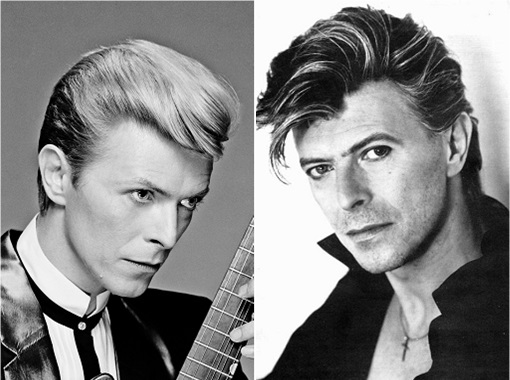

David Bowie, the legendary British rocker, died Sunday after an 18-month battle with cancer. Aged 69, he died 2-day after his birthday, when his album “Blackstar” was released. Bowie’s son, Duncan Jones, tweeted to confirm the news. His new album includes the song “Lazarus,” which begins with the words – “Look up here, I’m in heaven.”

If you haven’t heard of him, that’s because you either hate music, rock ‘n’ roll to be precise, or you were born yesterday. Even if you hate music, you should have heard his mighty stories about sex and drugs. The rock legend’s furious romantic adventures saw him bed an array of partners – both men and women.

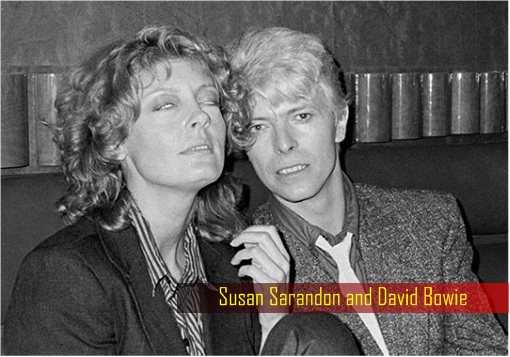

He reportedly engaged in relationships with Elizabeth Taylor, Marianne Faithfull, Bianca Jagger, Susan Sarandon and Ola Hudson. He also had rumoured sexual relations with men, including The Rolling Stones star – Mick Jagger. He even engaged in a threesome with his ex-wife Angie Bowie on the day of their wedding. He admitted he was both gay and bisexual.

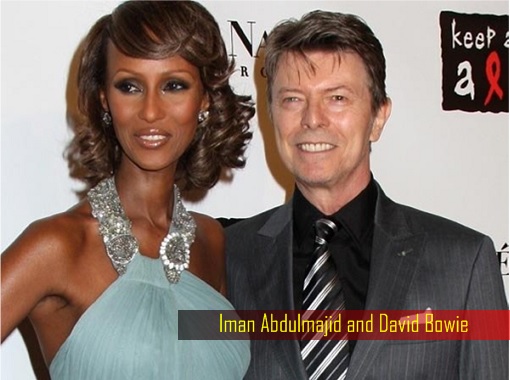

Angie, who admitted how she was late to her wedding to Bowie because she was caught up in a threesome, described him as a “bisexual alleycat”. Angie also reportedly caught Bowie and Mick Jagger in bed together. He met Iman Abdulmajid in Los Angeles in 1990, but it would take another 2-year for the rocker’s sexual drive to be fully satisfied before they married in 1992.

The name David Bowie didn’t rock the music world and broke the traditional sex life of musicians. He also changed and revolutionized the finance industry. Back in 1997, he wanted some cash. With Wharton educated banker David Pullman, he created bonds backed by the royalties from 25 of his albums released from his golden years starting from 1969 to 1990.

Bowie was the first artist in the world to securitize his future earnings in what has famously become known as “Bowie Bonds”. He raised US$55 million from the bonds, which were backed by his record label. The bonds secured Bowie’s future royalty streams from the copyrights over a 10-year period.

The 1997 “Bowie Bonds” earned an “AAA” Bond Rating from Moody’s and were privately sold to Prudential Insurance of America with a 10-year maturity (the bonds were always held by Prudential Insurance and were never made available to the public). At the time, RollingStone magazine estimated his net worth to be US$917 million, making him the U.K.’s richest rocker.

It was a sexy type of investment for Wall Street investors due to its 7.9% interest rate for investors, a higher rate of return than a 10-year Treasury note, which at that time, was merely 6.37%. Prudential also received guarantees from Bowie’s label, EMI Records, which had recently signed a US$30m deal with Bowie.

Bowie used the money for tax reasons and estate planning – because they were technically interest-paying bonds and thus considered a loan; Bowie got the money without the tax liability. But it was only possible back then because Bowie owned the rights to all of his songs. Bowie also used this income to buy songs owned by his former manager.

Thereafter, the “Bowie Bonds” concept was replicated by a few other artists at the time, such as Rod Steward, Iron Maiden, Ashford & Simpson and the Isley Brothers. After the first success, Mr Pullman went to work with other artists – James Brown, Marvin Gaye and the Jake Hooker – trademarking the financial instruments as “Pullman Bonds” instead.

Then peer-to-peer music sharing service Napster came and everything went “Kaboom!!” By 2004, with physical CD sales being cannibalized by piracy and the rise of online music services, Moody’s cut the credit rating of Bowie Bonds to BBB+ – one notch above junk status. Still, the original 10-year Bowie Bond was paid off in full at maturity in 2007.

Until today, Bowie Bond is still the biggest bond sale of such manner; no single artist was able to match it. Thanks to diminishing sales of recordings and low royalty rates, artists today are unlikely to use bonds as a tool to raise fast money. The Bowie Bond method was simply too expensive and difficult.

The nearest to Bowie Bond was something done in 2013 by a company called Fantex Holdings which created a security allowing investors to receive a share of an athlete’s income in exchange for an upfront payment. Till today, bonds issued by artists are also known as “Bowie Bonds” – in honour of the man who revolutionized music and finance.

Other Articles That May Interest You …

- SEX MOB – I’m A Syrian! You Have To Treat Me Kindly! Mrs. Merkel Invited Me!

- Celebrating 100-Year-Old – How Coca-Cola Bottle Got Its Sexy Shape

- Revealed – Why Facebook Mark Zuckerberg Wears The Same Shirt Every Day

- Steve Jobs’ Resignation Letters, In 1985 and 2011, Are Some Of The Best Ever

- 50 Cool Signatures Of World’s Rich & Famous People

- Steve Jobs, 56, Edison of 21st Century, Has Died

- Obama Dinner – Steve Jobs, Mark Zuckerberg are VVIP

|

|

January 12th, 2016 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply