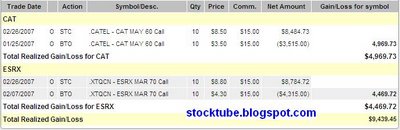

About a month ago on 26-Jan-2007 (yes, this trade is about a month old), Caterpillar reports highest ever fourth quarter and full-year sales and profit of $41.517 billion in sales and profit of $3.537 billion, or $5.17 per share for financial year 2006. The company also reported a record fourth quarter with sales and revenues of $11.003 billion and profit of $882 million, or $1.32 per share, up 10 percent from last year.

About a month ago on 26-Jan-2007 (yes, this trade is about a month old), Caterpillar reports highest ever fourth quarter and full-year sales and profit of $41.517 billion in sales and profit of $3.537 billion, or $5.17 per share for financial year 2006. The company also reported a record fourth quarter with sales and revenues of $11.003 billion and profit of $882 million, or $1.32 per share, up 10 percent from last year.

In 2007, the company expects another record year with sales and revenues in a range of $41.5 to $43.6 billion, which is flat to up 5 percent from 2006, and profit in a range of $5.20 to $5.70 per share. “I’m anticipating great things for Caterpillar in 2007. Despite a sharp decline in two key North American industries – on-highway truck engines and U.S. housing – and an expected reduction in dealer inventories, we are projecting another record year in 2007 … We expect to improve profit per share at a higher rate than sales and revenues, and that means a key focus in 2007 will be cost management.” said Chairman and Chief Executive Officer Jim Owens.

In 2007, the company expects another record year with sales and revenues in a range of $41.5 to $43.6 billion, which is flat to up 5 percent from 2006, and profit in a range of $5.20 to $5.70 per share. “I’m anticipating great things for Caterpillar in 2007. Despite a sharp decline in two key North American industries – on-highway truck engines and U.S. housing – and an expected reduction in dealer inventories, we are projecting another record year in 2007 … We expect to improve profit per share at a higher rate than sales and revenues, and that means a key focus in 2007 will be cost management.” said Chairman and Chief Executive Officer Jim Owens.

That’s all it needs to give Caterpillar the steroid to keep pushing the stock price up from the moment of the gap-up. From the chart, you can see it did paused for a while to establish a support level above $64 before continue its’ assault. Yesterday I sensed that Caterpillar could be trying to build another higher support level of $67 but I guess the sense of not wanting to be a pig (remember the phrase “Bull & Bear make money but Pig get slaughtered?“) prompted me to erase this position from my monitoring screen and take money off the table altogether. Furthermore it’s over 140% profits on my May 60 Call option position trading this lovely Caterpillar and I should be glad of it.

Express Scripts, Inc. (Nasdaq: ESRX, stock)  which launched the takeover bid for Caremark Rx, Inc. (NYSE: CMX, stock) in December 2006, posted earnings of $147.2 million, or $1.07 per share, compared with a profit of $111.1 million, 75 cents per share, during the same period a year earlier. Revenue however fell 1 percent to $4.53 billion from $4.58 billion. Express Scripts beat earning consensus of 97 cents per share on revenue of $4.6 billion polled by Thomson Financial.

which launched the takeover bid for Caremark Rx, Inc. (NYSE: CMX, stock) in December 2006, posted earnings of $147.2 million, or $1.07 per share, compared with a profit of $111.1 million, 75 cents per share, during the same period a year earlier. Revenue however fell 1 percent to $4.53 billion from $4.58 billion. Express Scripts beat earning consensus of 97 cents per share on revenue of $4.6 billion polled by Thomson Financial.

The main bullet was the upside profit guidance issued with new target between $4.08 and $4.20 per share from between $3.90 and $4.02 per share. Express Scripts said the guidance does not include any potential impact from a successful takeover of Caremark.

Upon earning announcement, the stock price of Express Scripts gapped-up but could not sustain the momentum thereafter and took a lazy rest. However the stock rises and performs what I hope for – an uptrend, more of 30 degrees. The uptrend somehow stopped last week below stock price of $78 but has since traded above this level. But it’s not moving upwards anymore, instead the stock try to build a support level at $78 but I’m not sure if this level can be maintained. My disadvantage on this Mar 70 Call option trade is I’m losing the time-value. So I decided to lock-in profit with over 100% profits. With both options, Caterpillar and Express Scripts, over 100% profits what else can I complaint?

# TIP: Depending on your risk management, holding on to stocks or option after a good earning announcement could sometime provide higher profits – require constant monitoring.

Other Articles That May Interest You …

|

|

February 27th, 2007 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply