There were 21 states at the end of November which had joined the US$1.99 club – where at least 1 station sells fuel at less than two bucks a gallon. Today, the number of states have jumped to 31. In essence, American drivers in these 31 states pay US$1.99 or less for a gallon or about 3.78 litre of gasoline – or US$0.53 (£0.42; RM2.22) per litre.

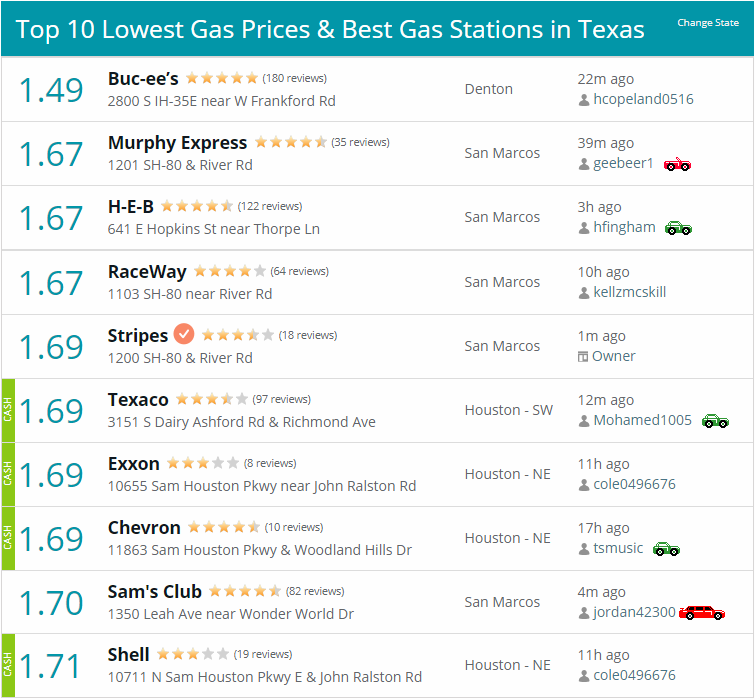

But even US$1.99 a gallon isn’t the lowest gas price you can get today. People in Texas are spoilt with more stations and even lower fuel prices. The cheapest gas can be found at Buc-ee’s in Denton, Texas. About 3 weeks ago, the station was selling at US$1.64 a gallon. Today (Dec 22), the same station flashes US$1.49 a gallon. That’s an insane US$0.39 a litre (£0.30 a litre; RM1.63 a litre).

International benchmark Brent crude oil broke the US$60 support level to about US$53. The American WTI, meanwhile, plunged below the US$52 psychological level to US$45 a barrel. The oil market has entered a very interesting stage – the lowest price since the third quarter of 2017. Ahead of Christmas and the New Year holidays, very few investors dare to bet against the bearish market.

Speculators and analysts no longer talk about whether the oil prices could reach the US$40 level. That mark has already been breached, when the crude was trading at about US$40 a barrel in the west Texas region that sits atop most of the Permian Basin. Oil companies were selling at a steep discount – 7 bucks a barrel – to benchmark U.S. West Texas Intermediate (WTI) crude futures.

Saudi oil minister Khalid al-Falih tried to reassure the market that we will not see a repeat of the 2014-2016 meltdowns. Yet, analysts and experts aren’t so sure. They think the price could go even lower – below the US$40 a barrel. After Friday’s closing, the U.S. WTI ended the session down at US$45.59 – the lowest closing price since January 2016.

In an effort to show its commitment to reducing supply, OPEC will release a table detailing output cut quotas for its members and allies such as Russia. Why do they even care about producing such table for all and sundry to see? It could only mean one thing – they are dead serious about cutting production, unlike previously where they cheated and didn’t cut but claimed to have cut.

Usually, production outages in large OPEC producers such as Libya would have had an immediately bullish effect on prices. Not anymore. A major production outage in Libya over the last two weeks has not been able to arrest the price slide. In fact, the oil market has chosen to ignore the disruption and continue to be bearish on the overall oil prices.

While the OPEC and non-OPEC allies agreed this month to curb output by 1.2 million barrels per day (bpd) from January 2019 in an attempt to drain tanks and boost prices, the Russians were said to be reluctant to be the first to cut its production for fear of losing market share. That was why the Saudi Arabia came out with the idea of the table detailing output cut quotas for everyone.

Investment banks are one by one beginning to revise their forecasts for oil prices next year and these forecasts are lower. According to Reuters data, Chinese refiners are not buying more U.S. oil despite the three-month truce agreed by U.S. President Donald Trump and Chinese President Xi Jinping last month. Could this due to the ongoing trade war?

Not really. Apparently, analysts said the price of U.S. oil simply wasn’t competitive. China can buy from Iran and Russia at the present price. So, the American oil price has to be lowered before it becomes attractive enough for the Chinese. The Chinese national oil companies also hesitate to procure U.S. crude unless they receive instruction to do so.

Therefore, the crude oil can only go down in order for the U.S. oil companies to sell to the Chinese. This would put pressure on OPEC, especially the Saudi Arabia which has just announced that the Kingdom will spend 7% more next year, at around US$295 billion (1.1 trillion riyals) – the highest budget ever amid oill price slump.

Other Articles That May Interest You …

- Get Ready For $40 Oil – Crude Drops Like A Rock, Here’s Why America Holds The Key To Oil Prices

- 2019 Recession May Have Started – December Stock Market Will Be The Worst Since 1931 Great Depression

- President Trump’s Trade War Strategy Against China Isn’t Working – It Gets Worse!!

- BOOM!! – Gasoline At US$1.64 A Gallon, Or RM1.80 A Litre Now

- Forget OPEC – These 3 Powerful Men Will Determine & Control The World Oil Prices

- BOOM!! U.S. Now World’s Largest Oil Producer – Oil Lost 20% In A Month, Could Drop To $40 In Bear Market

- BOOM!! – Crude Oil Prices Drop Spectacularly From Its $80 High, And Here’s Why It Will Continue To Fall

- 30 Investing Tips & Tricks You Won’t Learn At School

|

|

December 23rd, 2018 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply