There’re tons of books that you can buy and read about stock market and share investments. If you’re literally a bookworm who can digest thousands of pages of those financial, economy and investing books, go ahead. But for those lazy dummies who like to get some basic fundamental knowledge about stock investing, videos are perhaps the best training centre.

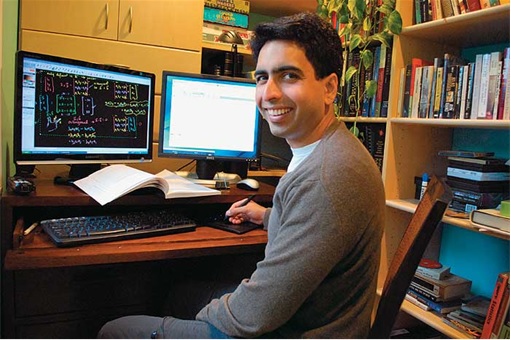

Salman Khan is a Bengali American educator, entrepreneur and former hedge fund analyst. His father is from Bangladesh while his mother was born in India, and he attended the public school Grace King High School in Metaire, Louisiana and later earned three degrees from the Massachusetts Institute of Technology. He founded Khan Academy in 2006, with the objective of giving free education.

Khan Academy is a non-profit educational organization which provide thousands of educational resources via video tutorials stored on YouTube covering wide range of topics – mathematics, finance, medicine, physics, chemistry, biology, history and whatnot. The initiative receives blessing from Bill and Melinda Gates foundation which provided Khan Academy with $1.5 million.

Other giants such as Google provided $2 million; Ireland-based O’Sullivan Foundation – $5 million; Mexico-based Carlos Slim Foundation made a donation to Khan Academy to expand its Spanish library of videos. His fleet of videos have so far attracted 2,089,353 subscribers and have been viewed over 458 million times. Here’re some of the basic fundamental free online short courses for you in stock investment.

{ 1 } What It Means To Buy A Company’s Stock

Why you should learn this?

It’s simply amazing and mind-boggling to see millions of people who jump into stock market without know what is shares or stock or bonds, let alone the relationship between assets and liabilities (debt) as well as owner’s equity. And if you don’t know the equation of assets, liabilities and owner’s equity, you wouldn’t know how to read a company’s financial statement, can you? So, do yourself a favour and learn this first step in stock investing by watching the YouTube above.

{ 2 } Bonds vs Stocks

Why you should learn this?

After you learned the basic stuffs about buying a company’s stock, you should know how a company raises capital – borrowing money and selling shares – both items relate to “debt” and “equities”. Obviously the former is called bond and the latter is known as stock. This is not something which is super-duper complicated but at least you know if a company is in trouble when it keeps on issuing bonds or sukuk or whatnot. This is helpful to identify if you’re about to invest in a problematic company.

{ 3 } Shorting Stock

Why you should learn this?

You’ve heard from Tom, Dick and his hamster about short-selling. But do you know what is this alien from planet Mars? It may not be applicable in countries that do not “encourage” short-selling, for obvious reason, but in US financial market people have been making tons of money regardless in bullish or bearish stock market. This is the same method how George Soros made US$1 billion and “broke the Bank of England” in 1992.

{ 4 } Raising Money For A Company – IPO

Why you should learn this?

It is always nice to learn why and how companies or people raise money for a startup. Before you can even go IPO, you would normally get angel investors to give you money in exchange for a stake in your company, provided you can convinced them about your story or idea. These angel investors could be your mom or dad or friends. You’ll learn about valuation and post-money valuation and how angel investors get to be part of your company.

{ 5 } Price & Market Capitalization

Why you should learn this?

How do you judge if a stock is cheap or expensive? Do you know that during the 2008 subprime crisis, Citibank stock tumbled to US$1 a share? So, is it fair to say a Stock-A trading at $1 is freaking cheap while a Stock-B at $10 is expensive? Don’t laugh but that’s exactly what herds of “clever” people did when buying penny stocks, even as we speak now. Obviously, there’s a difference between VIncent Tan’s Berjaya share and Warrent Buffett’s Berkshire stock prices.

{ 6 } Income Statement

Why you should learn this?

Income statement is one of the three most important financial statements, the other two being balance sheet and cashflow statement. Here, we’re going into more detail and boring stuffs – revenue, gross profit, operatin profit, pre-tax income, net income, ROE and so on. And hopefully you can go and figure out why AirAsia is making profit while Malaysia Airlines is drilling losses, quarter after quarter.

{ 7 } Earnings and EPS

Why you should learn this?

If you have no financial background, chances are you would only concern about net income of your company, which is fair enough. But when you start investing in other companies, you would want to know not only their earnings performance, but also EPS – earnings per share. After this video, you would start searching for EPS in a company financial statement. This component (EPS) will tell you how healthy a company is and if it may pay dividends.

{ 8 } Why Is P/E Ratio Important?

Why you should learn this?

You often hear about P/E ratio, which essentially means price-to-earnings ratio. While EPS, earnings-per-share, will tell if a company is making profit or loss, it doesn’t tell you if its share price is expensive or cheap, relative to its industry. Now, the secret is out. Investment banks and research houses normally use this magic ratio to tell if a company is cheap (time to buy) or expensive (time to sell).

Other Articles That May Interest You …

- Soros Bet $2.2 Billion On SPY Puts – Does He Know Something We Don’t?

- Here’re Insider Reasons Why Malaysia Airlines Bailout Will Not Work

- Cracking 16 Digits Credit Card Numbers – What Do They Mean?

- 10 Companies That Control Almost Everything You Buy & Eat

- 15 Successful, Rich and Famous People – Their Humble First Jobs

- 30 Investing Tips & Tricks You Won’t Learn At School

- How To Save Money This Year – 15 Exciting Tips

|

|

August 25th, 2014 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply