Effective today (June 1st), the highly unpopular GST (goods and services tax) is zero-rated from 6 percent. People are celebrating as suddenly everything has become 6% cheaper. From computer to Mercedes Benz, everybody wants to have a piece of the meat, before the new SST (sales and service tax) kicks in effective September 1st.

Coincidently, the “Hari Raya Aidilfitri” is around the corner. Businesses nationwide are expected to register a boost in sales. Car salesmen would be laughing all the way to the bank. People would be talking about how they had made the right choice in booting out the old Barisan Nasional coalition government. In the next 3 months, there is zero tax from GST and SST.

GST is one of the major factors which contributed to the demise of Barisan Nasional coalition after ruling Malaysia for 61 years since its independence in 1957. This tax, often called the oppressive tax, will be known for many decades as the silver bullet which brought down ex-Prime Minister Najib Razak. And nobody will dare to touch the toxic GST with a 10-foot pole.

Najib’s biggest mistake, besides stealing money in broad daylight, was arguably introducing the GST. You can debate until the cows come home, but the fact remains that majority of the people are “too poor” to be taxed 6% on everything they consume. Perhaps the broad-based GST would not be so disastrous had Najib regime able to manage the price hikes resulting from the tax.

So, what happened to the so-called economic experts, analysts or specialists who swore on their mother grave that GST will bring down the price of consumer goods and whatnot? Former Deputy International Trade and Industry Minister Ahmad Maslan famously said prices for goods will go down after the abolition of the 10% Sales and Service Tax (SST) in place of the 6% GST.

However, when the prices of goods failed to drop after the introduction of the GST, Mr. Mazlan said consumers were unwise to blame him. He conveniently blamed the traders for pricier goods post-GST. When he was trolled, he lectured the people that they can always fry rice without GST at home. He also bragged about graduated from his MBA with a 3.85 CGPA.

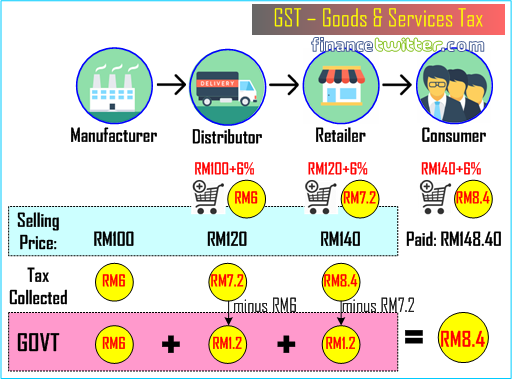

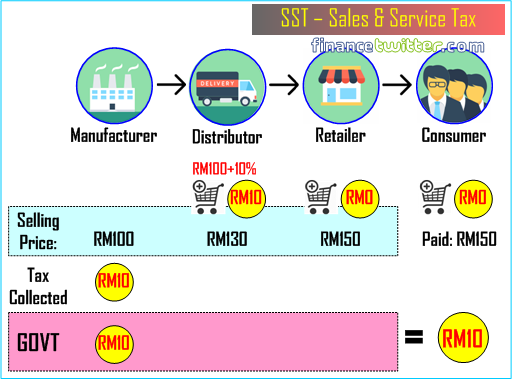

But was Mazlan really that dumb, or was he trying to sell the idea of GST based on the ideal situation? After all, it doesn’t take a rocket scientist to tell that a lower tax bracket of 6% is definitely better than the SST’s 10%. Let’s take a look at the chart above. Based on the comparison between 6% GST and 10% SST, obviously GST showed a cheaper product when it reaches consumer.

Referring to the diagrams, assuming a product was sold at RM100 by the manufacturer, and the distributor and retailer decided to make a profit of RM20 each on that product, at the end of the sales cycle the consumer would pay RM148.40. And the government would collect RM8.4 in GST taxes. When compares this with SST, consumer would pay RM150 while RM10 of tax will be collected.

Clearly, GST was better than SST. The consumers pay lesser while the government collect lesser tax in GST. Perhaps this was how Ahmad Mazlan got the picture hence he told all and sundry that GST will bring down the price of consumer goods. But if that was true, how did the price skyrocket and Najib Razak manage to collect more taxes using GST model?

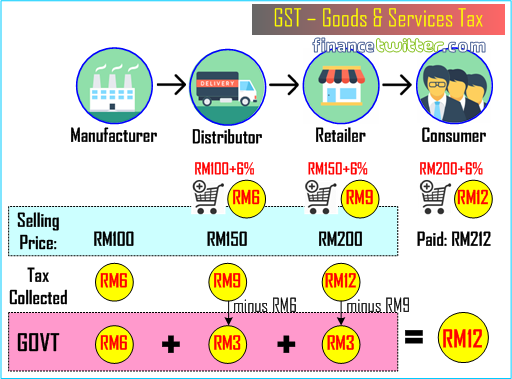

The fact that Najib regime had collected RM21 billion more in taxes through GST than using SST speaks volumes that the theory and practical are two different animals. In reality, the food chain doesn’t work that way. Now, look at the same chart of GST again above, but this time, the distributor and retailers decided to make RM50 in profit instead. What will happen?

At the end of the sales cycle of GST model, consumers pay RM212 (instead of RM148.40) for the same product while the government collects RM12 in taxes (instead of RM8.4). But based on the same profit margin, the consumers will pay only RM210 while the government will collect the same RM10 in taxes using SST model.

The difference in amount may look negligible but in reality, the multiplier effect is scary as there are more than 1 retailer or middlemen before the goods or products finally reach the consumers. And every layer making up the chain will be taxed 6%. The more layers there are between the manufacturer and consumer, the more money was collected by the old regime. That explains why Najib was grinning from ear to ear.

Other Articles That May Interest You …

- Mahathir Is Moving For The Kill – Scraps RM110 Billion HSR Project, And There’s Nothing Singapore Can Do

- New Government Practices Transparency – And Foreign Analysts & Agencies Aren’t Happy

- Taxpayers’ Money Secretly Used To Bailout 1MDB – Here’s Why Snake Oil Salesman Arul Should Be Jailed

- This Chart Shows How Najib Drove The Country To RM1 Trillion In Debt

- Why The Hell Didn’t Crooks Najib And Rosmah Flee Instantly After They Lost The Election?

- This Chart Shows How US-DOJ Links Auntie Rosie To A $27-Million Pink Diamond

- Swiss A.G. – Najib’s 1MDB Scammed At Least $800 Million Using “Ponzi Scheme”

- Don’t Say We Didn’t Warn You – Get Ready For 8% GST Next Year (2017)

- Budget 2016 Revision – What Najib Razak Doesn’t Want You To Know

- One Big Family Of Crooks? Najib’s In-Law Took Hermes Bags Without Paying

|

|

June 1st, 2018 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply