We’ve often hear about multi-billion conglomerates which make billions of dollars in a calendar quarter alone such as Apple Inc., Coca-Cola, McDonald’s and so on. But we rarely read stories about SMEs (small and medium enterprise), the engine which boost many developing countries’ economic growth. Forbes Asia has recently released its annual “Best Under A Billion” list – the 200 top-performing Asia-Pacific companies with less than US$1 billion in sales but with consistent profits.

A total of 17,000 publicly traded companies in the Asia-Pacific region were screened and roughly 885 companies with revenues between US$5 million and US$1 billion were short-listed. Thereafter, companies which produced the highest sales and earnings per share (EPS) growth for both the most recent fiscal one and three-year periods, and the strongest five-year average return on equity were chosen.

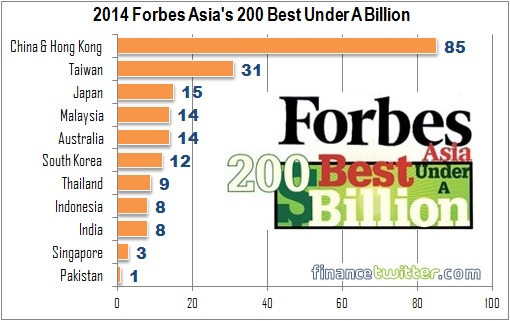

Amazingly, the combination of these 200 SMEs generated a whopping US$42 billion in sales last year. Needless to say, China dominates the list, thanks to its powerful manufacturing trains, and the fact that the country’s SMEs actually contributes 60% of its GDP (gross domestic product) and 80% of its employment. China and Hong Kong alone have taken a huge slice of 85 companies from the top-200 list.

Taiwanese companies made the list with 31 candidates, up from 26 last year. India only has 8 companies while the Philippines and Vietnamese failed to gain any representation this year. Malaysian companies, meanwhile have 14 representatives with most of them in the construction and properties sector. Here’re top-10 of the Malaysian companies that made it to the Forbes’ Best Under A Billion list.

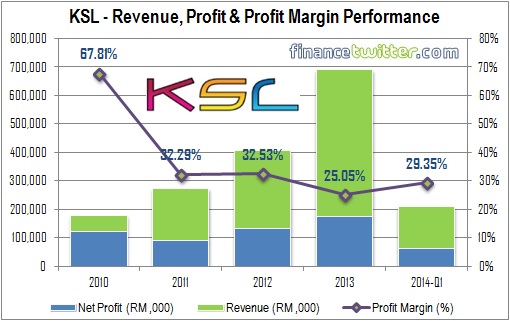

{ 1 } KSL Holdings Berhad

| Industry: Construction | Market Cap (Aug’14): RM1.26 billion |

| Founded: Apr 17, 2000 | Sales (2013): RM688.1 million |

| Stock Code: 5038 (Main Board) | Net Profit (2013): RM172.3 million |

KSL Holdings Bhd. is an investment holding company, which engages in the provision of management services. The company, through its subsidiaries, engages in the property development, property investment, car park operation, property management and hotel operation.

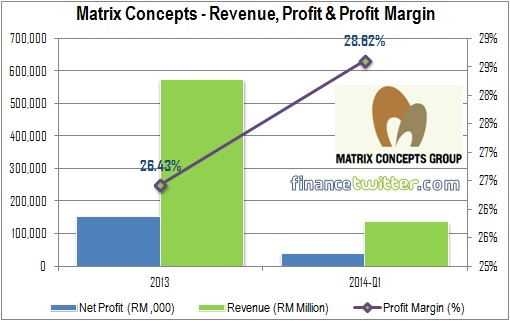

{ 2 } Matrix Concepts Holdings Berhad

| Industry: Construction | Market Cap (Aug’14): RM1.40 billion |

| Founded: Dec 24, 1996 | Sales (2013): RM573.5 million |

| Stock Code: 5236 (Main Board) | Net Profit (2013): RM151.5 million |

Matrix Concepts Holdings Bhd. operates as an investment holding company, which engages in the property development activities. It is focused on development of residential, commercial and industrial properties. The company operates in two business activities: Sales of Land and Property Development.

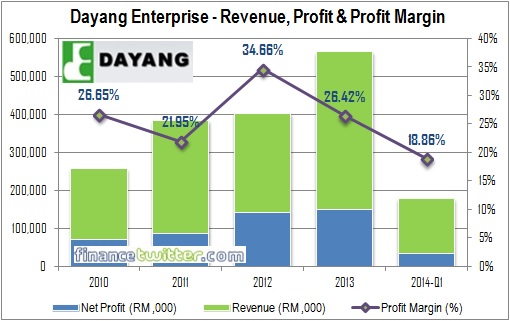

{ 3 } Dayang Enterprise Holdings Berhad

| Industry: Oil & Gas Operations | Market Cap (Aug’14): RM3.08 billion |

| Founded: Oct 10, 2005 | Sales (2013): RM563.3 million |

| Stock Code: 5141 (Main Board) | Net Profit (2013): RM148.8 million |

Dayang Enterprise Holdings Bhd. operates as an investment holding company, which engages in the provision of offshore topside maintenance services, minor fabrication operations, offshore hook-ups and commissioning, and the charter of marine vessels. It operates through four segments: Investment Holding, Topside Maintenance Services, Marine Charter and Equipment Hire.

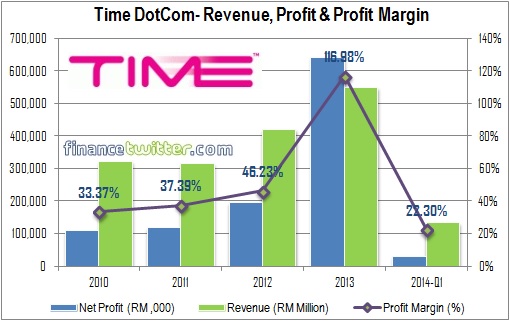

{ 4 } TIME dotCom

| Industry: Telecommunications | Market Cap (Aug’14): RM2.63 billion |

| Founded: Dec 11, 1996 | Sales (2013): RM548.2 million |

| Stock Code: 5031 (Main Board) | Net Profit (2013): RM641.3 million |

TIME dotCom Bhd. operates as a holding company with interest in providing mobile telecommunication services. The company offers extensive fibre optic-based telecommunication services to the corporations, government organizations and enterprises, which demand uncompromising reliability.

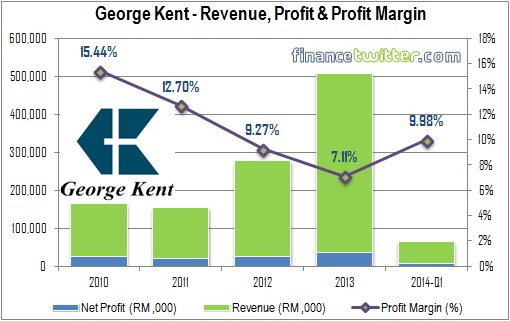

{ 5 } George Kent (M) Berhad

| Industry: Industrial | Market Cap (Aug’14): RM515.9 million |

| Founded: 1936 | Sales (2013): RM506.2 million |

| Stock Code: 5204 (Main Board) | Net Profit (2013): RM35.9 million |

George Kent (Malaysia) Bhd. engages in the provision of mechanical and electrical products and services. It operates in the Investment, Infrastructure, and Manufacturing segments. Its activities include the following: investment holding and provision of management services; manufacture and sale of water meters, waterworks fittings, fiberglass reinforced polyester panel tanks and others.

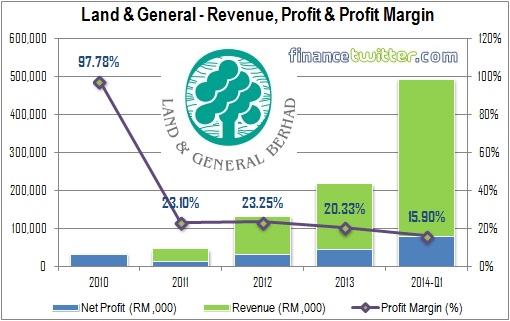

{ 6 } Land & General Berhad

| Industry: Construction | Market Cap (Aug’14): RM478.1 M |

| Founded: May 21, 1964 | Sales (2013): RM216.2 million |

| Stock Code: 3174 (Main Board) | Net Profit (2013): RM43.9 million |

Land & General Bhd. is an investment holding company, which engages in property investment and development business. It also engages in the cultivation of rubber and oil palm; management of club activities; ownership of a school building complex; and provision of education services. The company operates through three segments: Property, Education and Others.

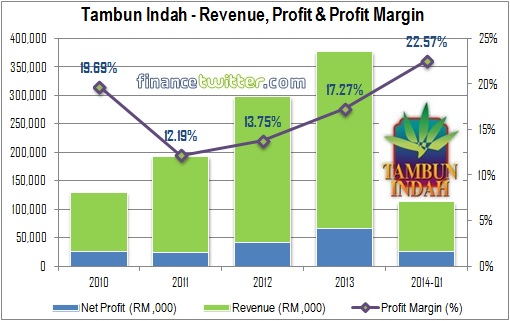

{ 7 } Tambun Indah Land Berhad

| Industry: Construction | Market Cap (Aug’14): RM1.0 billion |

| Founded: 1993 | Sales (2013): RM376.3 million |

| Stock Code: 5191 (Main Board) | Net Profit (2013): RM64.9 million |

Tambun Indah Land Bhd. operates as an investment holding company, which is engaged in investment holding, property development, construction and project management. The company operates its business through following segments: Investment Holding, Property Development and Construction and Project Management.

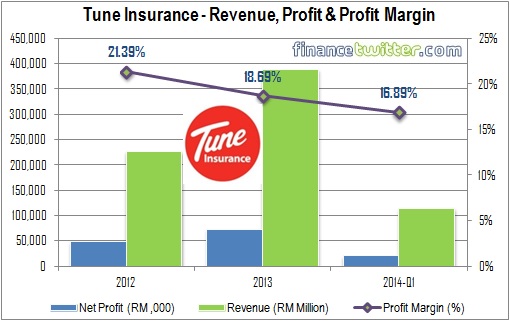

{ 8 } Tune Ins Holdings Berhad

| Industry: Insurance | Market Cap (Aug’14): RM1.9 billion |

| Founded: June 14, 2011 | Sales (2013): RM113.9 million |

| Stock Code: 5230 (Main Board) | Net Profit (2013): RM19.2 million |

Tune Ins Holdings Bhd. is an investment holding company, which engages in the provision of various general and life insurance products in the Asia Pacific. The company operates through following segments: Investment Holding & Others, General Reinsurance, Life Reinsurance and General Insurance Business. The owner is Tony Fernandez, the same owner of budget carrier AirAsia.

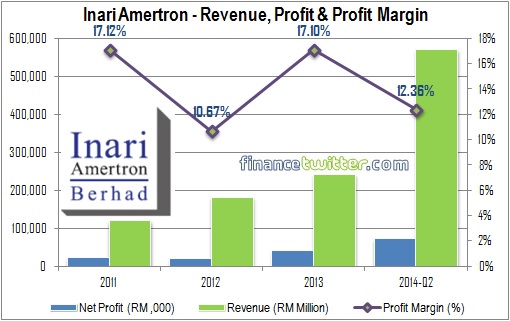

{ 9 } Inari Amertron Berhad

| Industry: Semiconductors | Market Cap (Aug’14): RM1.8 billion |

| Founded: May 5, 2010 | Sales (2013): RM241.1 million |

| Stock Code: 0166 (Main Board) | Net Profit (2013): RM41.2 million |

Inari Amertron engages in the designing, marketing and distribution of electronic products. The company involves in the back-end semiconductor packaging, which comprises back-end wafer processing, package assembly and RF final testing for the electronics and semiconductor industry. It also engages in the investment holding and property investment activities.

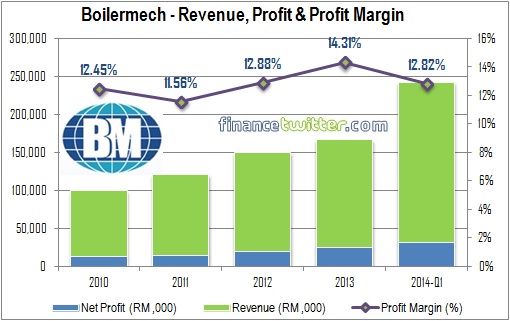

{ 10 } Boilermech Holdings Berhad

| Industry: Electrical Equipment | Market Cap (Aug’14): RM874.6 million |

| Founded: Sept 2005 | Sales (2013): RM165.8 million |

| Stock Code: 0168 (ACE Board) | Net Profit (2013): RM23.7 million |

Boilermech engages in the design, manufacture, installation, commissioning, and repair of biomass boilers in Malaysia. The company operates through two business segments: Bio-renewable Energy Systems and Others. The Bio-renewable Energy Systems segment engages in manufacturing and repair of bio-renewable energy systems and trading of related parts and accessories. The Others segment engages in the investment holding.

The other four companies that made it to the list are Sentoria Group, Prestariang, Willowglen and Elsoft Research. Overall, Malaysia is at fourth position, sharing the trophy with Australia, for the most firms that made it to the Forbes list. And Malaysia is the top scorer among Asean countries.

Other Articles That May Interest You …

- Cracking 16 Digits Credit Card Numbers – What Do They Mean?

- 10 Lousy Lies Bosses Tell, That You Should Know

- CIMB-RHB-MBSB Mega Merger – The Danger Of Creating A Too-Big-To-Fail Biggest Bank

- 10 Companies That Control Almost Everything You Buy & Eat

- Are You Holding The World’s Most Powerful Passport?

- 15 Successful, Rich and Famous People – Their Humble First Jobs

|

|

August 7th, 2014 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply