and starts quicker than conventional drilling, therefore before the rest of the world realize it, the supply of crude oil in U.S. would have exploded.

Other Articles That May Interest You …

- Forget MARS – China Is Building A “Space Station” … Under South China Sea

- No Action Talk Only – OPEC Happily Agreed To Do “Nothing” … Again

- Congress To Reveal 9/11 Secrets, Saudi Isn’t Happy So They Blackmail U.S.

- Worst Is Over On Oil? Not So Fast – Here’s Why

- Cheaper Than Water – This British Bank Thinks Oil Would Go To $10 / Barrel

- Meet United States – The World’s Latest Oil Exporter – After 40 Years

- Here’s Why Oil Above $100 Will Never Happen Again, Ever, Forever!!

- The Glory Days Are Over – OPEC Warlord Saudi Has Started Borrowing

|

|

June 9th, 2016 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply