Russians might love their President Vladimir Putin, who enjoyed consistently high rankings. Last year in June, Putin’s approval rate was at record-high of 89%, despite economic challenge due to tumbling currency ruble and oil price. But it’s a different story altogether with the Russian prime minister, who assumed office since 2012.

When Russian Prime Minister Dmitry Medvedev visited Crimea last month, he was prepared for handshakes and cheers from the people. It turned out that the region annexed by Russia from Ukraine in spring 2014 wasn’t an easy meat. When an angry woman repeatedly asked him why pensions hadn’t been adjusted for inflation yet, Mr. Dmitry was caught off guard.

Here’s the classic answer offered by Prime Minister Dmitry Medvedev – “There’s just no money. When we find the money, we’ll do it. Hang on in there. All the best! Have a good day and take care!” The video of his response to the woman was uploaded onto YouTube and has now recorded more than 3.5-million views.

Apparently, the woman was furious because the state pension of 8,000 Russian rubles a month (around US$125 a month) was not higher given the rising cost of living. The woman can be heard in the video heckling the prime minister on what she calls the “miniscule” pension. Medvedev’s stunt has since triggered a flurry of memes on Russian social media sites.

One of the famous memes was on tax declaration, which says – “Sorry there’s no money left but you keep well!” Another tweet joked that instead of paying his bill after a delicious meal at a restaurant, the Russian prime minister simply says – “There’s no money, but hang on in there. All the best and send my regards to the chef.”

While the remarks by the Russian prime minister have been made into jokes, in reality, it could happen to any country heavily depending on export of crude oil, including Malaysia. True, the 6% GST imposed by Malaysian Prime Minister Najib Razak was able to offset the tumbling oil prices. The tax has indeed helped Najib regime, but not the people.

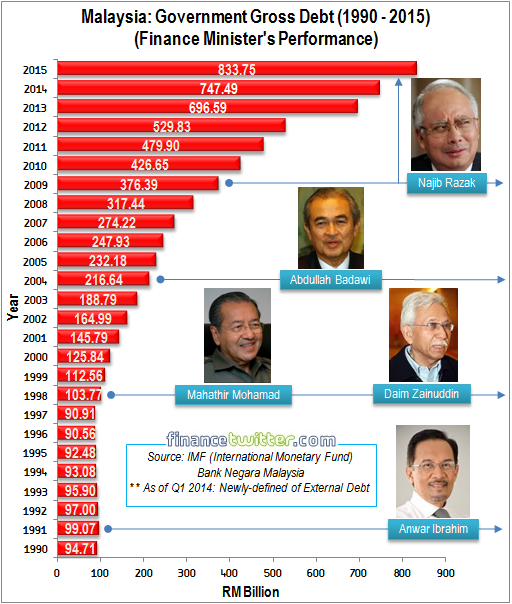

However, if the oil price stays in the region of US$50 a barrel, it’s a matter of time before big spender Najib hikes GST and other taxes. Under his administration, the country’s total gross external debt has climaxed in excess of RM830 billion. Meaning, even at 3% rate, the country needs to find and pay RM25 billion – every year – just on interest payment alone.

There’re already noises and hints in the local business community that PM Najib is ready to increase GST from 6% to 8%. Just like the monthly petrol price adjustments, the only thing that is blocking such tax increase is the recent Sarawak state election, the coming twin by-elections and the 14th general election due in 2018.

In spite of Malaysian government’s repetitive denials, Najib’s 1MDB scandal is far from over. In fact, it has gotten more serious with more sickening revelations on how US$1.051 billion (RM4.2 billion) took the ride across continents before ended up in the Malaysian prime minister’s private bank account.

1MDB’s debt has never been paid. What had happened was the transfer of its debt to the government, officially making it the taxpayers’ debt. Therefore, the ordinary people are now the debtors. In fact, Oxford Economics estimated that Putrajaya’s guarantees for 1MDB’s debt could add US$7.5 billion (£5.2 billion; RM30.3 billion) to its balance sheet, or 2.5% of GDP.

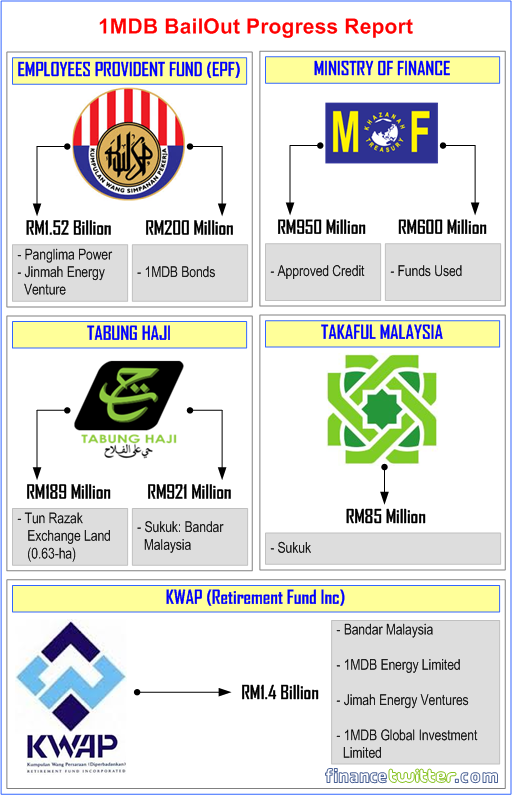

Najib Razak’s scandal is so massive that almost every single cash-cow institution and GLCs (Government-Linked-Companies) had lent money, one way or another, to his 1MDB. This includes the Employees Provident Fund (EPF), Tabung Haji (Pilgrims Fund Board), Ministry of Finance, Perbadanan Nasional Berhad (PNB), Takaful and Retirement Fund Inc (KWAP).

Yes, just like the Russian woman screaming for higher pension, the Malaysian pension fund for the civil servants – KWAP – had lent a staggering RM1.4 billion to 1MDB. EPF, another pension fund for private sector workers had put RM1.52 billion into 1MDB’s piggybank. In total, close to RM3 billion of pensioners’ money had been dumped into 1MDB.

How much has 1MDB returned to KWAP and EPF? Nil, Nada, Nothing, Zero, Zilch. So what did the pension funds do to recover the pensioners’ money? They were forced by PM Najib to liquidate overseas real estate holdings and repatriate the money back to Malaysia – so that the debt holes of 1MDB could be covered (*grin*).

In other words, workers’ money was used by the pension funds investing in foreign properties such as in London, but instead of being rewarded with handsome dividends, whatever profits (or even certain portion of the capitals) vanished into thin air so that 1MDB can be bailed out.

Essentially, 660,000 KWAP pensioners and 14.45-million EPF members were being taken as suckers. Unless 30-million Malaysians can continue to pay more and more in the form of GST (or other types of taxes), there would be one day where inflation is so high that angry pensioners will ask for higher pensions, only to be told by PM Najib – “There’s no more money left. Cheers!”

Other Articles That May Interest You …

- Riza Aziz’s London Mansion – UK Is “Fantastically Corrupt” For Doing Nothing

- Don’t Say We Didn’t Warn You – Get Ready For 8% GST Next Year (2017)

- The WSJ Is Hustling Razak Family – Nazir Could Have Committed Money Laundering

- Relax Najib, ABC Reporters Just Asking Questions, Not Throwing Shoes At You

- FB Angry Emoji – CY Leung Gets 170K, Najib Razak Most Hated In ASEAN

- Did Najib Pawn & Drag Malaysian Soldiers Into Syrian War For RM2.6 Billion?

- What Took You So Long, Singapore? Trying To Cover Najib’s 1MDB Scandal?

- Najib’s Twin Scandals – It’s Not Over Yet, It’s Just The Beginning

- WSJ’s Last Bombshell For The Year – Najib’s $700 Million Came From 1MDB

- If The US Really Wants To Put Najib On Trial, There’s No Escape

|

|

June 9th, 2016 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply