Guess?, Inc. (NYSE:

GES) which I highlighted almost a month ago (on Valentine day itself, to be exact) in “Will GUESS Defy Gravity And Continue 45 Degrees Uptrend?” did not only report earning which beat consensus, it also announced goodies in the form of 2-for-1 stock-split and a quarterly cash dividend of $0.12 a share. Such announcement will only steams the stock price upwards and this is exactly what happened. Guess?, Inc. reported fourth quarter earnings of $0.99 per share, $0.06 better than consensus, thanks to the globalization of the Guess? brand. Revenues rose 25.2% year over year to $346.4 mln versus consensus of $329.1 Million. It forecast earnings per share growth of up to 21% for the 2008 fiscal year. Operating margin in the fourth quarter improved 480 basis points to 20.5%, compared to the prior year’s quarter. The company saw double-digit top line growth in each of its businesses, with Europe and licensing posting the largest increases.

Guess?, Inc. reported fourth quarter earnings of $0.99 per share, $0.06 better than consensus, thanks to the globalization of the Guess? brand. Revenues rose 25.2% year over year to $346.4 mln versus consensus of $329.1 Million. It forecast earnings per share growth of up to 21% for the 2008 fiscal year. Operating margin in the fourth quarter improved 480 basis points to 20.5%, compared to the prior year’s quarter. The company saw double-digit top line growth in each of its businesses, with Europe and licensing posting the largest increases.

T he stock price peaked on Feb-20-2007 before consolidates – a period which I should have close my position but my greed-friend told me to hang-on as the overall market sentiment was still bullish. The China stock market crash on Feb-27-2007 added salt to my wounds and should serve as a reminder that a day of holding a stock/option is an extra day of risk exposure. Fortunately the stock price recovered quite fast on the same day itself and should you have monitored the stock movement, you’ll know what I meant. It was a good experience for traders to test their emotions for the next subsequent days when the stock just refused to goes up again.

he stock price peaked on Feb-20-2007 before consolidates – a period which I should have close my position but my greed-friend told me to hang-on as the overall market sentiment was still bullish. The China stock market crash on Feb-27-2007 added salt to my wounds and should serve as a reminder that a day of holding a stock/option is an extra day of risk exposure. Fortunately the stock price recovered quite fast on the same day itself and should you have monitored the stock movement, you’ll know what I meant. It was a good experience for traders to test their emotions for the next subsequent days when the stock just refused to goes up again.

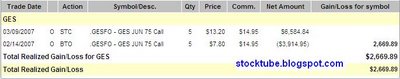

It’s true that whatever goes up must comes down and vice versa. Guess?, Inc. reversed and recovered thereafter and I took the opportunity to lock-in profit last Friday, Mar-9-2007. I’ve to close the position anyway because the additional shares from the split will be distributed on Monday, Mar-12-2007. And the profit I made for being greedy is only at 69% compare to more than 100% should I sell it somewhere at the peak. But you’ll never know. However, as long as your trade is profitable, you should be grateful and continue the journey of trading and investing.

Other Articles That May Interest You …

|

|

March 11th, 2007 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply