A few decades ago the only way to invest was through a broker. Due to high costs it only made sense if the amount you wanted to invest was considerably higher compared to the fee you had to pay to the broker.

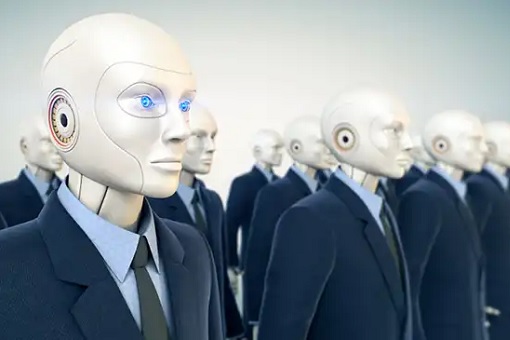

The rise of AI and technology changed this forever when it created robo-advisers. These are dedicated apps, either stand-alone or connected to a service package from a bank. The costs have decreased to a fraction of the original, while the ROI is similar to that offered by finance professionals.

Wealth management for the masses

We are now witnessing a change of generation. Millennials have enough economic power to determine significant changes in the market. This high-tech generation demands instant gratification and want everything literally at their fingertips. However, when it comes to money matters, Forbes shows that millennials would love to have a trustworthy personal advisor. However, from a fees perspective most would not cope with the cost, so an automated version will have to do.

Inspired by the smartphone revolution, banks and investment companies have adapted and now offer AI-powered advisors as part of their packages. Consumers are very interested in easy processes, where they retain control.

The news from automated platforms is that these take into consideration all your assets, including bank accounts, credit cards and other property and suggest ways of improving your portfolio.

Most algorithms are highly customizable, but all of them offer at least three basic options regarding your appetite for risk (conservative, moderate, and high-risk). After choosing one of these, you are presented and at least three scenarios so that you know what to expect.

Human or machine?

Robo advisers have significant advantages over their human counterparts. First, they work 24/7 with no signs of fatigue or annoyance. This is great for beginners who want to ask a lot of questions, try a lot of strategies and generally are more demanding than well-versed investors. If you would like to know more about benefits check this guide: https://aaacreditguide.com/personal-capital-review/.

Next, the cost dimension is not negligible. While for a human broker it makes no sense to manage an investment portfolio which is a year’s salary, a robo-advisor has no problem with adding pennies. Companies which choose this route do so with millions of small investment accounts. Since the process is automated and self-improving we can even expect to get better ROI in the near future.

Most platforms even have an option to interact with a human counselor if the algorithm is not satisfying. Stand-alone robo-advisors still have a long way to go before they break into the mainstream and are trusted with large investments.

Final thoughts

Technology has the gift of bringing exclusive services to the masses. The investment sector is no different. By employing the latest developments in machine learning and artificial intelligence, financial institutions are able to provide their clients with user-friendly tools to manage their portfolios. The entry barriers in the investing world have been lowered so much that now virtually anyone can hold and grow a portfolio.

For now, the robo advisors will not replace completely their human counterparts, they still have a lot to learn and a lot of trust to earn before they can be in charge of the world’s wealth.

|

|

May 24th, 2018 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply