I finally gave-up the crowded cyber-café and the slow bandwidth, instead I drove to the nearest Starbucks again (yeah, and another cup of latte) for the precious internet access. My own internet line is still down and my temper is about to erupt anytime now considering it’s been more than 48 hours since I reported the problem. The thing you hate the most is when the ISP’s (internet service provider) customer support doesn’t care to even pick-up your call.

Anyway, remember when the Apple Inc  (Nasdaq: AAPL, stock) announced earning which beats estimates but gave a lower (conservative) guidance on Jan-17-2007 after the market closed? In case you missed it, the website is here. In order to close the gap of my loss, I re-open another position, AAPL Feb 90 Put, on Jan-18-2007 just when it crossed the lower of the lowest within 45 minutes. And it drifted lower thereafter as what I hoped for. I put a stop-limit to lock-in profit at about $84 plus (the three months chart gives you a support at about $84

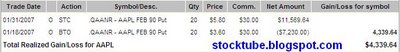

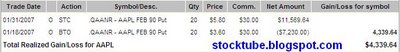

(Nasdaq: AAPL, stock) announced earning which beats estimates but gave a lower (conservative) guidance on Jan-17-2007 after the market closed? In case you missed it, the website is here. In order to close the gap of my loss, I re-open another position, AAPL Feb 90 Put, on Jan-18-2007 just when it crossed the lower of the lowest within 45 minutes. And it drifted lower thereafter as what I hoped for. I put a stop-limit to lock-in profit at about $84 plus (the three months chart gives you a support at about $84  level). It got triggered on Jan-31-2007 – the period of which I couldn’t monitored due to the disruption to my internet line.

level). It got triggered on Jan-31-2007 – the period of which I couldn’t monitored due to the disruption to my internet line.

(Nasdaq: AAPL, stock) announced earning which beats estimates but gave a lower (conservative) guidance on Jan-17-2007 after the market closed? In case you missed it, the website is here. In order to close the gap of my loss, I re-open another position, AAPL Feb 90 Put, on Jan-18-2007 just when it crossed the lower of the lowest within 45 minutes. And it drifted lower thereafter as what I hoped for. I put a stop-limit to lock-in profit at about $84 plus (the three months chart gives you a support at about $84

(Nasdaq: AAPL, stock) announced earning which beats estimates but gave a lower (conservative) guidance on Jan-17-2007 after the market closed? In case you missed it, the website is here. In order to close the gap of my loss, I re-open another position, AAPL Feb 90 Put, on Jan-18-2007 just when it crossed the lower of the lowest within 45 minutes. And it drifted lower thereafter as what I hoped for. I put a stop-limit to lock-in profit at about $84 plus (the three months chart gives you a support at about $84  level). It got triggered on Jan-31-2007 – the period of which I couldn’t monitored due to the disruption to my internet line.

level). It got triggered on Jan-31-2007 – the period of which I couldn’t monitored due to the disruption to my internet line. Just imagine if there’s no option for me to execute a limit-order and “Good Until Cancelled” just like in Malaysia stock market. My previous option position on Apple which is Apr 95 Call (before Apple earning) is still in the red but after minus the profits just pocketed, I’m still making some money. And should Apple shares decided to reverse its’ down-trend (assuming $84 is the support), my Call option positions will start to make me money. Furthermore the Call option expires on Apr-2007 – time-value is on my side.

# TIP: Always put time-value as the main criteria during option trading. Without time-value on your advantage, it’s difficult to salvage your trade. Also, remember to use limit-order instead of market-order when you’re investing.

Other Articles That May Interest You …

|

|

February 2nd, 2007 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply